Hi from the Scoreplex team,

We’re thrilled to introduce our H1 product update — a major step forward in making fraud prevention more transparent, customizable, and automated. From a brand-new rule-based scoring engine, IP intelligence, phone/email/name cross matching to deeper identity consistency checks and enhanced email risk analysis, we’ve added powerful tools that give you more control and insight at every verification step.

Let’s walk through the key improvements:

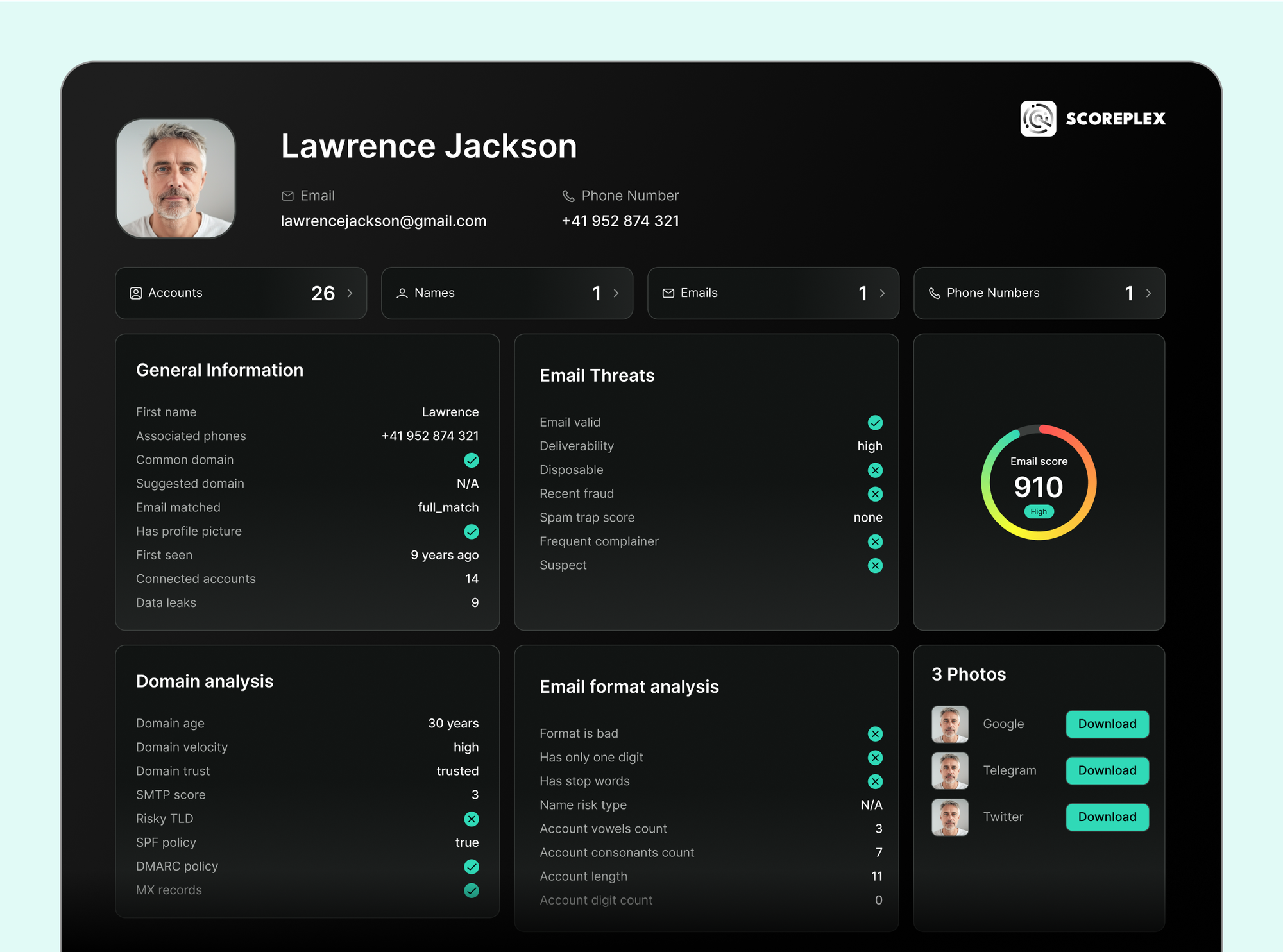

New Scoring Model – Transparent, Customizable, Included

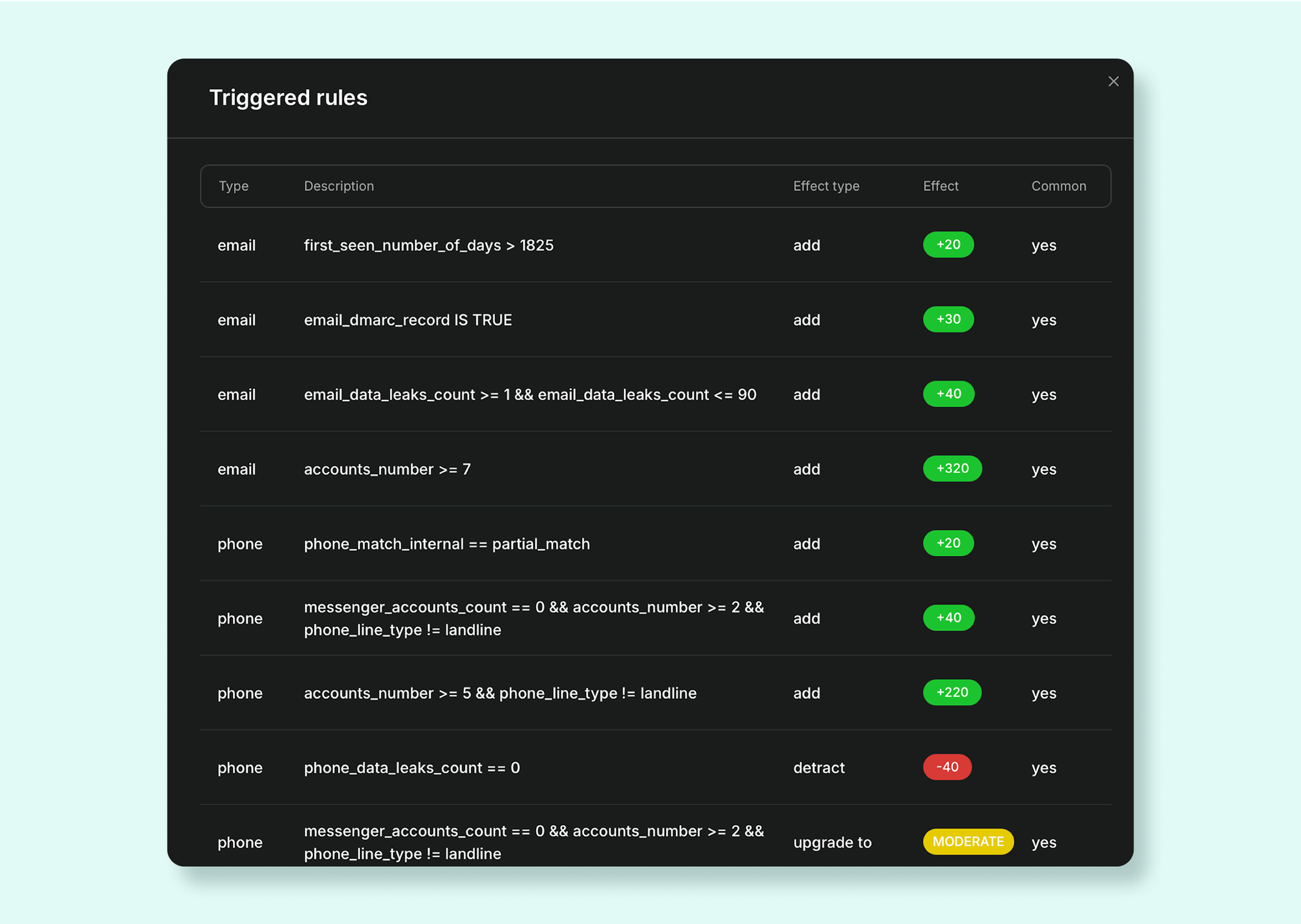

At the heart of this release is our new scoring model — a fully transparent, rule-based system that helps you detect fraud with both precision and explainability. This isn’t a black-box system with obscure weights and opaque logic. You’re in control of the rules, the thresholds, and the outcomes.

What makes our new scoring engine different:

- White-box logic: all scoring decisions are visible, documented, and understandable. You can see why a certain score was assigned — no hidden math or AI guesswork.

- Rule-based architecture: build your scoring logic using a set of 200+ pre-configured rules or create your own with our intuitive rule editor. Rules can be toggled on/off, adjusted in weight, or extended with custom logic.

- 5-category scoring scale: we classify results into five easy-to-understand categories:

- HIGH (776–1000) Strong and consistent digital evidence of trustworthiness

- GOOD (551–775) Several positive signals detected

- MODERATE (451–550) Partial info available, uncertain identity

- BAD (226–450) Multiple negative signals present

- POOR (0–225): Likely spam, bot traffic, or synthetic identity

- Included in all plans: our scoring engine is now part of the core Scoreplex platform — no additional fees, no hidden paywalls.

Use case: a BNPL platform in Mexico wants to filter risky users before triggering costly KYC. With the new engine, they:

- Enable rules that flag suspicious phone carriers and free email domains

- Set a low threshold for VPN usage and name mismatches

- Auto-decline applications with a POOR score

- Send users with a MODERATE score to manual review

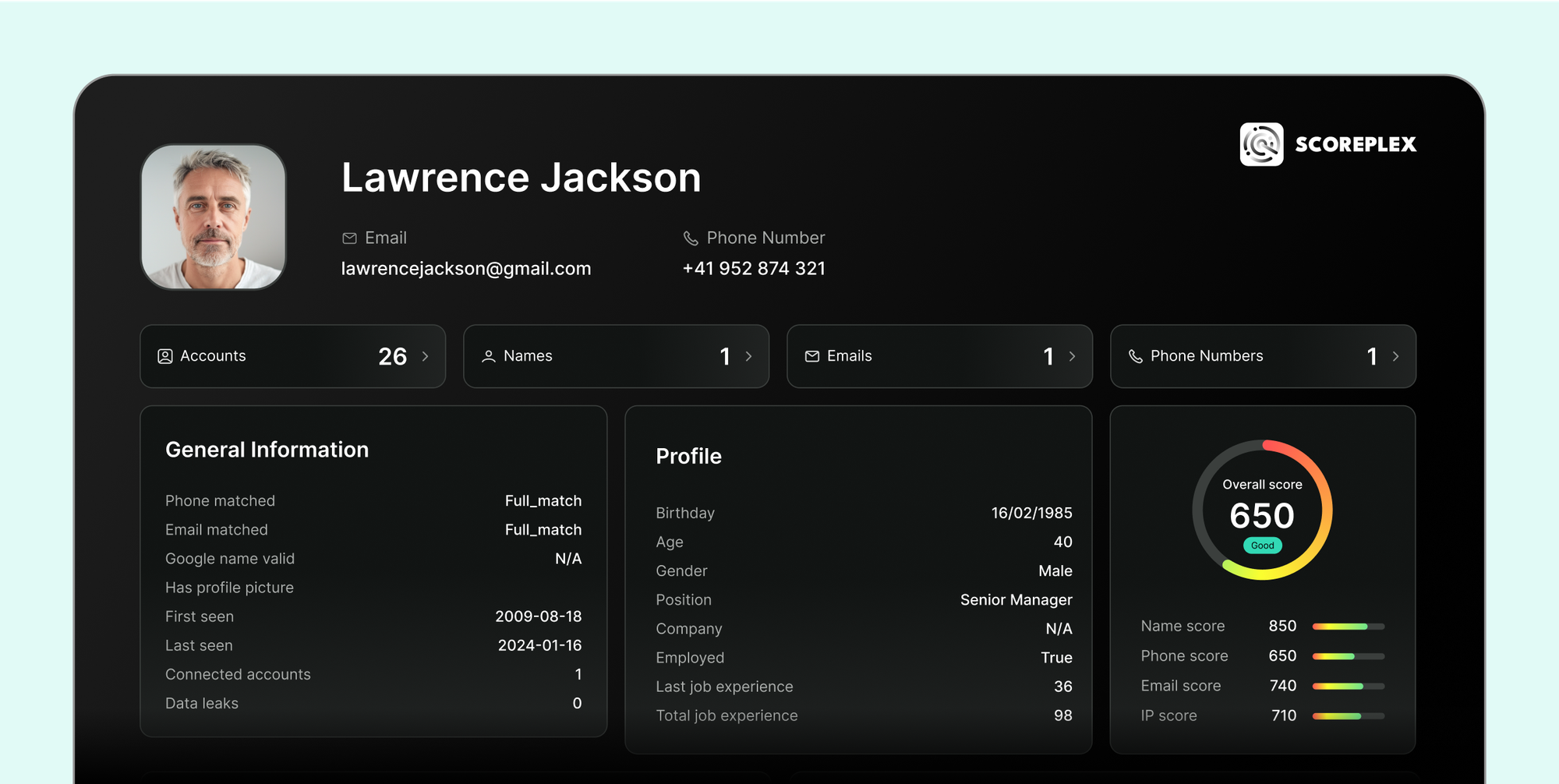

IP Address Intelligence

IP addresses reveal a lot more than location — they help uncover obfuscation, suspicious behaviors, and potential fraud networks.

Here’s what you can now detect with Scoreplex:

- General IP metadata: includes geolocation (country, region, city), ISP, timezone, organization, and business/residential classification.

- Use of proxies, VPNs, or the TOR network: we identify and flag common obfuscation techniques. For example, traffic through TOR or commercial VPNs often correlates with synthetic identity fraud. You can now distinguish between corporate VPNs (common for work use) and suspicious private VPN use.

- Blacklist status: we cross-check the IP address against real-time fraud and botnet blacklists, identifying addresses associated with malware, automation, or abusive behavior.

These insights help you decide whether to proceed, request verification, or decline access based on the IP signature alone.

Use case: a digital bank in Colombia suspects that fraudsters are using stolen identities. Their fraud analyst notices:

- Dozens of accounts with different names/emails

- All sharing the same IP flagged for TOR access and found on a botnet list

Name Analysis and Pattern Recognition

We’ve significantly enhanced our full name analysis to identify red flags commonly seen in synthetic identities and fraudulent signups.

The updated name analysis now includes:

- Risk pattern checks: detect common fraud signals in names, such as:

- Placeholder names (e.g. "John Doe", "Test User")

- Typosquatting or keyboard mashing

- Fictional or joke names

- Impersonation of celebrities or brands

- Numeric-only or vulgar names

- Mixed-language names (e.g. “Иван Smith”)

- Redundancy or repetition (e.g. “John Johnson”)

- First and last name matching (e.g. “Anna Anna”)

- Validation and plausibility scoring: determine whether a name follows global cultural naming patterns, helping filter out clearly invalid or autogenerated identities like "Crypto Lizard."

- Gender estimation: suggest gender based on international naming conventions.

These signals are useful both for automated scoring and for manual reviews where contextual clues matter.

Use case: an Indonesian neobank notices users trying to bypass real-name checks using random or joke names. Scoreplex flags these cases with specific tags and suggests appropriate risk levels.

