Synthetic identity fraud has emerged as one of the most pervasive and challenging forms of financial crime today. Unlike traditional identity theft, where a criminal steals and uses a real person's information, synthetic identity fraud involves creating a completely new identity by combining real and fabricated data. This blend of authentic and fictitious information makes it exceedingly difficult to detect, allowing fraudsters to exploit financial systems over extended periods before being identified.

The scale of this issue is staggering. In 2023, synthetic identity fraud accounted for approximately $35 billion in losses, marking a significant increase from previous years . This surge is attributed to the growing sophistication of fraud schemes and the increased availability of personal data.

The impact extends beyond financial losses. Victims, often individuals with limited credit histories, may remain unaware of the fraud for years, leading to long-term damage to their credit and financial standing. For businesses, especially those in the financial sector, the repercussions include increased charge-offs, regulatory scrutiny, and a loss of consumer trust.

As the digital landscape evolves, so do the tactics of fraudsters. Understanding the mechanics of synthetic identity fraud and its implications is crucial for businesses aiming to protect themselves and their customers.

What Is Synthetic Identity Fraud?

Synthetic identity fraud is a sophisticated type of financial crime in which fraudsters create entirely new identities by combining real and fabricated information. Unlike traditional identity theft, where a criminal steals someone’s existing personal information, synthetic identity fraud often uses real Social Security numbers—frequently those of children, the elderly, or individuals with little credit history—paired with fake names, birthdates, or addresses.

The goal is to build a new credit profile that appears legitimate to banks, lenders, and other financial institutions. Over time, these synthetic identities can be used to open credit accounts, apply for loans, or conduct large-scale fraudulent transactions. Because the information is partially real, these identities can often pass standard verification checks, making them extremely difficult to detect.

Key Characteristics of Synthetic Identity Fraud:

- Combination of real and fake data: Fraudsters may use a valid Social Security number with fictitious names or addresses.

- Long-term exploitation: Synthetic identities can exist undetected for months or even years before being discovered.

- Hard to detect with traditional methods: Standard fraud detection tools, such as credit history checks or ID verification, often fail to flag these identities.

- High financial impact: The Federal Reserve estimates that synthetic identity fraud causes billions in annual losses for financial institutions.

Impact of Synthetic Identity Fraud

Synthetic identity fraud is not just a theoretical threat—it has real, measurable consequences for both businesses and consumers. Its sophisticated nature allows fraudsters to operate undetected for months or even years, amplifying the financial and reputational damage.

Financial Losses for Businesses

- Banks and lenders are the primary targets. Fraudsters can open credit cards, loans, and other financial accounts under synthetic identities, often maxing them out and disappearing before repayment.

- Synthetic identity fraud is projected to cost institutions $58.3 billion globally by 2030, driven by AI-powered scalability of identity fabrication.

- Beyond direct losses, businesses also face increased charge-offs, fraud investigation costs, and operational disruptions.

Reputational and Regulatory Risks

- Businesses affected by synthetic identity fraud can suffer loss of customer trust, which may lead to reduced retention and revenue.

- Regulatory compliance is increasingly stringent. Failure to detect and prevent synthetic identity fraud can result in fines, audits, or sanctions from oversight bodies.

- The rising frequency of these attacks has prompted many organizations to invest in advanced detection solutions to maintain credibility and compliance.

Systemic and Industry-Wide Consequences

- Synthetic identity fraud undermines the reliability of credit reporting systems and complicates lending decisions for financial institutions.

- It also raises operational costs across the industry, as businesses must implement more sophisticated verification and monitoring systems.

Who is Most at Risk?

While synthetic identity fraud can impact virtually any business, some industries are especially vulnerable due to the high volume of digital transactions, reliance on automated approvals, and limited in-person verification. Below are the sectors most at risk:

Online Lending and Buy Now, Pay Later (BNPL)

The rise of online lending and BNPL services has created new opportunities for fraudsters. These platforms typically emphasize fast, frictionless onboarding, often with limited identity verification checks. Synthetic identities can:

- Secure small loans or purchases that help build credibility.

- Gradually expand into larger lines of credit.

- Disappear once high-value credit is extended, leaving lenders with unrecoverable debt.

According to TransUnion, synthetic identity fraud is one of the fastest-growing risks for lenders, contributing heavily to charge-offs in unsecured lending.

Fintech

Fintech platforms are often early adopters of digital-first onboarding and automated KYC processes. While efficient, these methods can be bypassed by well-constructed synthetic identities. Fraudsters exploit:

- Automated account creation with minimal human review.

- Gaps in traditional fraud scoring models.

- Rapid scaling of fintech platforms, which makes manual review impractical.

Cryptocurrency

The crypto sector’s pseudonymous nature and lack of standardized regulation make it attractive for synthetic fraudsters. Synthetic identities can be used to:

- Open exchange accounts under false identities.

- Move funds across wallets for laundering purposes.

- Exploit onboarding incentives offered by exchanges.

