Traditional credit scoring methods, though widely used, exclude a staggering number of individuals globally—approximately 3 billion people—due to insufficient or absent credit histories. Often labeled as "credit invisibles," these individuals face considerable challenges accessing loans and other financial services, emphasizing an urgent need for alternative scoring methods.

A large segment of populations in developing countries remains underbanked or entirely unbanked. Without credit histories, these individuals cannot be evaluated through conventional scoring models like FICO scores, significantly limiting their access to formal financial services.

Simultaneously, financial behaviors worldwide have evolved rapidly, leaving traditional scoring models struggling to keep pace. Millennials and Generation Z exhibit distinctly different financial habits—relying heavily on digital banking, gig economy income streams, and online transactions, while frequently avoiding traditional credit products. This generational shift has been driven by factors such as the aftermath of the global financial crisis, the growth of digital banking and gig platforms, and widespread digital marketing influence. Consequently, traditional credit scoring methods must adapt to accurately reflect today's financial realities.

The Rise of Alternative Credit Scoring

Alternative credit scoring solutions are swiftly gaining market momentum to address these challenges. By leveraging data beyond traditional credit bureau reports, these innovative approaches offer a broader, more accurate picture of individuals' financial behaviors. They help reduce fraud, improve risk assessment, and, crucially, expand financial inclusion. Alternative scoring methods especially benefit underbanked and unbanked populations, individuals in cash-based economies, rural communities, young adults, immigrants, and others who lack formal credit histories, thus providing them greater access to financial opportunities.

Introducing the 2025 Alternative Credit Scoring Landscape

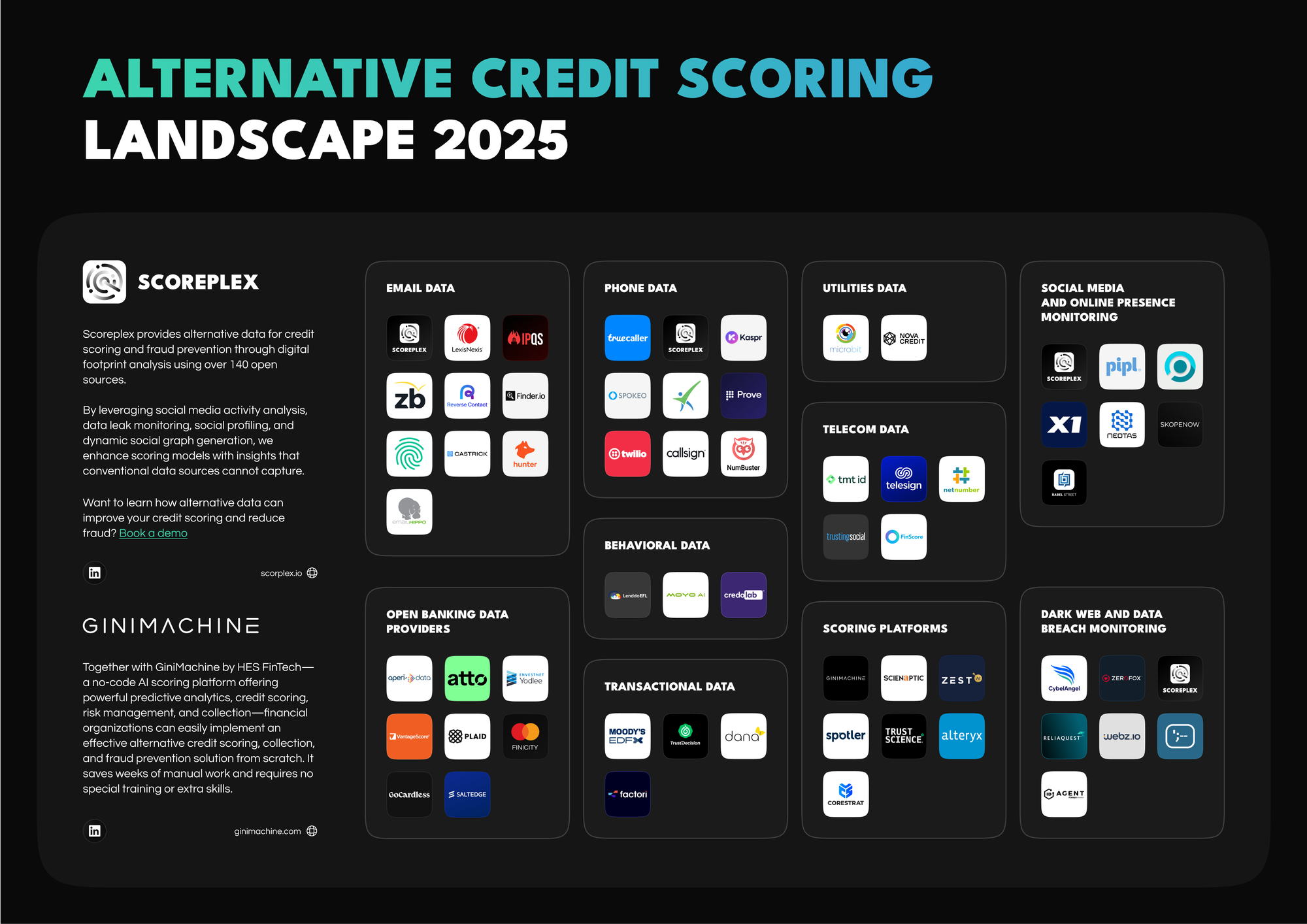

In collaboration with Ginimachine by HES, Scoreplex proudly presents the industry's first comprehensive Alternative Credit Scoring Landscape for 2025.

This detailed landscape includes 60 leading data providers across 10 essential product categories, comprehensively covering all critical domains required to build robust alternative credit scoring systems:

- Email Data: Verification tools identifying suspicious domains, inconsistent personal details, blacklist appearances, and other fraud indicators related to email addresses.

- Phone Data: Services monitoring phone numbers for signs of fraud, such as blacklist entries or disposable number usage.

- Utilities Data: Analysis of historical utility bill payments and rent payments, serving as alternative creditworthiness indicators.

- Telecom Data: Insights derived from user activity within telecommunication networks, tracking travel patterns, location, and behavioral trends.

- Behavioral Data: Evaluation of user interactions with devices or online platforms, including metrics such as typing speed, mouse movements, and user interactions, to detect fraudulent activities.

- Social Media and Online Presence: Leveraging social media data to determine creditworthiness, identify behavioral patterns, and spot potential fraudulent behavior.

Together, these diverse data categories offer financial institutions a powerful, modern solution to develop alternative credit scoring systems.

Ready to explore the landscape in detail?

Click the button below to download your high-resolution copy of the Alternative Credit Scoring Landscape 2025.

About Scoreplex

Scoreplex provides alternative data for credit scoring and fraud prevention through digital footprint analysis using over 140 open sources.

By leveraging social media activity analysis, data leak monitoring, social profiling, and dynamic social graph generation, we enhance scoring models with insights that conventional data sources cannot capture.

About Ginimachine by HES

Together with GiniMachine by HES - a no-code AI scoring platform offering powerful predictive analytics, collection, credit scoring and risk management - financial organizations can easily implement an effective alternative credit scoring and fraud prevention solution from scratch. It saves weeks of manual work and requires no special training or extra skills.