Social media accounts have become an invaluable tool in alternative credit scoring, offering deep insights into individuals' backgrounds and behaviors. By examining social media activity, lenders can quickly access detailed information such as professional history, current occupation, residential location, travel patterns, social connections, marital status, and more.

Why Use Social Media Data?

Real-Time Updates

One major advantage of social media is the ability to obtain data instantly through automated crawlers. This real-time retrieval contrasts sharply with traditional, often outdated databases. Immediate data access proves especially valuable in industries like payday lending and "Buy Now Pay Later" (BNPL), where rapid and accurate assessments of new customers are crucial.

Reaching Unbanked Populations

Globally, approximately 5.07 billion individuals—about 62.6% of the world's population—are active social media users. For communities lacking robust traditional banking data, social media profiles become essential for credit scoring. Leveraging social media thus expands financial access to underserved populations, offering meaningful credit assessments even when conventional data sources fall short.

Enhanced Fraud Detection

Social media data can significantly strengthen fraud prevention. Discrepancies in personal information—such as inconsistent names, profile images, or addresses across platforms—or the complete absence of online profiles frequently signal fraudulent activities, including fake or synthetic identities. Detecting these inconsistencies early reduces risk and improves overall decision-making.

Limitations of Using Only Social Media Data

While social media data offers substantial benefits, exclusive reliance on it carries specific limitations:

Limited Information Availability

Many users maintain partially completed or private accounts, restricting available data to minimal details such as avatars or names. Furthermore, legitimate users might intentionally obscure their identities by adopting pseudonyms or creating multiple profiles. To address this limitation, advanced solutions like Scoreplex aggregate data from over 140 publicly available sources, ensuring more comprehensive and accurate profiles.

Accuracy Concerns

Decisions based solely on a single data source are prone to inaccuracies. To maintain reliable credit scoring decisions, information should always be cross-verified across multiple data points and sources. This verification process mitigates errors and enhances accuracy in credit assessments.

Indicators of Fraud or Increased Credit Risk

Although platforms vary, several consistent indicators highlight potential fraud or heightened credit risks:

- Minimal or No Social Profiles: An absence of online presence often indicates a fabricated identity, posing significant lending risks.

- Mismatched Information: Variations in personal details, such as differing names or photos across social media platforms, typically suggest attempts at creating fake or synthetic identities.

- Regional Discrepancies: Users predominantly active on social media platforms geographically distant from their claimed residence may signal fraud risks or increased credit concerns.