The decentralized structure of cryptocurrency markets makes it particularly difficult to trace synthetic accounts once they’ve been established.

Insurance

Synthetic identities are increasingly used to target the insurance sector, particularly in areas like health, life, and auto insurance. Fraudsters may:

- Apply for policies using synthetic identities to later file false claims.

- Use policies to create a “proof of identity” trail, further legitimizing the synthetic profile.

- Exploit weak identity checks in online insurance applications.

Insurers often discover these schemes only after claims are filed—by which point losses are already significant.

Generative AI: The New Engine Driving Synthetic Identity Fraud

The rise of Generative AI (GenAI) is reshaping the fraud landscape. While AI has incredible potential to strengthen fraud detection, it also equips cybercriminals with powerful new tools to create and scale synthetic identities faster and more convincingly than ever before.

How Generative AI Supercharges Synthetic Identity Fraud

- Realistic Fake Documents

AI-driven tools can generate highly convincing driver’s licenses, passports, or utility bills that pass automated verification checks. Fraudsters no longer need crude Photoshop edits — they can create documents indistinguishable from real ones. - Deepfake Audio and Video

Generative AI enables the creation of synthetic voices and videos. Fraudsters can impersonate victims or create supporting “proof of life” media during verification processes. - Automated Social Media Profiles

Synthetic identities need digital footprints to appear legitimate. GenAI can generate entire social media personas — complete with AI-written posts, images, and interactions — making fake identities seem authentic to lenders and platforms. - Scalable Fraud Operations

What once required manual effort and time can now be scaled with AI. Fraud rings can generate thousands of unique synthetic identities in days, testing different versions until they pass onboarding systems.

Common Signs of Synthetic Identity Fraud

Synthetic identities are carefully constructed to appear real, making them difficult to detect with traditional checks. However, certain warning signs in digital and behavioral patterns can help organizations identify these fraudulent profiles early.

- Lack of a Public Digital Footprint

Real users leave traces online: social media profiles, forum posts, or service registrations. Synthetic identities may have no presence outside the onboarding process. A completely blank digital footprint is a strong indicator of fraud. - Inconsistent Name, Phone, and Email Combinations

Even if individual data points seem legitimate, mismatched combinations—like a common name with an unusual email domain or foreign telecom provider—can reveal fabricated identities. Evaluating relational consistency between fields is crucial. - Geographic Metadata Mismatches

Inconsistencies between the claimed location, phone registration, and device IP address often signal identity manipulation. For example, a listed home address in one country, a phone from another, and a device logging in from a third is highly suspicious. - Suspicious or AI-Generated Profile Images

Profile photos may appear human but often reveal anomalies upon closer inspection. Common indicators include AI-generated faces, stock images, or reused photos. Digital analysis can detect these inconsistencies and flag potential fraud. - Absence from Any Data Breaches

While appearing in breaches is usually negative, a completely clean digital history can also be suspicious. Longtime internet users typically appear in at least one breach. A pristine profile may indicate a recently created synthetic identity. - Email or Phone Appearing in Multiple Breaches

Conversely, contact details appearing in multiple breaches may have been harvested and reused by fraudsters. Excessive exposure across platforms can indicate recycled information for synthetic profile creation. - VOIP or Disposable Phone Numbers

Synthetic profiles frequently use virtual or temporary phone numbers, which are inexpensive and easy to acquire. These numbers often lack verifiable links to real-world users, making them a red flag during identity verification. - Recently Created or Inactive Email Addresses

Newly created email addresses with no online activity are suspicious. Fraudsters often use burner emails that haven’t appeared in breaches, directories, or standard platforms. Absence of account age or activity metadata can indicate a synthetic identity.