Example: a user signs up as Captain Marvel. Scoreplex flags:

- Fictional name (categorical downgrade to POOR)

- Name not found on linked accounts (deduction)

Score: POOR → Sent for manual validation.

Email Risk Analysis: Go Beyond Metadata

While metadata enrichment (like domain age and reputation) is useful, fraud often hides in the email username itself. That’s why we’ve expanded our email analysis to deeply evaluate the structure, language, and intent of the username.

New email analysis capabilities include:

- Pattern detection: catch brand impersonations, random strings, leetspeak (h4ck3r), vulgarity, and other red flags based on email naming patterns.

- Placeholder and fictional name detection: identify usernames like john.doe123, test.user, or elon.musk@gmail.com that may not belong to real individuals or are impersonations.

- Google account match: we cross-reference the name associated with the email’s Google account. If the email is john.doe@gmail.com but the Google account is registered to “Dog Walker,” that’s a mismatch worth flagging.

- Stop-word detection: classify emails like sales@, info@, support@ as non-personal or generic — not suitable for KYC.

- Username digit analysis: evaluate if the digits (e.g., john123, johndoe1990) follow human-like patterns or suggest bulk generation.

- Vowel-consonant ratio & structure check: analyze whether the username appears to be a human-readable name or just random characters.

Each of these signals is integrated into our scoring system and visible in the UI for review and explanation.

Use case: a P2P lending platform receives thousands of applications with Gmail addresses. But many usernames are suspicious or generic.

Scoreplex helps filter:

- Valid emails with joke names or bot patterns

- Business-only emails not meant for individuals

- Mismatches between claimed name and Google account name

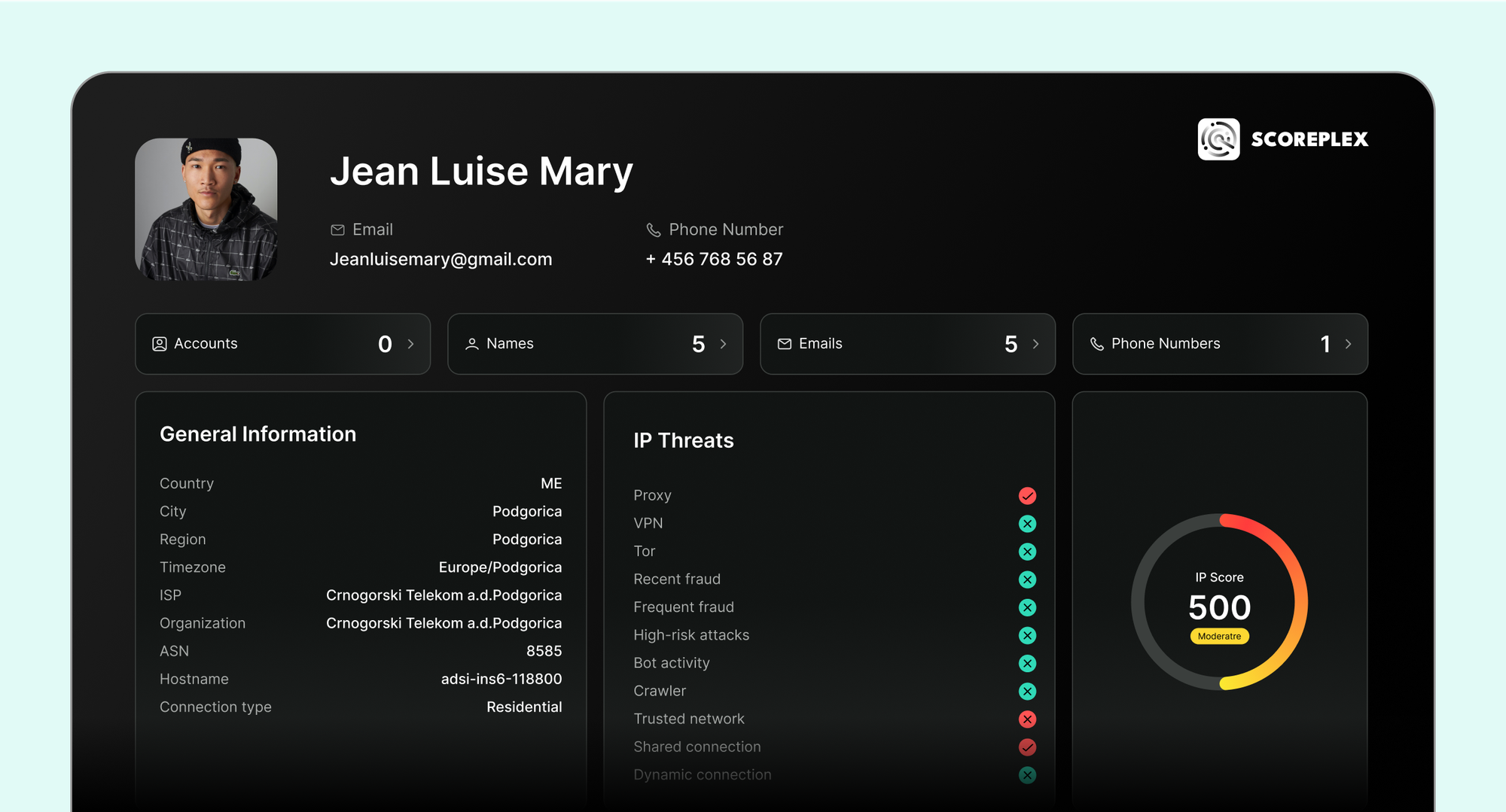

Name, Phone, Email Cross-Field Matching: Identity Consistency Checks

Fraudsters often submit mismatched or temporary data — an email not connected to their phone, a made-up name, or a throwaway IP.

Our new matching mechanism cross-verifies the full name, email address, and phone number against enriched databases to evaluate:

- Whether these inputs appear consistently across public and private records

- Whether they are likely to belong to the same person

- Whether the name provided is supported by the associated email account or phone record

Use case: Detecting Stolen Identities Using Disposable Inputs

Fraudsters often bypass standard onboarding checks by combining stolen email credentials (often bought in bulk from the dark web) with prepaid burner phones registered under fake or untraceable names. These credentials may look superficially valid, but they don’t hold up under scrutiny — especially when you evaluate their consistency across the digital footprint.

Scoreplex’s matching engine cross-references phone numbers, emails, and names against enriched third-party data to spot inputs that lack authentic digital history or show signs of being single-use and disposable.

Example:

- Name provided: Ricardo Sánchez

- Email: robsanchez@gmail.com — appears valid and deliverable

- Phone number: +52 33 1234 5678 — prepaid mobile from an anonymous SIM provider

- IP address: public café network in Guadalajara

Matching Results:

- The email is associated with Rob Sanchez, not Ricardo Sánchez — potential identity theft

- The email has no consistent social footprint and no matching accounts across platforms

- The phone number is new, prepaid, and not linked to any verified profiles

- The full name Ricardo Sánchez appears nowhere in the digital history tied to this email or phone number

Scoreplex response:

- Score for phone: POOR (no match, anonymous carrier)

- Score for email: BAD (valid but mismatch with claimed identity)

- Name: NOT FOUND in associated records

- Overall score: POOR

Why it matters:

While each component looks technically correct, the lack of cohesive identity across data points reveals the likely use of:

- A burner phone purchased for one-time use

- A compromised or synthetic email address

- A borrowed or fabricated name unrelated to any enriched digital profile

This matching logic empowers fraud teams to catch advanced identity fraud at the pre-KYC stage, reducing cost, chargebacks, and compliance risk — without introducing friction for genuine users.

Get Hands-On: Book a Live Demo

Want to see the updated Scoreplex in action?

We’d love to show you how our tools can:

- Reduce your onboarding risks

- Improve fraud detection speed and accuracy

- Give your compliance and risk teams full transparency and control