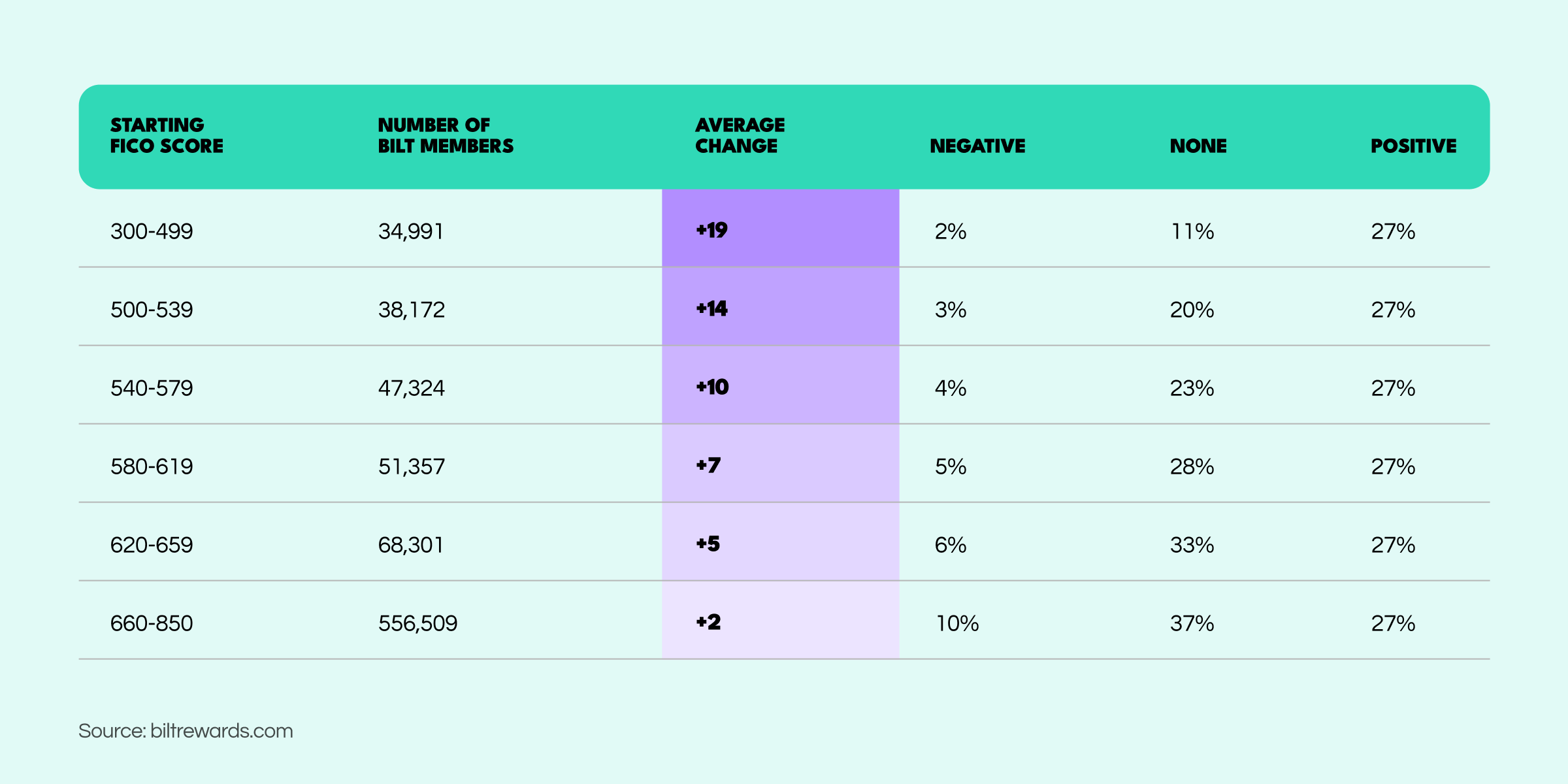

In recent years, rental payment data has become increasingly recognized as a powerful indicator of an individual's creditworthiness. Regular, timely rental payments demonstrate clearly a borrower's financial discipline, reliability, and willingness to meet their debt obligations fully and punctually.

Research from the Urban Institute further supports the importance of incorporating rental payment history into traditional credit scoring models, such as the widely-used FICO score. Their findings indicate that including rent payment data significantly improves the accuracy of credit evaluations. This is particularly valuable for individuals who were previously deemed "credit invisible," typically due to a lack of traditional credit records.

In addition to rental payments, utility payment history has also become an essential component in evaluating an individual's creditworthiness. Regularly paying bills for phone services, internet, insurance premiums, gym memberships, subscription boxes, and other recurring expenses collectively helps build a more comprehensive picture of a person's financial stability and solvency.

By utilizing rent and utilities payment data, lenders can better assess the true financial health of potential borrowers. This approach not only helps in creating more inclusive and fair credit opportunities but also enhances fraud prevention measures by accurately distinguishing reliable borrowers from those presenting higher risks.

As financial institutions increasingly adopt these alternative data points, the scope of credit assessments expands significantly, providing opportunities for previously underserved individuals to access necessary financial products and services.

About Scoreplex

Scoreplex provides alternative data for credit scoring and fraud prevention through digital footprint analysis using over 140 open sources.

By leveraging social media activity analysis, data leak monitoring, social profiling, and dynamic social graph generation, we enhance scoring models with insights that conventional data sources cannot capture.