How Scoreplex Helps to Detect Synthetic Identity Fraud

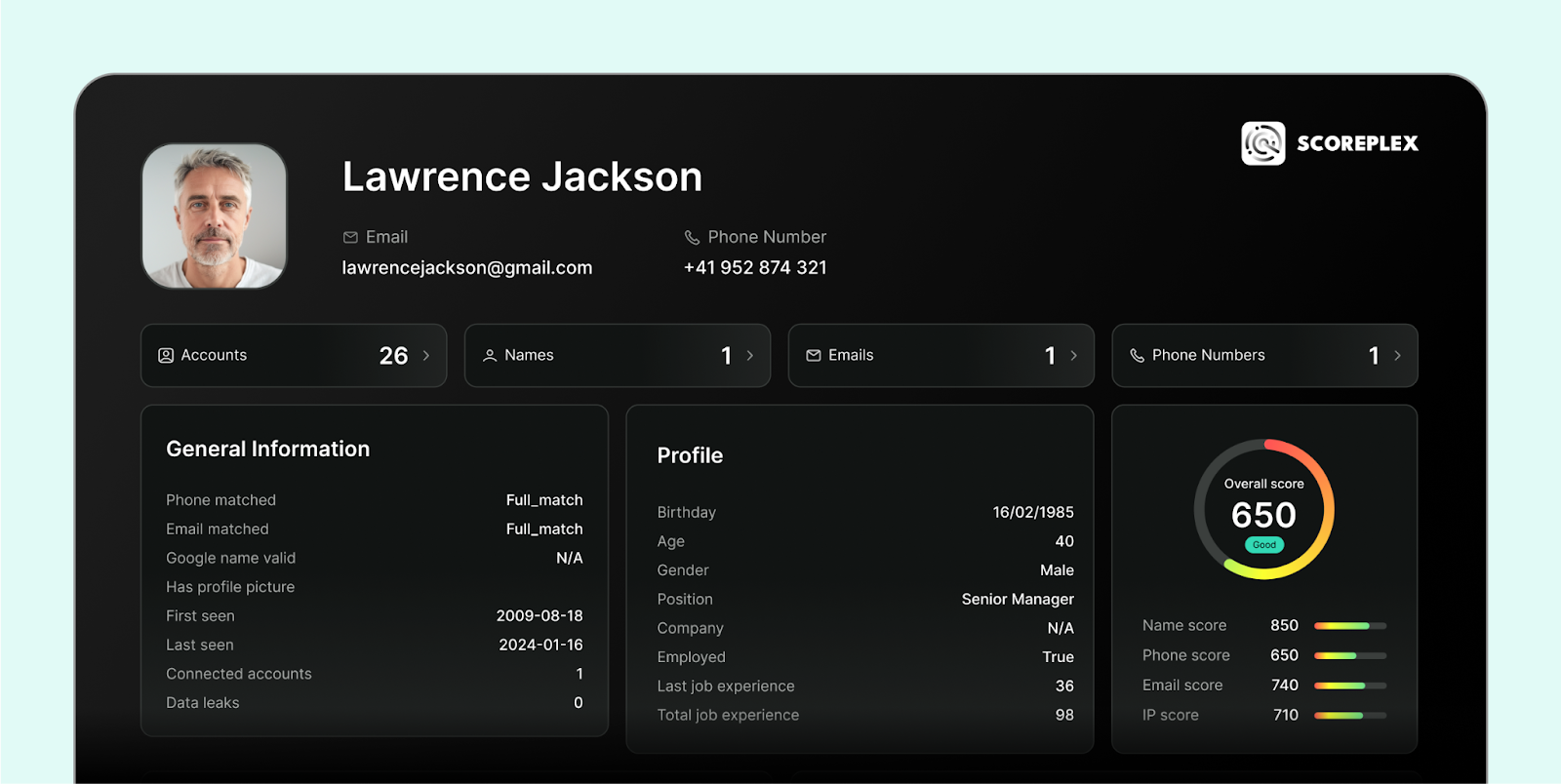

Scoreplex detects fake accounts and synthetic identities by leveraging AI-driven digital footprint analysis to assess risk and verify identities in real time. The platform integrates cutting-edge algorithms and machine learning models to provide real-time verification of accounts based on various data points.

Here's how we can help:

- Comprehensive Risk Scoring: Scoreplex assigns risk scores to profiles based on multiple data factors, such as email address, phone number, digital presence, and name analysis. This allows businesses to quickly identify high-risk accounts before they pose a threat.

- Online presence: Scoreplex examines an account’s online presence and activity patterns across digital platforms. Suspicious behaviors—such as newly created accounts, abnormal engagement bursts, or isolated networks—are flagged with precision.

- Cross-Matching Name, Email, and Phone: the platform performs triangulated checks, ensuring that the name, email, and phone number associated with an account align logically.

- Real-Time Email and Phone Verification: through robust email and phone number validation system, we can instantly identify disposable email addresses or phone numbers, VOIP numbers, and email addresses that have been flagged in past data breaches. This helps identify fake accounts using low-quality contact information.

- Data Leak Monitoring: the platform monitors thousands of data sources to ensure that the information linked to accounts hasn’t been exposed in previous data leaks. If there’s a match, we’ll flag the account as potentially compromised or synthetic.

Conclusion

Synthetic identity fraud is no longer a fringe issue — it is now one of the fastest-growing financial crimes, costing billions annually and putting businesses, consumers, and even entire industries at risk. Unlike traditional identity theft, these fabricated personas can slip through outdated fraud detection systems, quietly building credit and credibility until it’s too late.

The rise of generative AI has only made synthetic identities more sophisticated, enabling fraudsters to create realistic documents, deepfake media, and convincing digital footprints at scale. Traditional methods like credit bureau checks, static KYC processes, and siloed fraud systems are no longer enough.

To stay ahead, businesses must rethink their fraud detection strategies. That means adopting solutions that go beyond surface-level checks, leverage advanced analytics, and provide cross-institution visibility into suspicious patterns.

In an era where fraudsters are moving faster and smarter, prevention requires the same level of innovation — if not more. Organizations that act now to modernize their defenses will not only reduce losses but also protect their customers, reputation, and long-term growth.

If you would like to learn more about Scoreplex and its products or receive a professional consultation, feel free to book a demo: