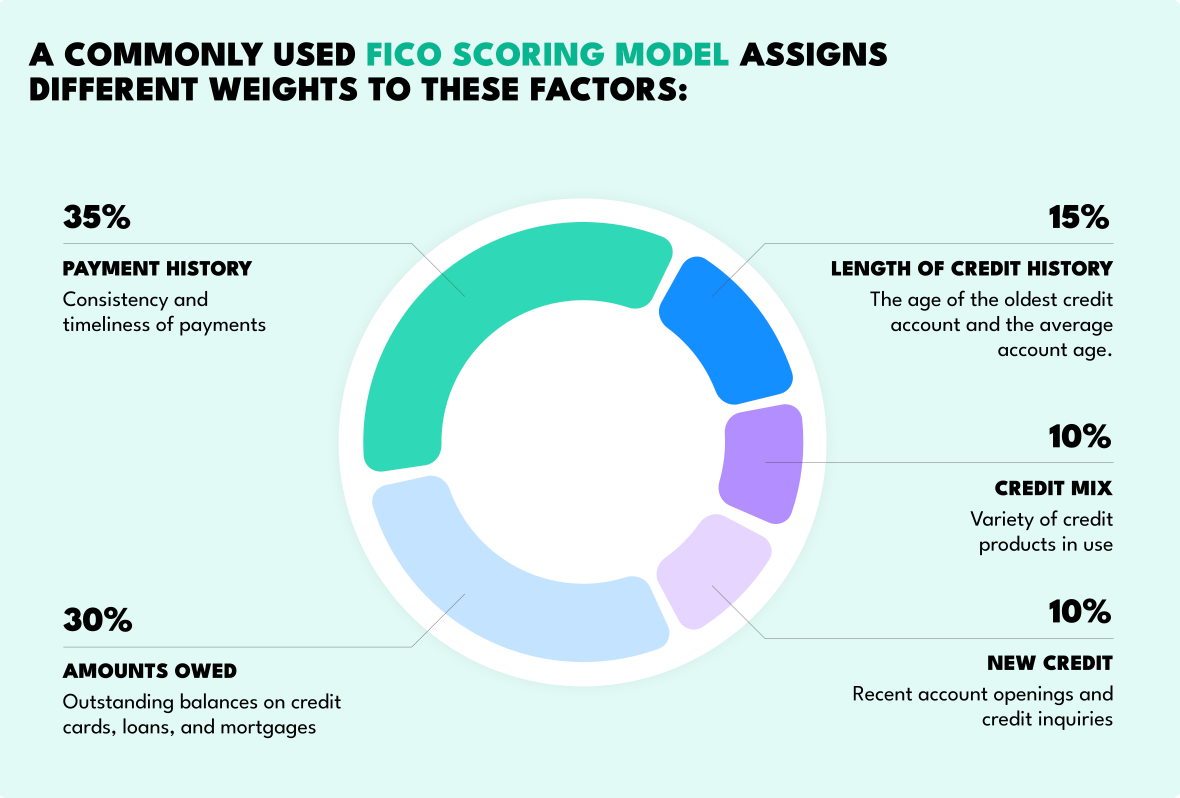

In the 20th century, credit was a simple, rule-bound system: you either had a credit history or you didn’t. You were either in the system or out. If you had no loans, no bank-issued credit cards, and no accounts in good standing with reporting agencies, then it didn’t matter how responsible or financially stable you were—lenders saw you as a risk. A blank page, to them, was worse than a bad one.

But in 2025, that model is not just outdated—it’s harmful.

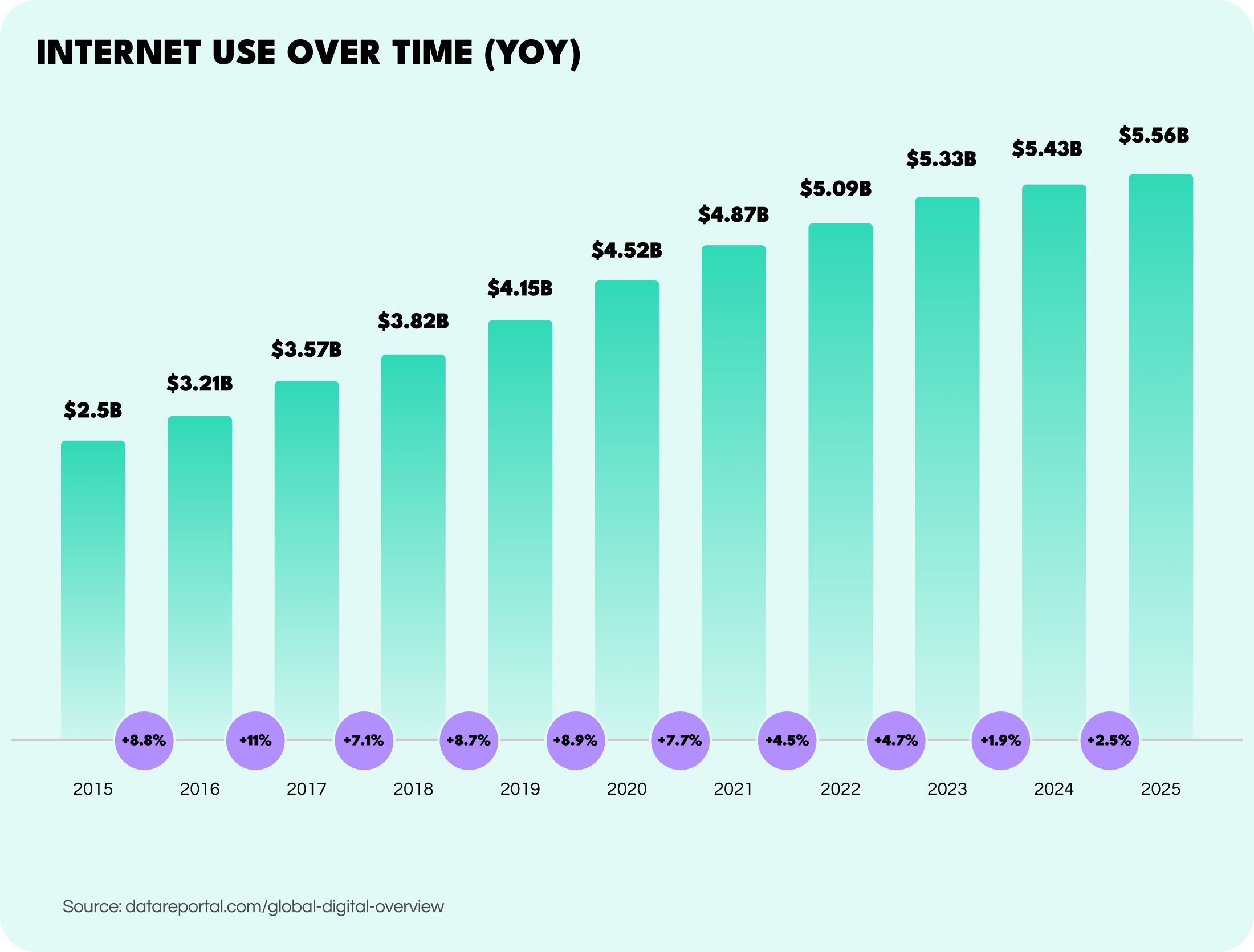

Today, over 3 billion people around the world are either unbanked or underbanked. That’s nearly 40% of the global population. And while these individuals are excluded from traditional credit scoring systems, many of them are active participants in the digital economy. They pay rent. They buy subscriptions. They use mobile apps. They engage with online marketplaces. Their lives leave behind something powerful: a digital footprint.