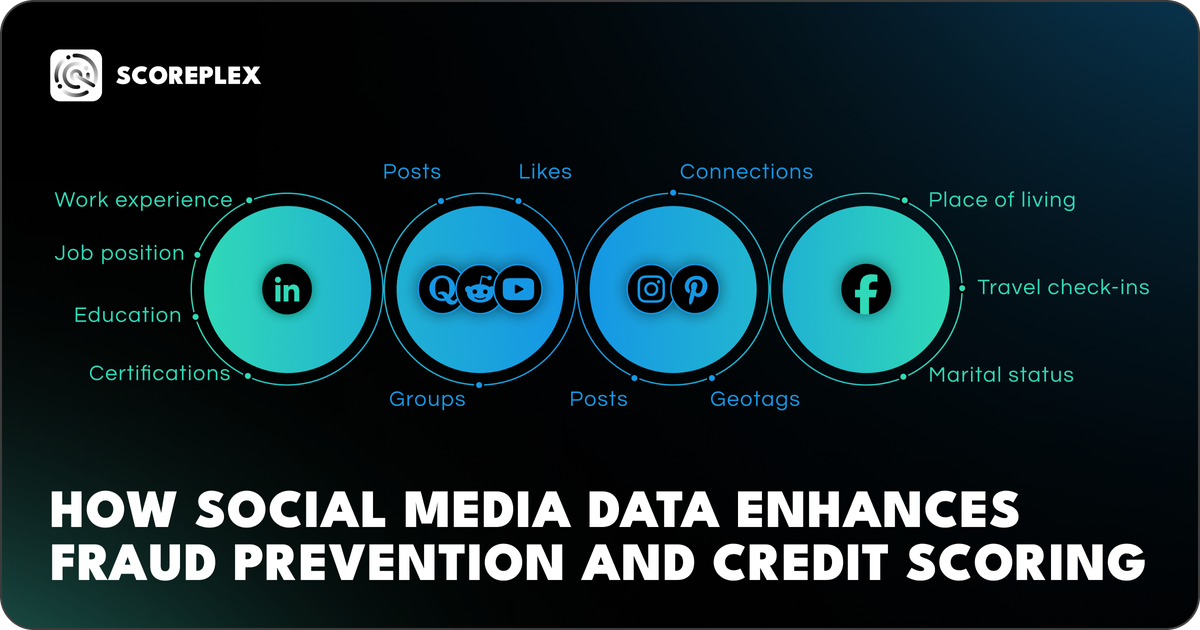

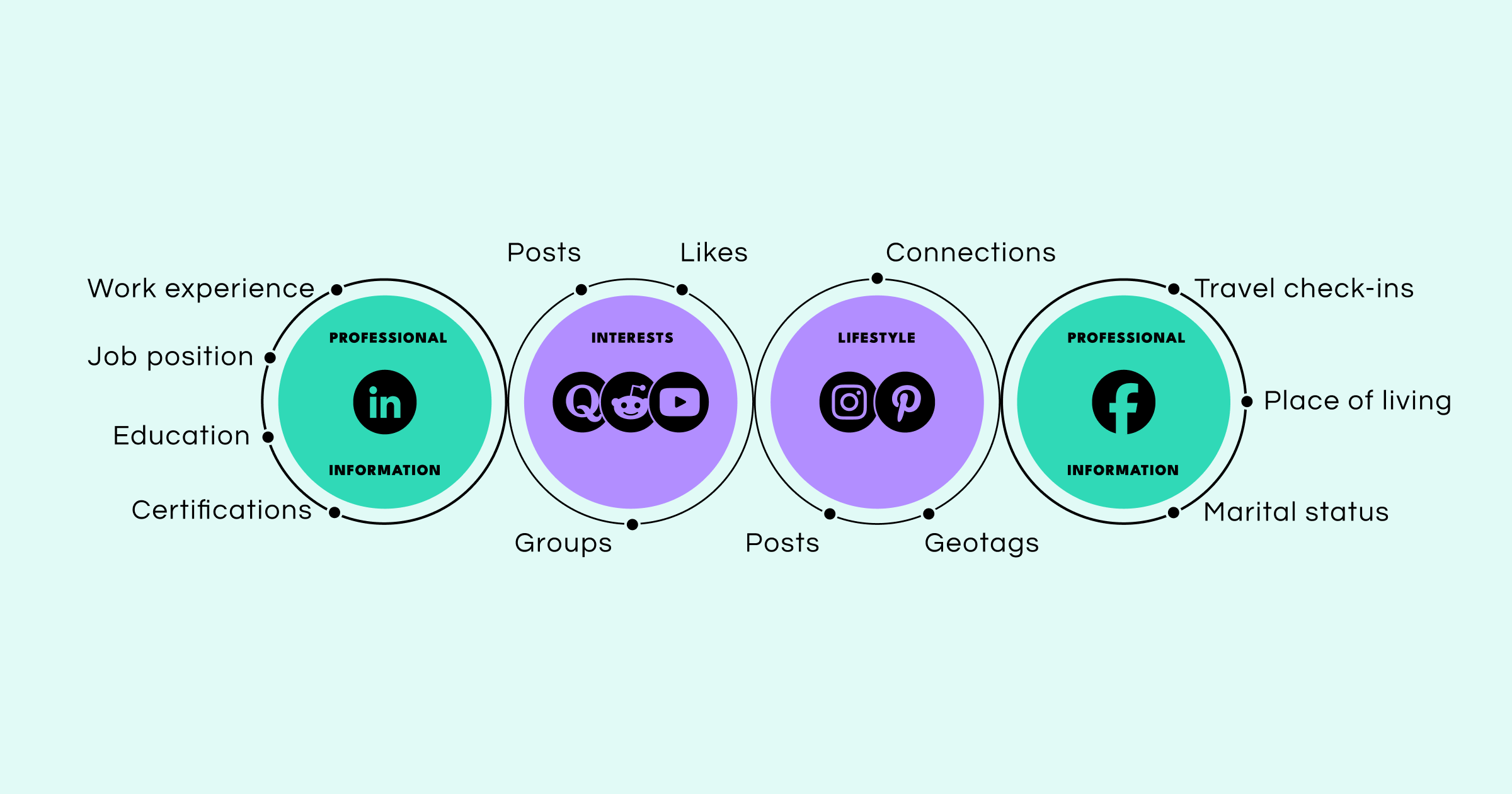

Leveraging Multiple Social Media Sources

Integrating data from multiple social media platforms enriches the depth and reliability of individual profiles. For instance:

- LinkedIn: Provides detailed professional data including current roles, previous employment, organizational affiliations, educational background, and certifications.

- Facebook: Adds crucial personal information such as marital status, residential locations, frequent check-ins, and detailed travel history.

By combining these varied data sources, lenders can construct a fuller, more accurate picture, significantly enhancing the efficacy of credit scoring and fraud prevention strategies.

About Scoreplex

Scoreplex provides alternative data for credit scoring and fraud prevention through digital footprint analysis using over 140 open sources.

By leveraging social media activity analysis, data leak monitoring, social profiling, and dynamic social graph generation, we enhance scoring models with insights that conventional data sources cannot capture.