Imagine a fintech startup that launches in Buenos Aires. Within its first year, they blow past growth targets—signing up thousands of customers a week. Then, quietly, their chargeback rates climb, mysterious accounts created using synthetic identities rack up unpaid loans, and their operational costs swell. Investors start asking tougher questions: “What’s your fraud prevention strategy?” and “How do you verify who your users really are before you onboard them?”

This kind of scenario is becoming distressingly common. Fraud isn’t just a nuisance—it’s a system risk. According to the 2025 Alloy State of Fraud report, 60% of financial institutions and fintechs reported an increase in fraud in the past twelve months. Alloy Even more alarming, nearly one-third of those organizations lost more than US$1 million in direct fraud losses.

One of the fastest-growing fraud vectors is synthetic identity fraud—when fraudsters create a person who doesn’t fully exist by mixing real personal data (breached or leaked) with fake names, addresses, or documents. Losses from synthetic identity fraud in 2023 crossed US$35 billion globally. In the UK alone, Experian observed a 60% increase in false-identity cases in 2024 compared to 2023, with false or synthetic identities making up nearly 29% of all identity fraud cases.

The methods evolve quickly: bots, AI-generated deepfakes, credential stuffing, account takeover, phishing, and fraud rings deploying cross-border tactics. At the same time, regulation is tightening—from identity verification mandates to privacy laws—and customers expect frictionless experiences. SaaS businesses are stuck in a balancing act: block the bad actors without slowing down growth or degrading UX.

In this article, we won’t try to tell you which fraud prevention tool is “the best.” Rather, we’ll survey what’s out there: the tools, systems, and approaches shaping fraud prevention in 2025. We’ll spotlight leaders and innovators; show you what they do well, what trade-offs they bring, and what to watch out for if your company wants to protect revenue, compliance, and customer trust—all while scaling.

What to Look for in Fraud Prevention Tools

When you’re shopping for a fraud prevention tool, it’s not enough to see flashy features. What matters are the right capabilities — how fast, how accurate, how flexible — because fraudsters evolve fast. Here are key qualities to watch for, followed by how different businesses will value them differently.

Key Capabilities & Qualities

- Detection speed / real-time alerting: Fraud that’s allowed to complete is damage done. Tools that can monitor transactions, logins, or account changes as they happen (or with seconds of delay) drastically reduce losses.

- Adaptability & continuous learning: Fixed rules are brittle. The best tools use AI / ML so they can detect new attack vectors like synthetic identities, bot attacks, or newly exploited data leaks.

- Low false positive rates: Marking legitimate activity as fraud frustrates users, damages conversion, and wastes team resources. Studies show that AI-driven systems can reduce false alarms by ~30%.

- Geographical & data-source coverage: If your users are global (or in LATAM, APAC etc.), you need signals from local identity registries, address verification, device / IP reputation, etc. Without these, fraud in “fringe” markets slips through.

- AI / ML capabilities & model transparency: Mature models need high-quality, diverse training data, and ability to explain why something is flagged (important for internal reviews and regulatory audit).

- Ease of integration & scalability: If the system takes months to integrate, or struggles under peak load (e.g. Black Friday e-commerce, product launches), your fraud tool becomes a bottleneck.

- Cost & ROI: Not just in license fees; also manual reviews, chargebacks, lost sales, customer trust. A tool with higher upfront cost but fewer false positives or better prevention can pay back many times over.

Different Needs by Business Size, Risk Profile & Region

- Small / early-stage SaaS / fintechs: Often constrained by budget and engineering resources. For them, out-of-the-box tools with APIs, prebuilt rules, strong defaults are valuable. They might accept slightly higher false positives in exchange for speed of deployment and decent coverage.

- Mid-size companies / growing risk exposure: These need more fine-tuned models, customization (e.g. custom risk scoring), maybe ensemble ML + rule based, and better data coverage (local signals, device fingerprinting).

- Large enterprises / heavily regulated industries: Here, everything above is table stakes. They’ll require audit trails, strong model transparency, ability for in-house tweaking, certifications, global compliance, regional data centers, low latency at very high transaction volumes.

Fraud Prevention Tool Types & Categories

Fraud prevention isn’t a single technology—it’s a layered defense system. Different threats require different responses, and most businesses end up combining several categories of tools. Understanding these categories helps make sense of why each vendor focuses on a particular niche and where their strengths lie.

1. Fraud Pre-Check

An emerging category, pre-check tools run lightweight assessments before full onboarding. They filter out fake emails, flagged phone numbers, or high-risk IPs early—saving time and compliance costs. Scoreplex is leading here, offering pre-KYC screening powered by 300+ OSINT data sources. By enriching personal emails, phones, and IPs in real time, Scoreplex allows businesses in high-volume sectors like lending or classifieds to block obvious fraudsters before they ever reach the costly verification stage.

2. Device fingerprint & Behavioral Analysis Tools

These tools monitor how a user interacts with your platform: device fingerprinting, typing cadence, mouse movements, or geolocation. Subtle signals—like switching IPs mid-session or logging in from a rooted phone—can reveal risky behavior. Vendors like Kount (Equifax) use device intelligence to map trusted versus suspicious devices, while Sift applies behavioral analytics to flag unusual account activity in real time.