And from that footprint, a new model of credit is being born.

The Crisis of the Credit Invisible

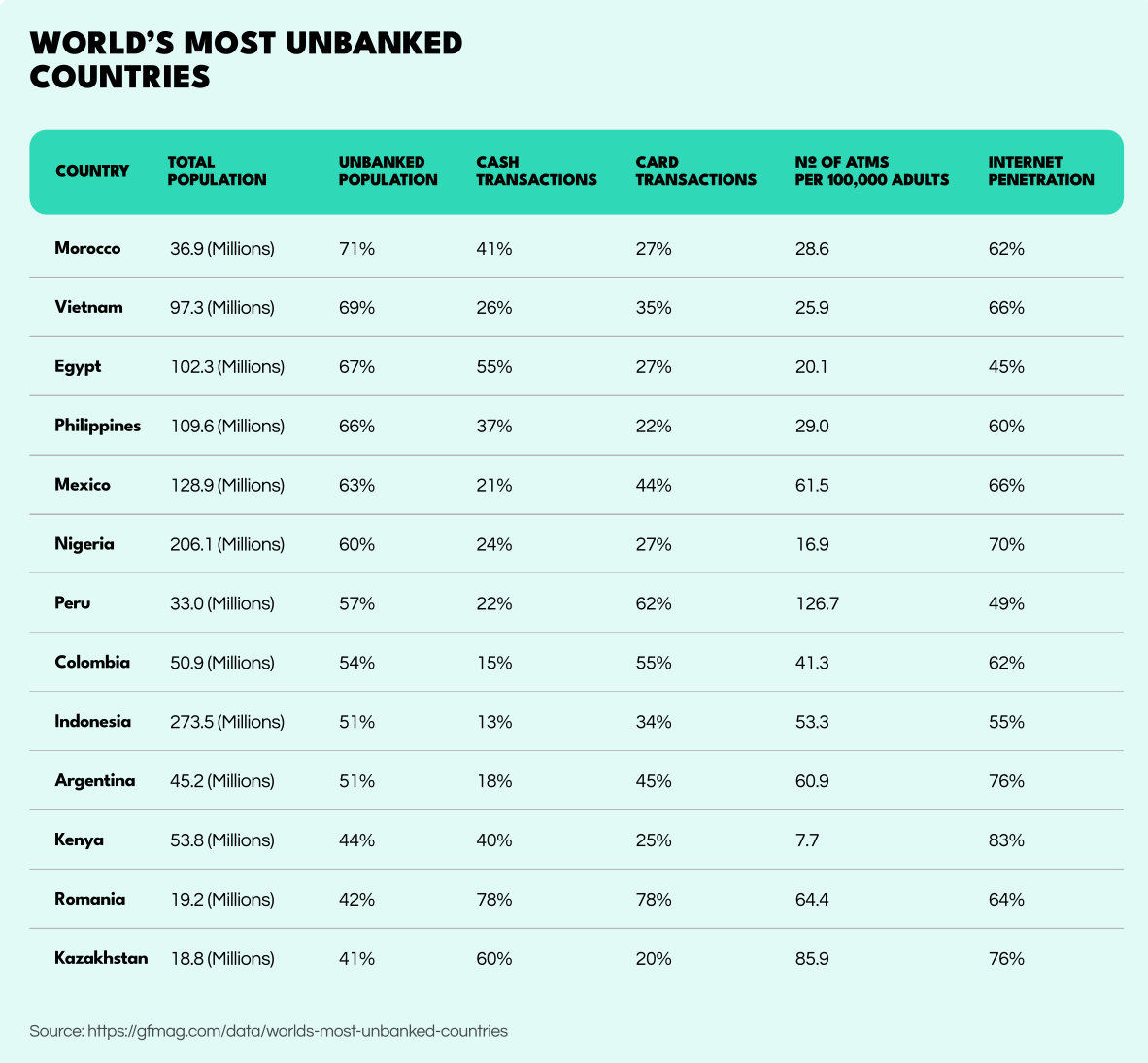

Consider the country-level numbers. In Morocco, 71% of people are unbanked. In Vietnam, it’s 69%. In Egypt, 67%. Even in the emerging tech hub of Mexico, 63% of citizens live without access to formal financial services. These are not marginal populations—they are vast majorities in entire nations. And the implications are massive.

In regions with high smartphone penetration but limited credit infrastructure, individuals are stuck in a paradox: they use technology every day, but have no financial identity. And even when they’re financially stable in reality, lenders are blind to it. The traditional FICO model can’t see their Netflix subscriptions. It doesn’t recognize the rent they’ve paid on time for five years. It’s never heard of their activity on Mercado Libre or Jumia.

At the same time, digital-native consumers in developed countries—especially Millennials and Gen Z—are choosing not to build traditional credit histories. They avoid debt, reject credit cards, and prefer Buy Now Pay Later (BNPL) services, mobile wallets, or digital banks. Their money flows are real—but invisible to traditional credit bureaus.

This is where alternative credit scoring comes in. And it’s not just a niche innovation anymore. It’s a necessity.

From Reports to Signals: The Core Shift

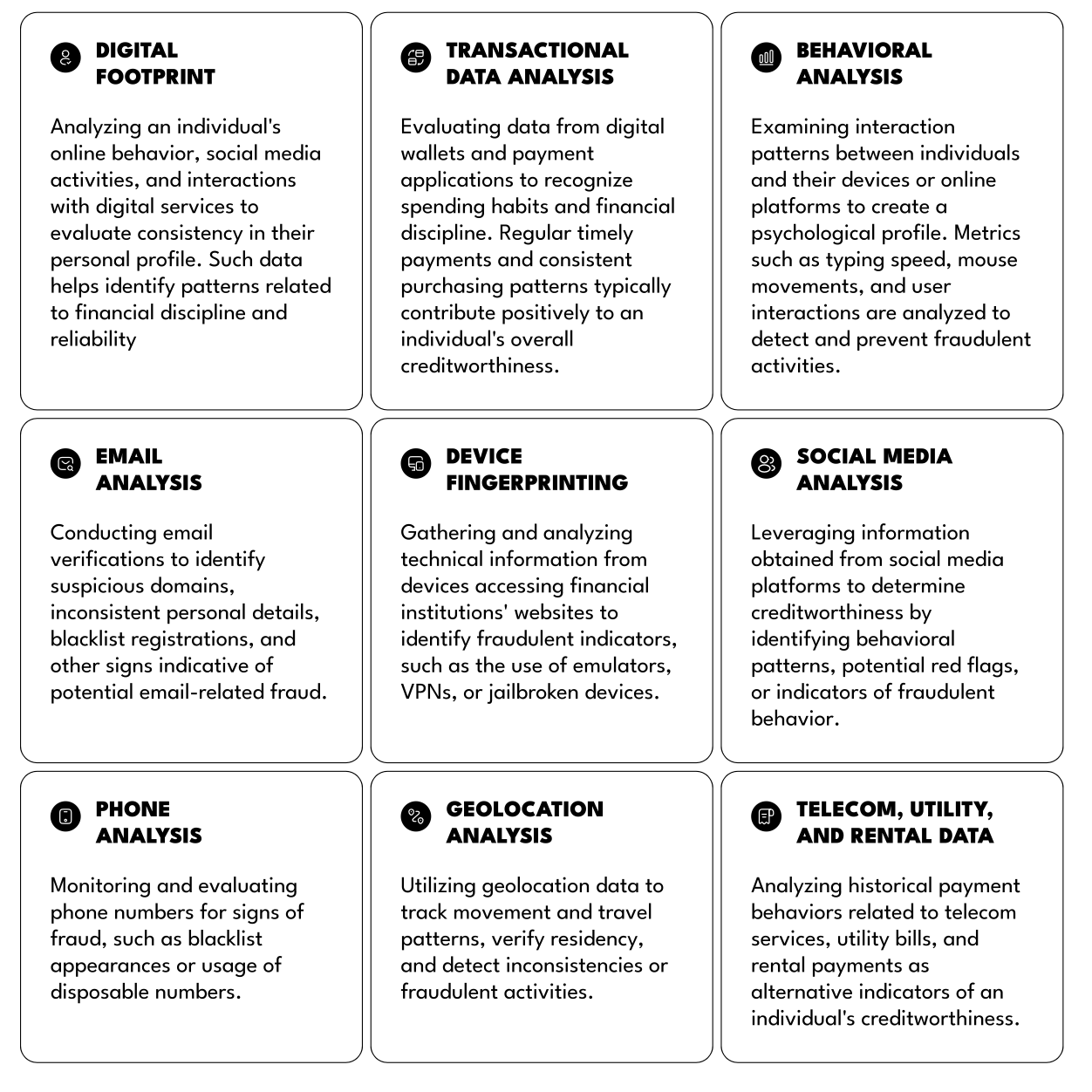

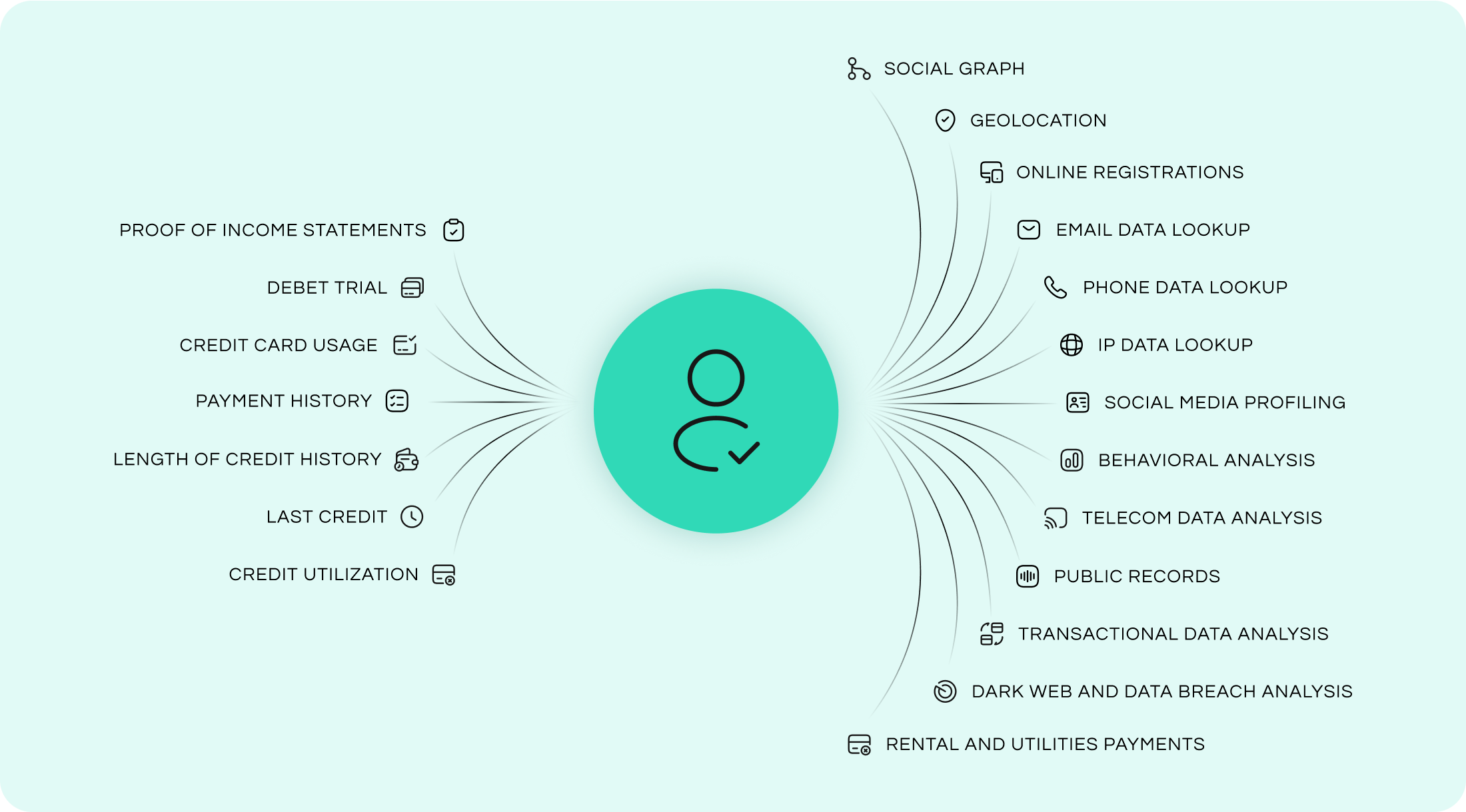

Where traditional credit scoring evaluates people based on credit cards, loans, and formal banking relationships, alternative credit scoring takes a broader view. It looks for behavioral signals, digital identity patterns, and publicly available data that reflect an individual’s financial reliability—even in the absence of formal records.

A few examples tell the story:

- An individual with three or more active paid subscriptions—like Spotify, Amazon Prime, or a local fitness app—demonstrates consistent disposable income and payment reliability.

- Someone actively using LinkedIn, Facebook, and Instagram, with consistent geolocation metadata and name/avatar usage, likely has a stable identity and long-standing online presence.

- A phone number tied to dozens of verified online accounts, used during regular business hours, and not present in spam or fraud blacklists, is a stronger sign of trust than a formal bank reference.

This model isn’t theoretical. It’s in use today by fintech companies, micro-lenders, neobanks, and credit platforms in dozens of countries.

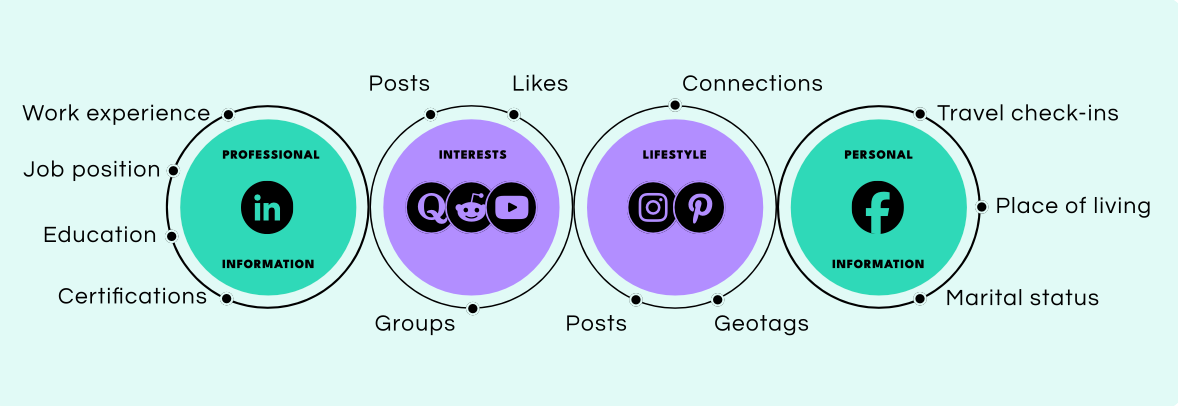

The Power of Social Media and Digital Identity

Social media is at the heart of digital identity in the modern era. As of 2025, there are 5.07 billion active social media users globally—representing 62.6% of the world population. In developing regions, social profiles often serve as the only digital identity people have.

What does this mean for credit scoring?

Platforms like LinkedIn, Facebook, Instagram, TikTok, and Telegram reveal not just who a person is—but how consistently they present themselves. For example, LinkedIn activity may confirm a person’s current employer and professional background. Facebook check-ins show location history. Instagram can reflect lifestyle and interests, which correlate with income tiers.

But equally important are anomalies:

- If an applicant claims to live in Mexico but shows years of social activity in Belarus, it could signal synthetic identity or application fraud.

- A person with no social profiles or only recently created ones may be attempting to create a fake persona.

- Inconsistent photos, mismatched names, or unusual regional associations across platforms are frequent flags in fraud scoring.

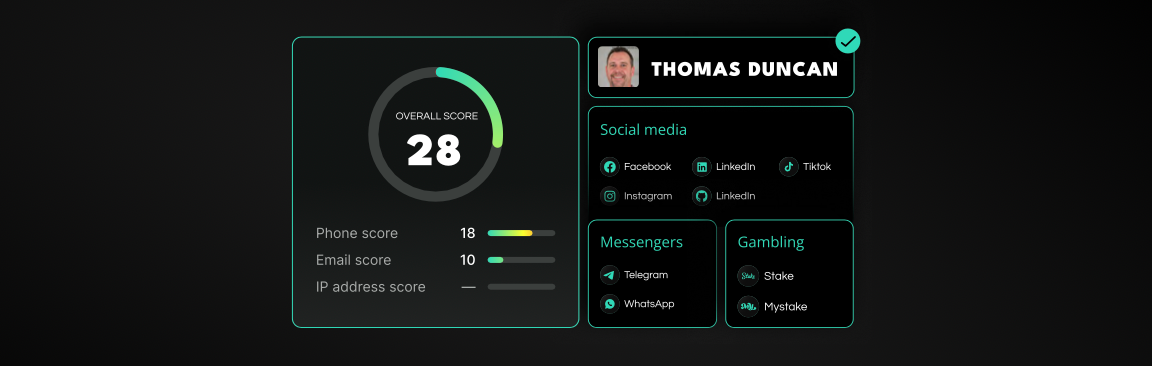

Platforms like Scoreplex address this by aggregating data from over 140 open sources, offering a panoramic view of the applicant’s digital self.

Mapping Trust with Social Graphs

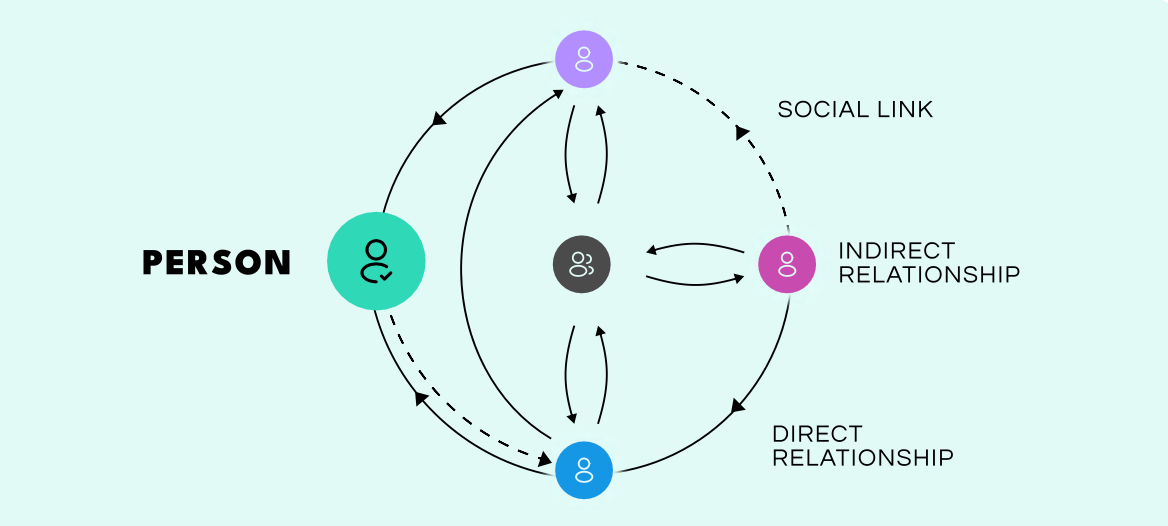

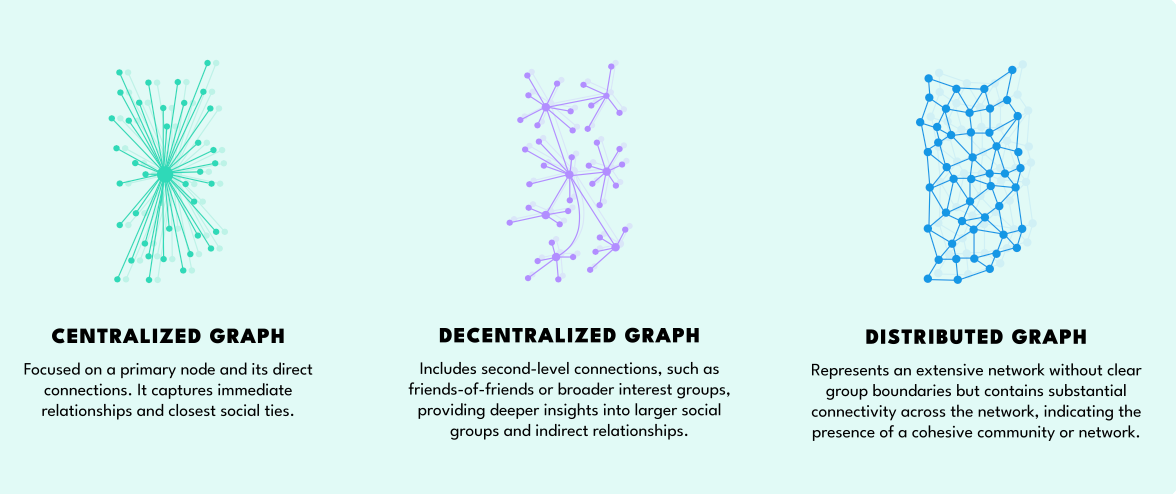

Going beyond profiles, social graphs—mathematical models of human connection—add another layer of predictive power. These graphs map relationships between users: friends, followers, colleagues, and mutual contacts.

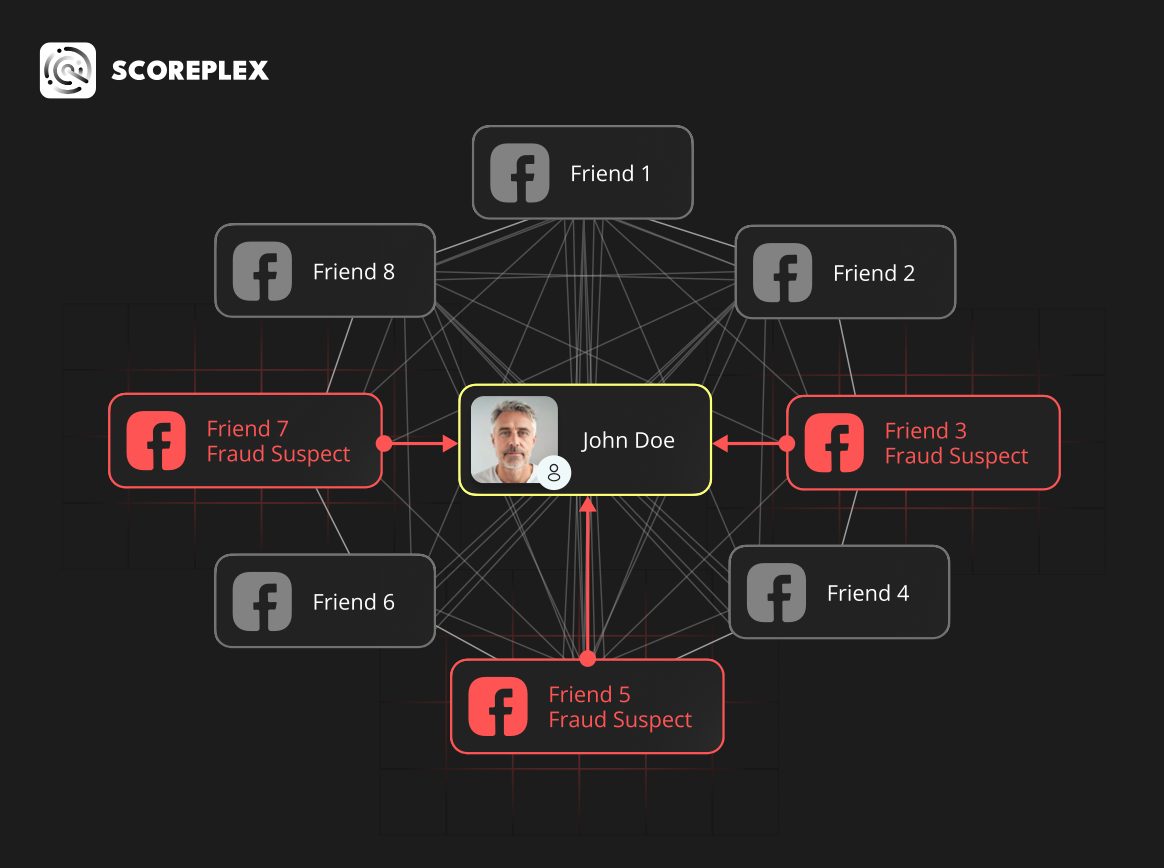

Here’s where it gets interesting. If a person is directly or indirectly connected to known fraudsters, their risk score goes up. Fraud rings often operate in clusters, and social graphs are one of the best tools for early detection.

Conversely, someone whose close network consists of solvent, stable individuals is statistically more likely to be trustworthy. In some models, lenders even use the social graph to assess community risk and design targeted offers to groups that exhibit low risk behavior collectively.

Digital Footprints as Behavioral Biometrics

A digital footprint includes every trace a user leaves behind online: reviews, forum posts, account registrations, purchases, and even leaked credentials from data breaches.

One powerful example is the presence of paid subscriptions. Data from the white paper shows that more than three active subscriptions is a reliable marker of financial discipline.

On the flip side, patterns of online gambling or betting raise red flags. If an applicant is found to have more than two active accounts on betting platforms like Stake or MyStake, their credit risk typically rises—especially in short-term lending and BNPL contexts.

Even data leaks tell a story. A legitimate user will likely have been caught in at least two breaches—which, ironically, helps verify the authenticity and age of the profile. Fraudulent identities tend to have pristine digital footprints—which is precisely what makes them suspicious.

Rent and Utilities: The Underutilized Goldmine

It may surprise some lenders to learn that rent and utility payments are among the most reliable and predictive indicators of repayment behavior.

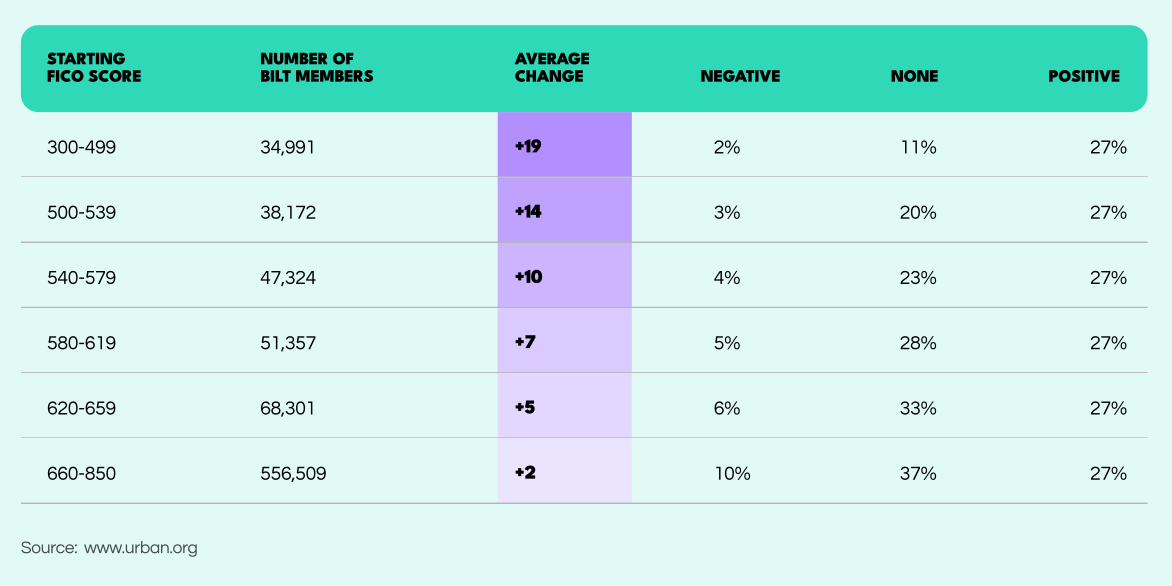

According to research from the Urban Institute, adding rental history to a borrower’s credit file can increase FICO scores across all brackets—especially for those with low or no scores.

For users starting in the 300–499 range, average score improvements were +19 points after including rent data. Even users in the 500–539 bracket saw +14 points on average. This is significant. In many cases, it pushes applicants from "subprime" to "near-prime" status, making them eligible for better interest rates and higher limits.

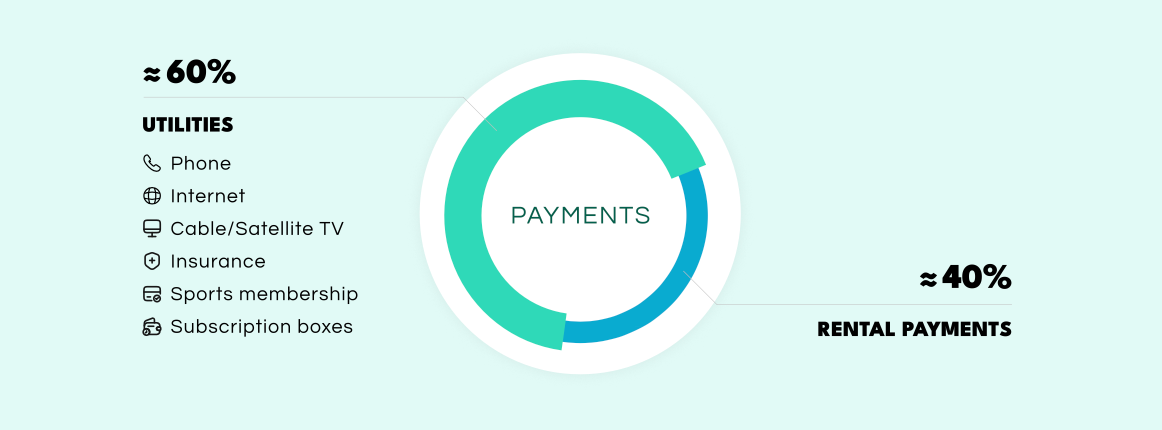

Utilities, such as internet, insurance, gym memberships, and subscription boxes, are similarly telling. The white paper indicates that 60% of recurring payment signals come from these sources. When paid consistently, they signal both cash flow and discipline—two traits any lender should value.

Behavior Over Balance Sheets

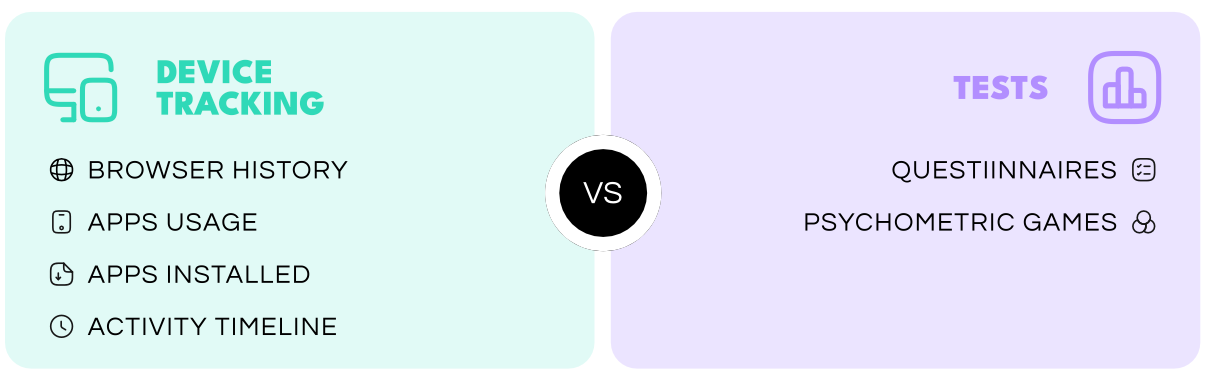

Some of the most promising advancements in credit science come from behavioral analytics. Instead of looking at static information, systems now observe how a person interacts with their device and the digital world.

Do they visit financial websites regularly? Are they most active during working hours (9 AM to 5 PM), which correlates with employment? What kinds of apps do they use—productivity, education, or gambling?

Even psychometric tests—short games or quizzes embedded in applications—can reveal traits like patience, risk aversion, and attention span. All of these behaviors, when combined, offer a remarkably accurate view of someone’s creditworthiness.

Email, Phone, and IP: Anchors of Digital Trust

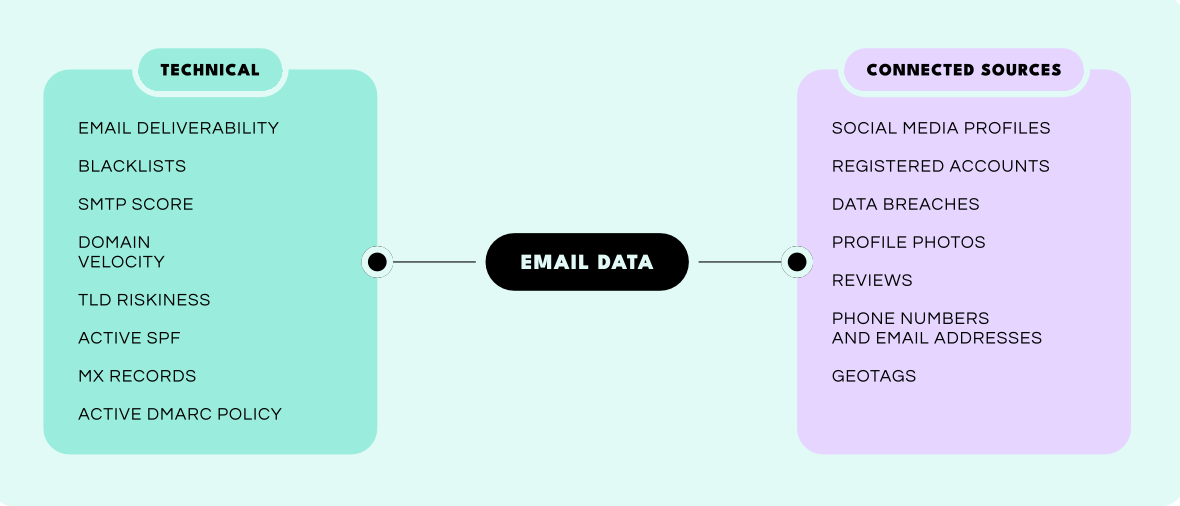

An email address might look like just a string of characters, but to scoring engines, it's a gateway to dozens of signals.

- Is it deliverable?

- Is it tied to known social accounts?

- Does it have an SPF record and DMARC policy?

- Has it appeared in breaches or fraud blacklists?

These technical checks are then augmented with social data, associated usernames, registered websites, profile pictures, and even geolocation hints.

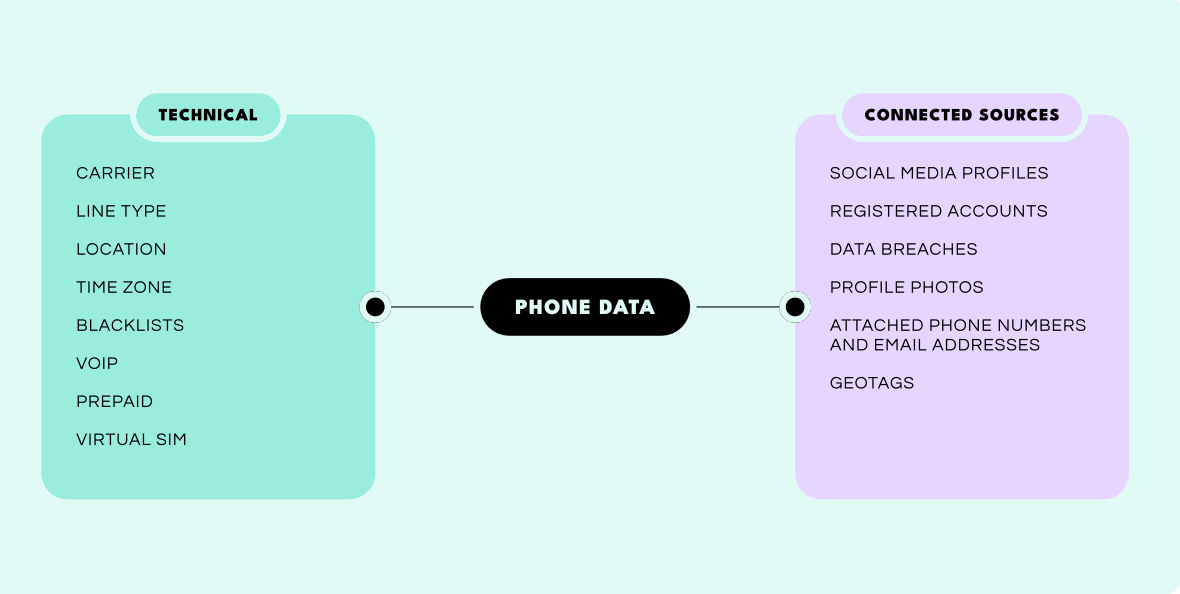

The same applies to phone numbers. A reverse lookup can tell if the number is prepaid, VOIP-based, or tied to a virtual SIM. Each of these carries different levels of risk. For instance, burner phones (prepaid SIMs with no ID requirements) are frequently used by fraudsters. Conversely, a phone linked to multiple verified services over time is a strong marker of identity consistency.

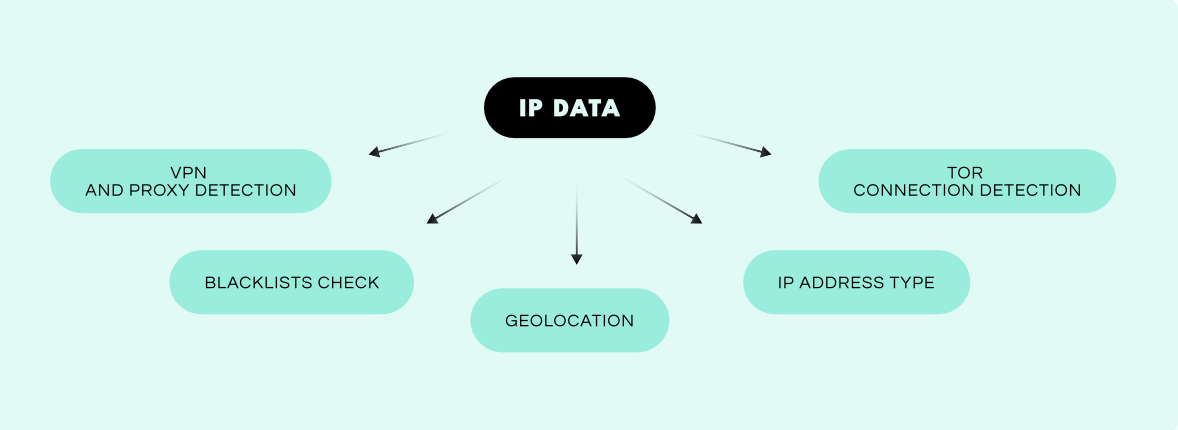

IP data also plays a role. A connection from a residential IP in the applicant’s claimed region is normal. But a TOR connection or data center IP—especially from a different country—may indicate someone trying to hide their real location.

The Real Impact: Accuracy and Inclusion

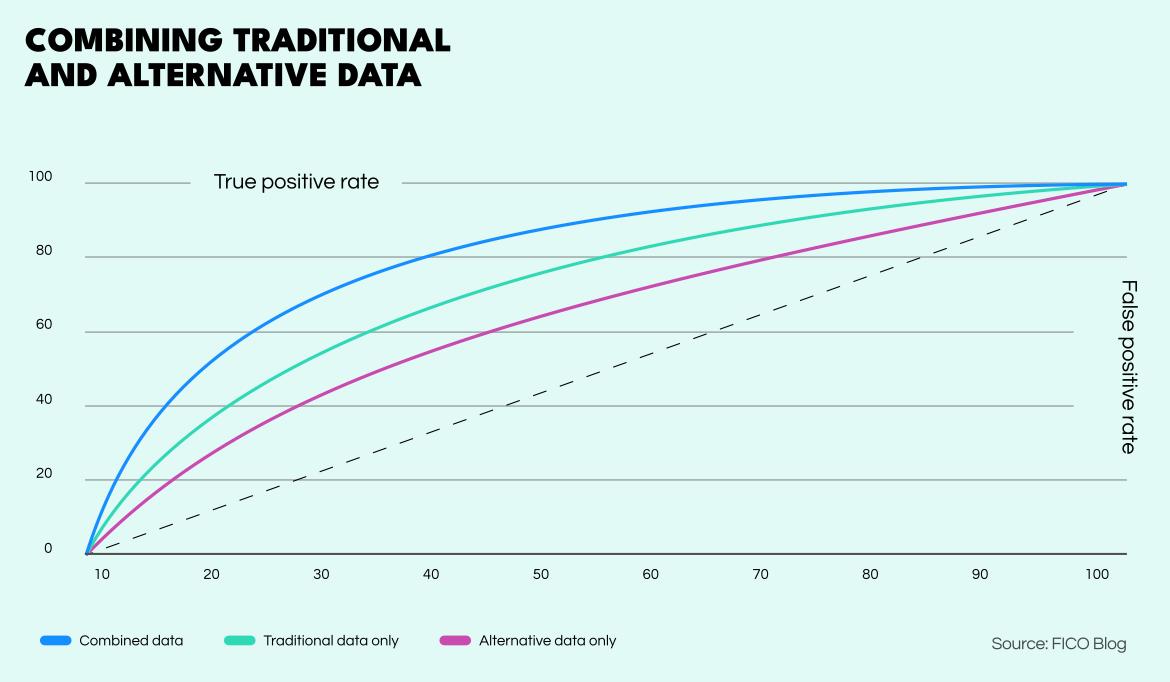

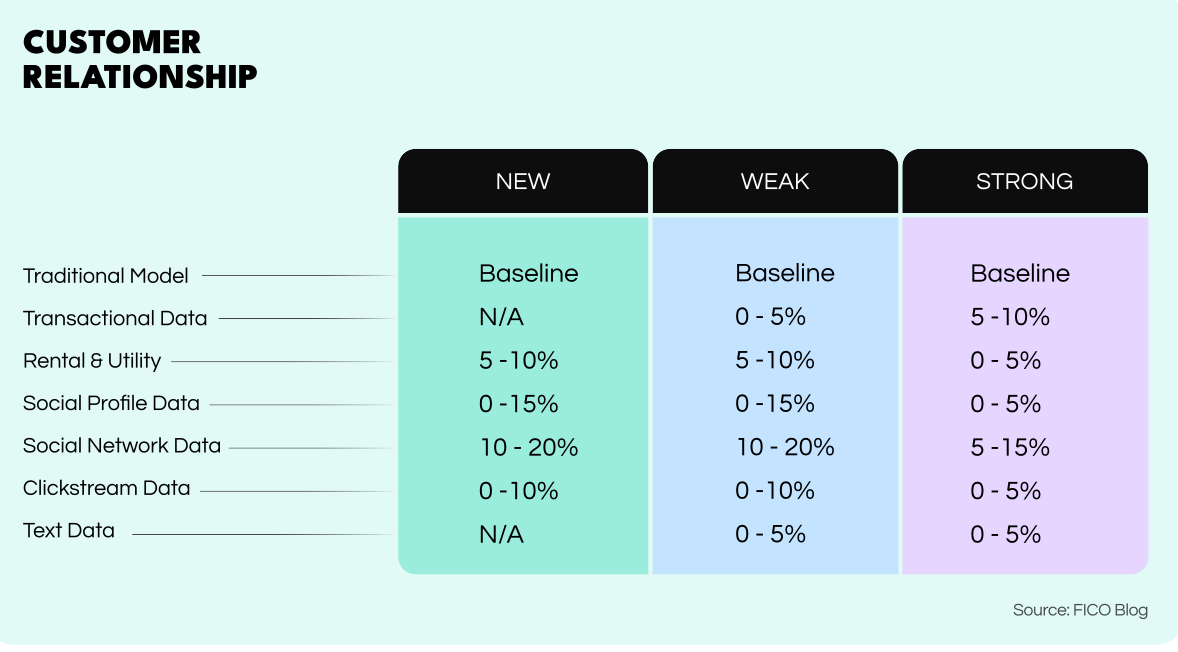

On its own, alternative data delivers about 60% of the predictive power of traditional financial credit data. But when combined with traditional signals, the result is powerful. Accuracy jumps by 10 to 20%, significantly reducing false positives and giving lenders more confidence in their risk models.

More importantly, this hybrid model allows lenders to serve first-time borrowers, immigrants, gig workers, and people from emerging markets—without compromising on risk assessment.

It’s not about being more lenient. It’s about being more intelligent.

Toward a Fairer Financial System

The promise of alternative credit scoring isn’t just technical—it’s moral. For decades, millions have been excluded from the financial system not because they were untrustworthy, but because the system didn’t know how to see them.

Now, with digital footprints, we can.

By embracing alternative signals, financial institutions can reduce fraud, improve model accuracy, and bring financial access to people who’ve been ignored for too long. The future of credit isn’t hidden in a bank vault. It’s on your phone, in your subscriptions, in your network, and in the way you live every day online.

We’re no longer asking, "Have you borrowed money before?" Instead, we’re asking, "Can we trust the life you live?"

And increasingly, the answer is yes.

Get the White Paper

If you're ready to dive deeper into the data, frameworks, and methodologies behind alternative credit scoring—along with detailed insights on social graphs, behavioral signals, email and phone intelligence, and more—download our full white paper.

About Scoreplex

Scoreplex provides alternative data for credit scoring and fraud prevention through digital footprint analysis using over 140 open sources.

By leveraging social media activity analysis, data leak monitoring, social profiling, and dynamic social graph generation, we enhance scoring models with insights that conventional data sources cannot capture.

About Ginimachine by HES

Together with GiniMachine by HES - a no-code AI scoring platform offering powerful predictive analytics, collection, credit scoring and risk management - financial organizations can easily implement an effective alternative credit scoring and fraud prevention solution from scratch. It saves weeks of manual work and requires no special training or extra skills.