3. Identity Verification & Synthetic Fraud Detection

When onboarding a customer, the biggest question is: is this person real? Identity verification tools check documents, biometrics, or government databases. Synthetic fraud detection goes further, spotting identities that combine real and fake data—a fraud type responsible for $35+ billion in global losses in 2023. Companies like Socure and Onfido specialize in verifying identities quickly while catching increasingly sophisticated fakes.

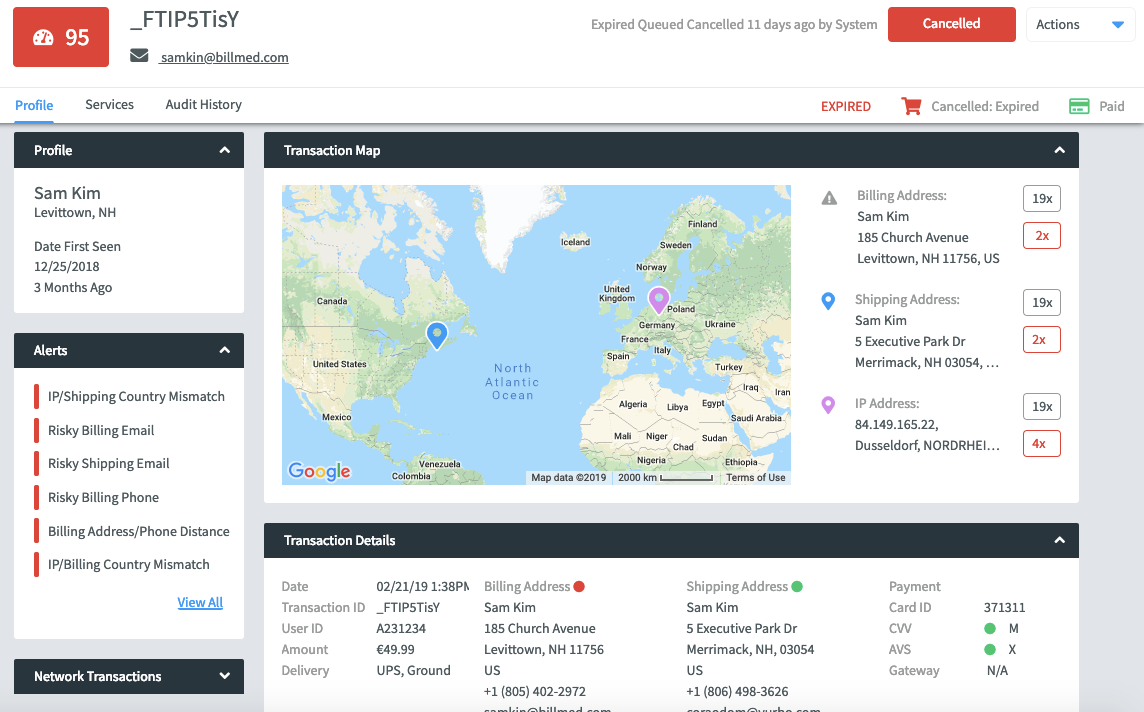

4. Payment Fraud Detection

For e-commerce, fintech, and SaaS businesses, protecting transactions is mission-critical. These systems analyze patterns across card data, devices, and history in real time. Forter, for example, processes billions of transactions to decide instantly whether to approve or block, helping merchants reduce chargebacks while keeping checkout friction low.

5. Bot Detection

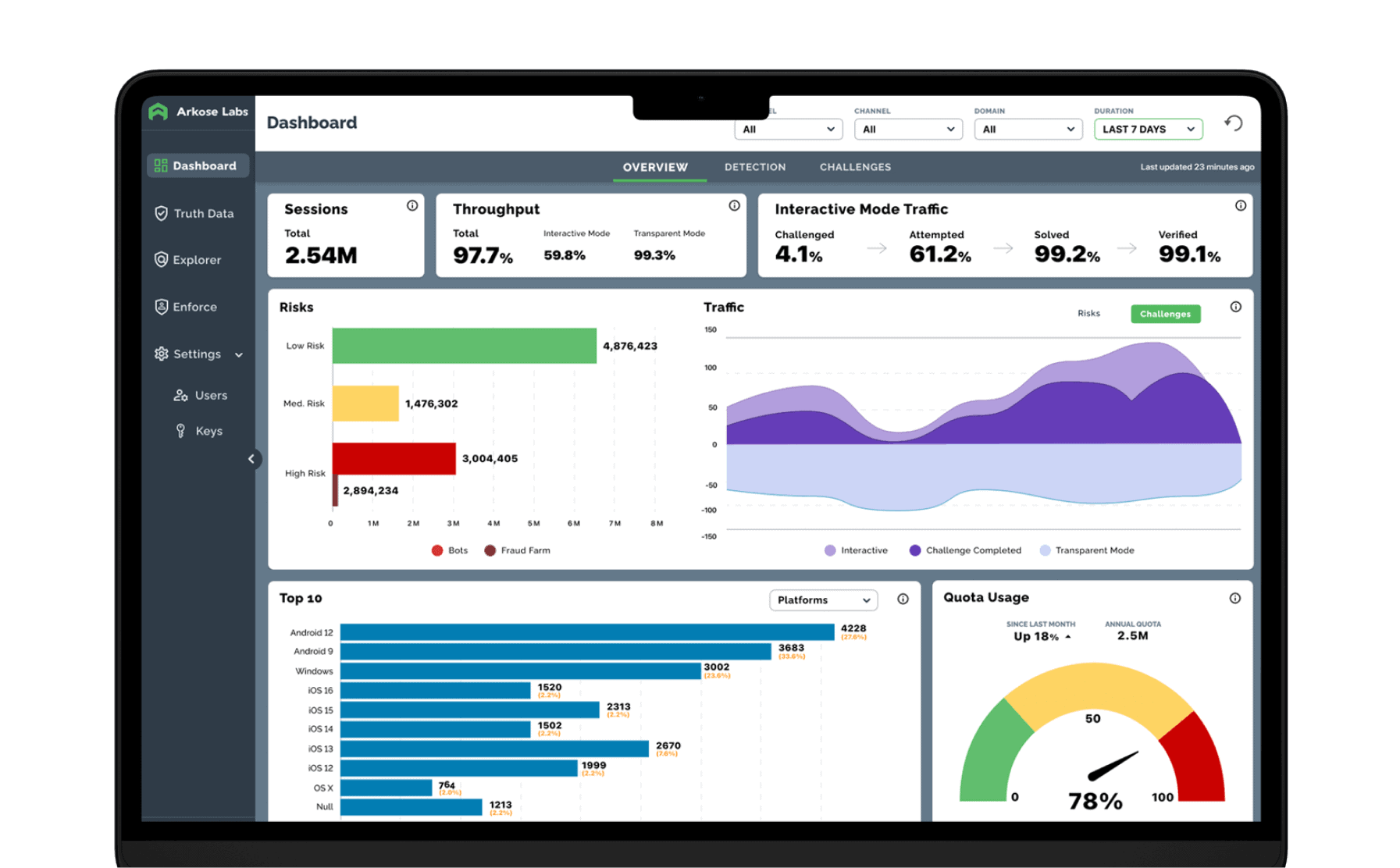

Automated attacks—from credential stuffing to fake account creation—are rampant. Bot detection tools use behavioral challenges and adaptive friction. Arkose Labs is well-known here, applying “risk-based friction” that makes large-scale attacks expensive for fraudsters but nearly invisible to real users.

6. Identity Intelligence

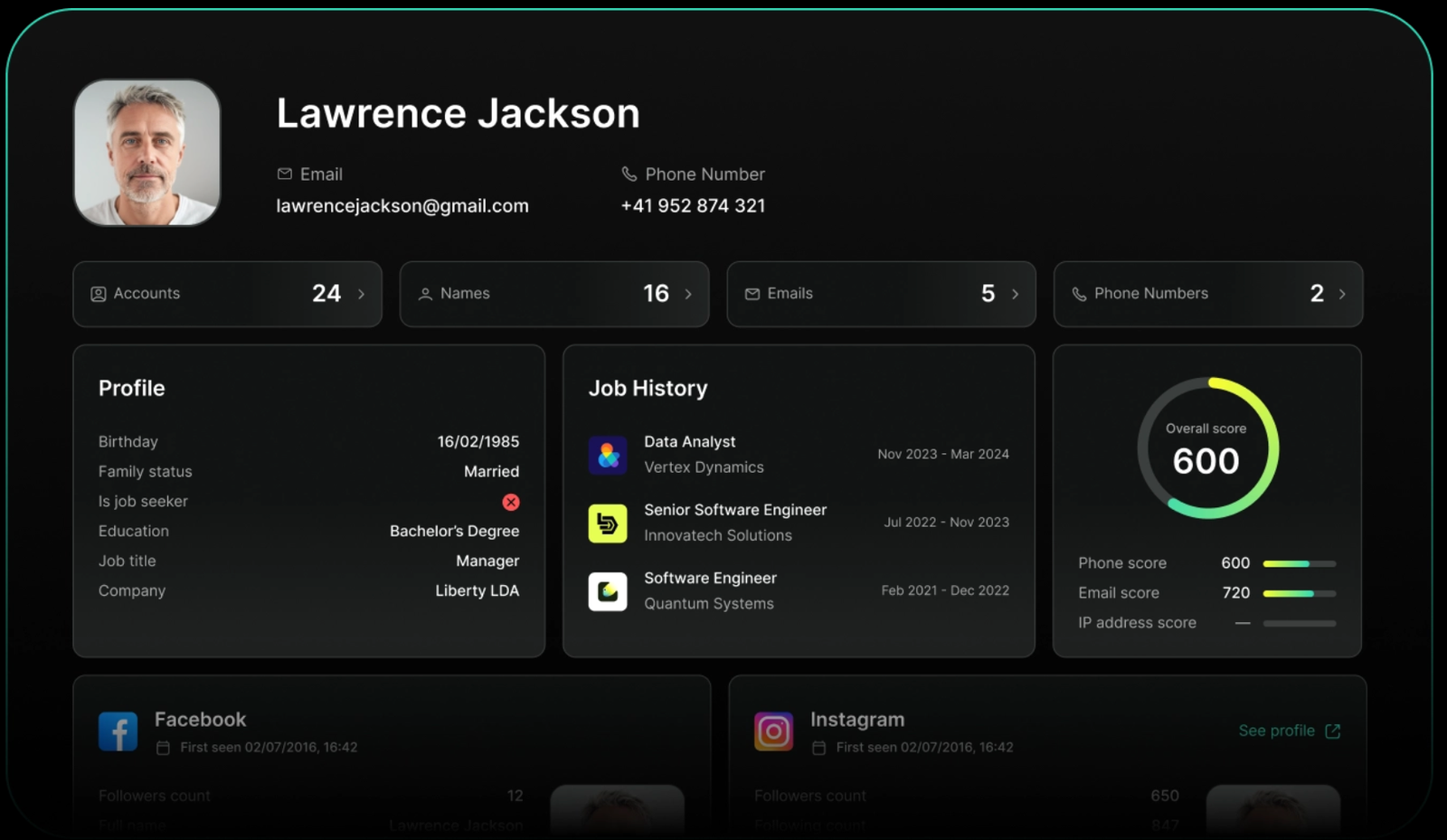

Some of the most revealing fraud signals come from digital identifiers like emails, phone numbers, and devices. Identity intelligence tools analyze these elements against global data sources to uncover risks such as disposable emails, high-risk domains, or suspicious activity histories. By scoring identities early, businesses can stop bad actors before they reach checkout or onboarding. Emailage (LexisNexis Risk Solutions) is a leading player in this space, transforming email addresses into powerful fraud signals by linking them with billions of transactions across industries. This approach gives companies an early warning system, helping reduce chargebacks, account takeovers, and costly verification cycles.

Top 10 Fraud Prevention Tools — Overviews

1. Scoreplex — Fraud Pre-Check with Alternative Data

Most fraud tools wait until a user is halfway through onboarding or checkout before they flag risk. By then, you’ve already burned time and money on verification. Scoreplex flips this model: it acts as an early-stage pre-check, quietly filtering out fraudsters at the front door.

What it does best: Scoreplex ingests everyday identifiers—emails, phone numbers, IPs—and instantly enriches them against 300+ alternative data sources. The platform hunts for red flags like disposable emails, VOIP numbers, VPN or TOR routing, or identifiers exposed in breach data. It then produces a five-tier risk score, giving teams a clear signal: approve, escalate, or block.

Who uses it: Scoreplex is built for high-volume industries where fraud can quietly eat margins—digital lending, BNPL, classifieds, and marketplaces. For example, lenders in LATAM report saving double-digit percentages on KYC costs simply by screening out synthetic or low-trust applicants before expensive ID checks.

Why it stands out: Unlike legacy systems focused on U.S. or EU data, Scoreplex emphasizes LATAM and APAC coverage, markets where traditional credit bureaus are thin and fraud rates are high. It also treats personal emails as a primary risk vector—a data point most tools overlook, but one that often reveals disposable usage or abnormal activity patterns.

Trade-offs: Scoreplex isn’t designed to replace KYC or payment-level fraud systems. It works best as a first-line bouncer, reducing noise and costs for the layers that follow. For businesses struggling with verification waste and fake applications, it offers an immediate ROI: fewer dead-end checks, smoother flows for real customers, and a stronger baseline of trust from the start.

2. Sift — Digital Trust & Safety at Scale

In the world of fraud, scale changes everything. A small e-commerce shop might see a handful of suspicious logins a day; a global marketplace sees millions of micro-events every hour. That’s where Sift thrives. Positioned as a “digital trust & safety” platform, Sift helps businesses not only block fraud but also protect the entire customer journey.

What it does best: Sift applies machine learning to behavioral data—logins, account changes, orders, device fingerprints—to detect anomalies in real time. The system’s Global Data Network, powered by billions of events across its client base, gives it a network effect: when one platform sees a new fraud pattern, the others benefit almost instantly.

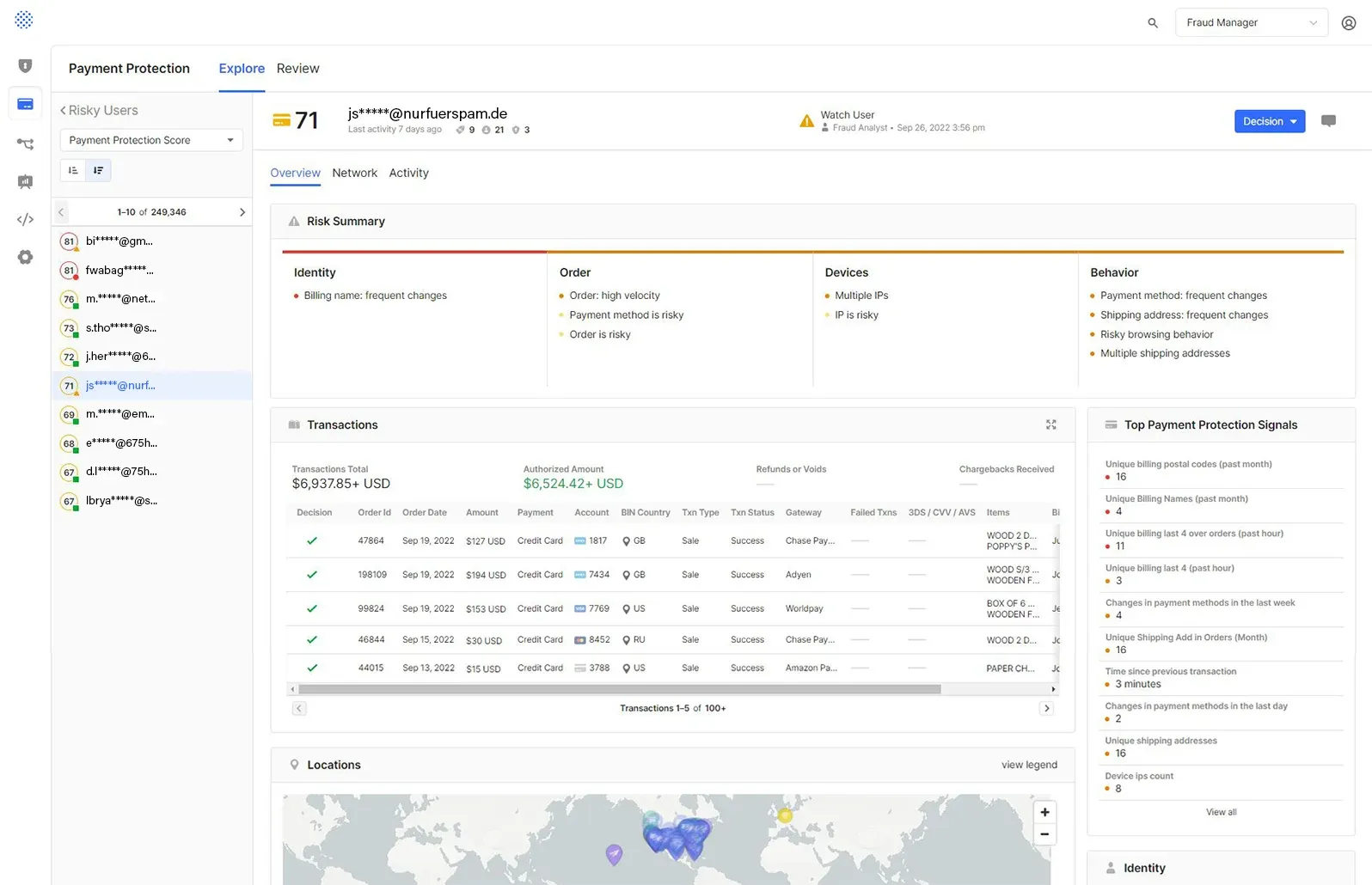

Who uses it: Sift is a favorite of high-volume consumer apps—food delivery, ride-hailing, e-commerce, online travel—where speed is everything. Risk and ops teams rely on its case management tools to flag edge cases, while product teams like that it minimizes false positives and keeps conversion high.

Why it stands out: Sift doesn’t just say “yes” or “no.” It assigns a risk score with context, allowing businesses to route decisions intelligently (approve, block, or send to manual review). Its decisioning platform is praised for helping businesses recover revenue, not just prevent losses. In fact, case studies report significant lifts in order approval rates after moving from rigid rules to Sift’s adaptive models.

Trade-offs: Such sophistication comes at a cost. Sift requires careful tuning to match your risk appetite, and smaller startups may find pricing high. But for companies at scale, Sift serves as a central nervous system for trust and safety—one that evolves as quickly as fraudsters do.

3. Forter — Instant Trust Decisions for Global Commerce

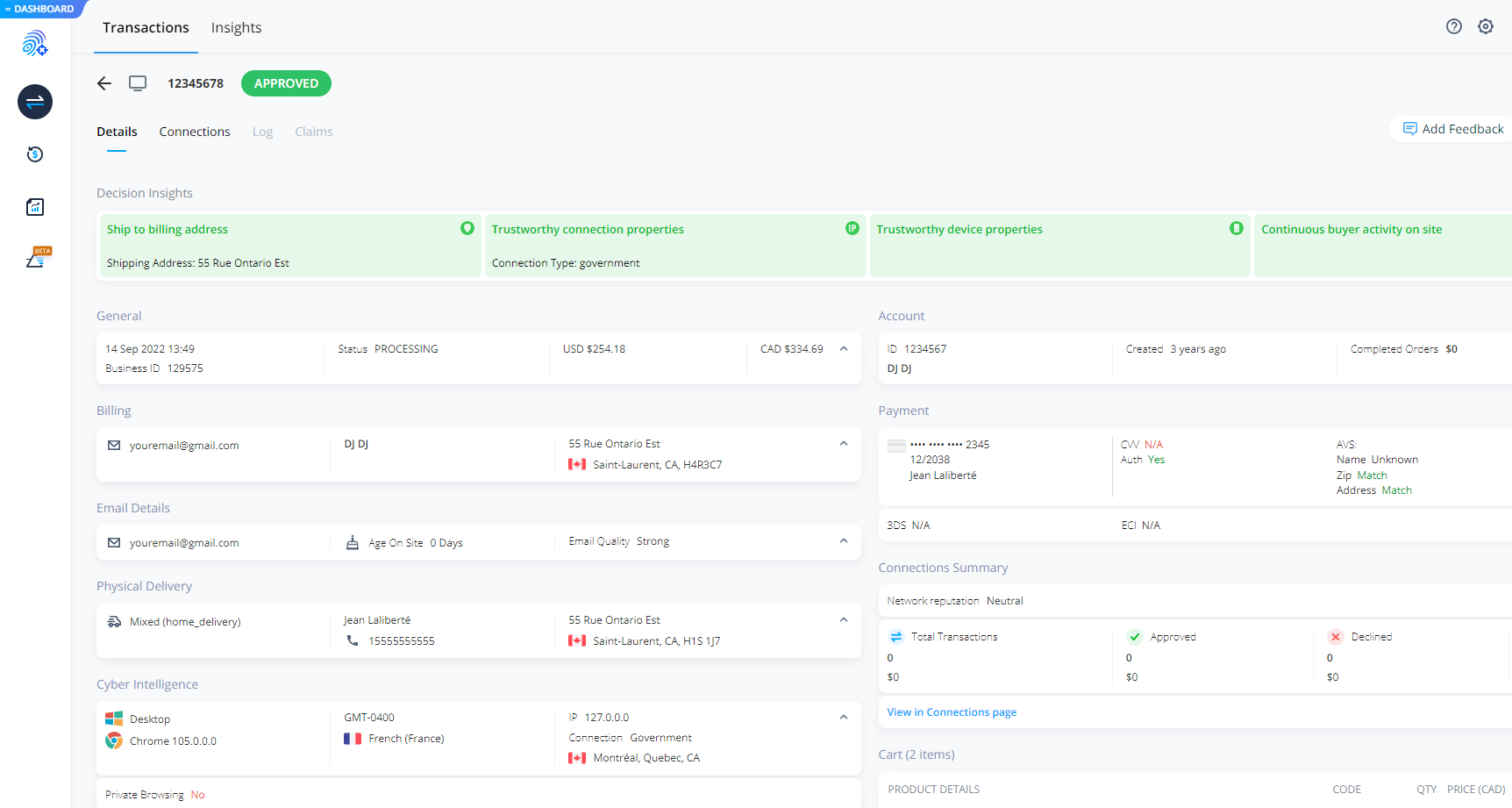

In online commerce, every second counts. A checkout decision delayed by even a few moments can mean an abandoned cart—and a lost customer. Forter built its reputation on delivering real-time, automated fraud decisions at the scale of global retail. Instead of relying only on static rules, it draws from a massive Identity Graph built on billions of transactions, enabling merchants to instantly know whether to approve or decline.

What it does best: Forter’s strength lies in transaction trust decisions. The platform analyzes behavioral data, device fingerprints, payment histories, and merchant-shared intelligence to make lightning-fast calls. Unlike rigid rule engines, Forter prioritizes approving more good orders—keeping revenue flowing while blocking fraud.

Who uses it: Forter is the go-to choice for enterprise e-commerce, travel platforms, and omnichannel retailers managing peak transaction volumes. Think global fashion brands, airlines, and marketplaces that can’t afford high false declines.

Why it stands out: Forter emphasizes conversion uplift as much as fraud reduction. By reducing false positives, it helps merchants reclaim millions in revenue that other systems might mistakenly block. Its partnerships with payment providers and acquirers also give it a unique vantage point in the transaction ecosystem. During peak sales events—like Black Friday—Forter can handle surges without slowing down.

Trade-offs: Forter’s sweet spot is transactional fraud. Businesses facing heavy account-level abuse, promo misuse, or synthetic identity fraud will likely need complementary tools. Implementation can also be complex, especially for smaller merchants without in-house fraud teams.

For enterprises running high-stakes commerce, Forter isn’t just a gatekeeper—it’s a silent partner in ensuring customers enjoy a smooth, trusted buying journey.

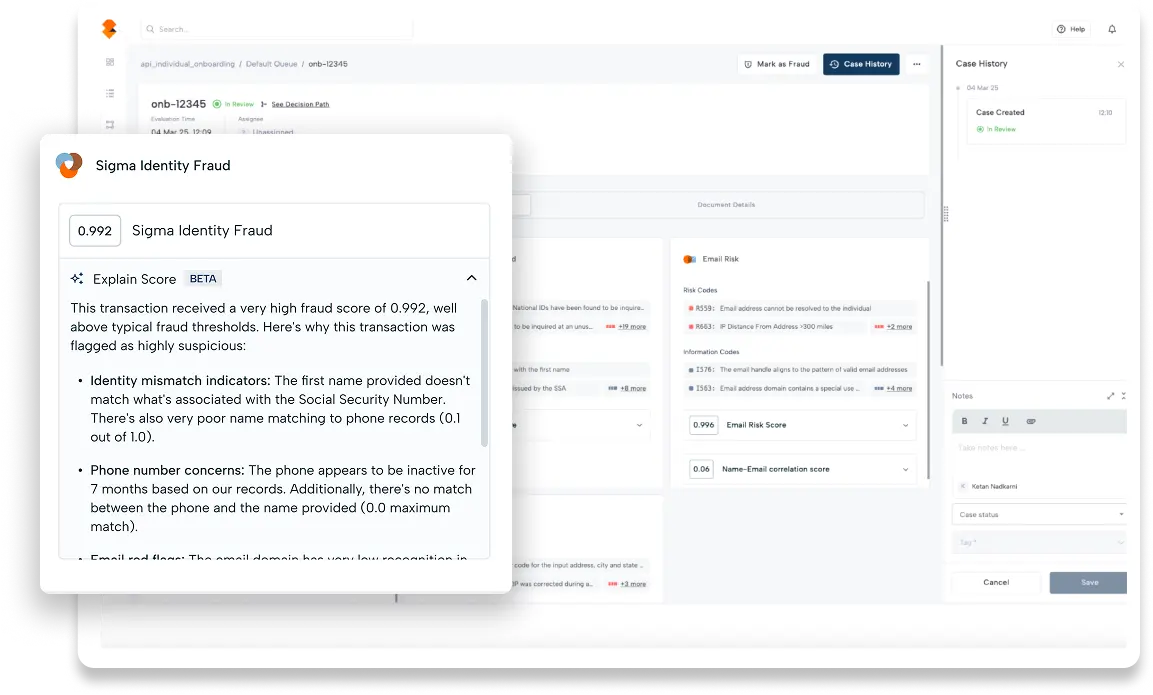

4. Socure — AI Identity Verification for the Digital Era

Onboarding is often the most fragile moment in a customer journey. Too much friction and users abandon. Too little, and fraudsters slip through. Socure was built to solve this balancing act with AI-driven identity verification that promises both speed and security.

What it does best: Socure combines document verification, biometrics, email, phone, device, and behavioral data into a single identity trust score. Its machine learning models are trained on diverse, large-scale datasets, allowing the platform to catch synthetic identities—fraudsters stitching together real and fake data—that many traditional tools miss. According to industry analysts, synthetic identity fraud caused over $35 billion in global losses in 2023, making this capability mission-critical.

Who uses it: Socure is a trusted partner for banks, fintechs, government agencies, and marketplaces that need compliance-grade verification without sacrificing conversion. Digital banks lean on it to safely open accounts in seconds, while public programs have used it to prevent billions in pandemic-era benefits fraud.

Why it stands out: Socure has received recognition from Deloitte and Forbes as one of the fastest-growing regtech companies. Its auto-decision rates often exceed 90%, meaning most customers pass instantly while only a small fraction go to manual review. This balance reduces operational overhead while maintaining security.

Trade-offs: Identity stacks can grow complex, and Socure is no exception. Businesses must tune thresholds and escalation paths to match their own risk tolerance. For smaller startups, integration and pricing may be significant considerations.

For organizations where trust begins at signup, Socure offers a compelling proposition: verify faster, catch more fraud, and keep genuine customers moving smoothly through the funnel.

5. Arkose Labs — Making Fraud Economically Impossible

Fraudsters love automation. With the help of bots, they can flood a platform with fake accounts, test stolen credentials, or scrape data at industrial scale. Arkose Labs exists to break that model—not by trying to block every attack outright, but by making fraud too expensive to sustain.

What it does best: Arkose Labs combines device fingerprinting, behavioral analysis, and real-time risk scoring to detect automated traffic. When risk is high, instead of just blocking, the system applies adaptive friction—smart challenges that legitimate users can pass easily, but bots struggle to solve. The result: attackers burn time, money, and resources, while good users hardly notice.

Who uses it: Arkose is a favorite of social platforms, gaming companies, fintech apps, and travel marketplaces—all sectors hit hard by account takeovers, credential stuffing, and fake sign-ups. For businesses where fake accounts lead to downstream fraud or abuse, Arkose acts as the first line of defense.

Why it stands out: The company pioneered the concept of “risk-based friction.” Unlike static CAPTCHAs, Arkose challenges evolve continuously, making them resistant to solver farms and machine vision. Its partnerships with major platforms like Microsoft and PayPal underscore its credibility. Fraudsters describe Arkose as “annoying”—which in this industry is a badge of honor.

Trade-offs: Any friction carries the risk of impacting user experience. Overly aggressive settings can frustrate legitimate customers, so careful tuning is key. Arkose is also primarily bot-focused; organizations still need identity and payments layers to round out protection.

For companies battling relentless automation, Arkose Labs doesn’t just block bots—it tips the economics of fraud in favor of the defender.

6. Emailage — Email Intelligence as the First Fraud Signal

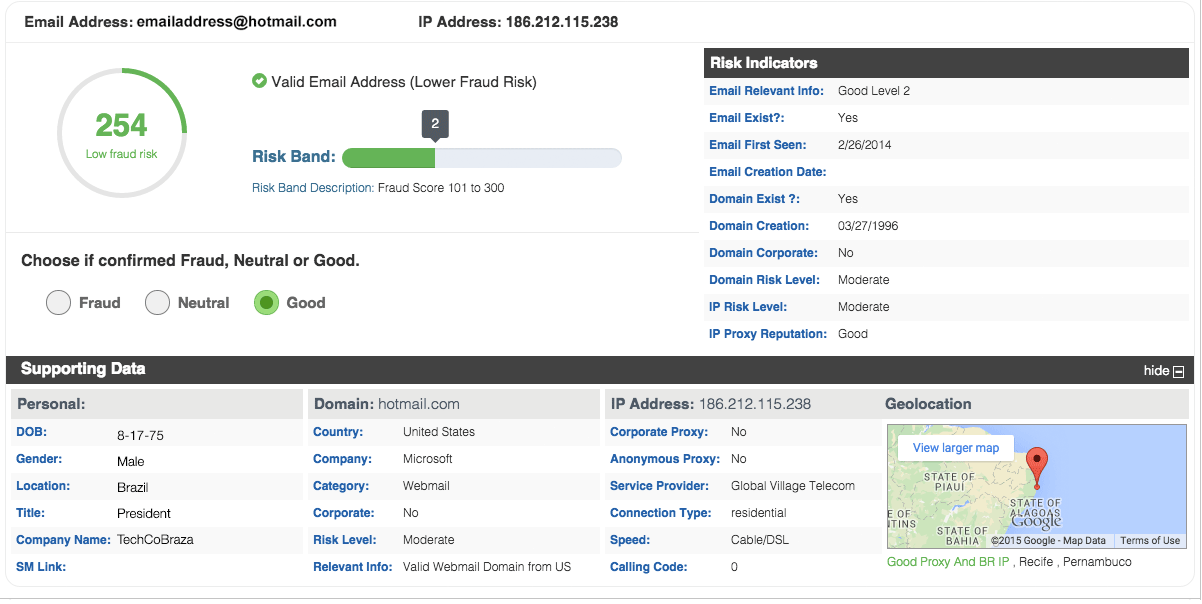

Every online interaction starts with an email address. Yet for years, fraud teams underutilized it as a risk signal. Emailage, now part of LexisNexis Risk Solutions, built its business around a simple but powerful idea: the email is a global digital identifier—and it can tell you far more than whether a message was delivered.

What it does best: Emailage enriches an email address by checking its age, domain reputation, historical usage patterns, and connections to other identifiers like devices and IPs. It then delivers a risk score that helps businesses decide, often within milliseconds, if a new customer looks trustworthy. This makes it one of the earliest filters in the fraud journey—catching suspicious signups before they escalate into payment disputes or account abuse.

Who uses it: Emailage is used by e-commerce platforms, travel companies, financial institutions, and payment providers. For merchants, it reduces chargebacks and account abuse. For lenders, it offers fast insights before committing to costly KYC or credit checks.

Why it stands out: The strength of Emailage lies in its consortium data network—a vast intelligence pool built on billions of transactions across industries. This network effect means that if fraudsters burn an email at one merchant, that risk signal travels downstream to others. LexisNexis’ acquisition further enhanced its global footprint, integrating email intelligence into broader identity and fraud prevention suites.

Trade-offs: While powerful, email-based scoring isn’t a full fraud solution. Disposable or brand-new emails may generate less reliable signals, and businesses still need complementary layers like device fingerprinting or identity verification.

For fraud teams, Emailage turns an everyday piece of data—the humble email address—into an early-warning system, giving companies a head start in the fight against fraud.

7. Kount — Device Intelligence Meets Payment Protection

Long before “digital trust” became a buzzword, Kount was already helping merchants spot risky devices and protect payments. Now part of Equifax, Kount has evolved from a niche device-fingerprinting solution into a full-fledged fraud platform that connects identity, payments, and credit risk data under one roof.

What it does best: Kount’s foundation is device intelligence—tracking unique device fingerprints across sessions to spot anomalies like multiple accounts tied to the same laptop or high-risk devices surfacing across merchants. Layered on top are AI-driven models and customizable rules that analyze transactions in real time. Merchants can automate “approve/decline” decisions or escalate edge cases to case management dashboards for review.

Who uses it: Kount is a staple for e-commerce merchants, subscription-based SaaS platforms, and payment providers. Businesses facing high chargeback rates or card-not-present fraud often integrate Kount to cut losses without sacrificing conversion speed.

Why it stands out: With Equifax backing, Kount now offers Kount 360, combining device intelligence with Equifax’s trove of identity and credit data. This gives businesses a more holistic picture of customers, bridging the gap between fraud prevention and financial risk management. Case studies show merchants using Kount have reduced chargebacks by 50% or more while maintaining high approval rates.

Trade-offs: The product portfolio can feel complex, especially with Equifax’s broader ecosystem layered in. Smaller teams may need guidance to avoid duplicating features they already own. Also, while strong in payment fraud, Kount is less specialized in areas like bot detection or pre-KYC screening.

For merchants wrestling with payment risk, Kount remains a trusted veteran—now supercharged with Equifax data to provide a 360-degree view of trust.

8. Ravelin — Seeing Fraud as a Network, Not Just a Transaction

Fraudsters rarely act alone. They operate in rings, reshipping networks, or clusters of accounts that quietly drain platforms. Ravelin built its reputation on exposing these hidden webs through graph-based machine learning, making it a favorite among marketplaces and delivery platforms that need to see the bigger picture.

What it does best: Ravelin ingests transaction data, customer details, device information, and behavioral signals, then maps the connections between them. The result is a graph network where fraud rings stand out as suspicious clusters. Combined with predictive ML models, Ravelin flags risky payments, accounts, and even promo abuse before losses mount.

Who uses it: Ravelin is widely adopted by food delivery apps, mobility platforms, online retailers, and marketplaces. These industries often face large volumes of transactions with thin margins, where a single fraud ring can cause disproportionate damage.

Why it stands out: Unlike black-box ML, Ravelin emphasizes explainability. Its platform provides clear reasons for risk scores, helping fraud teams fine-tune policies and justify decisions to stakeholders. The company also has deep expertise in PSD2/SCA compliance in Europe, helping merchants balance fraud checks with regulatory requirements. Case studies show that Ravelin has helped platforms cut chargeback ratios below card scheme thresholds, a lifesaver for payment acceptance.

Trade-offs: Graph-based insights require data scale and quality. Smaller merchants with limited datasets may not see the full benefits, and the system demands ongoing model supervision. Ravelin is also more specialized in payment and promo fraud than in identity verification or bot mitigation.

For platforms that see fraud as a network problem, Ravelin offers the lens to uncover hidden connections and dismantle coordinated attacks.

9. Fraud.net — Harnessing Collective Intelligence for Enterprises

Fighting fraud in isolation can feel like playing whack-a-mole. Each business sees only a slice of the problem, while attackers operate across platforms and industries. Fraud.net approaches this differently: it leverages a consortium model, pooling intelligence from a broad network of enterprises to give every participant a stronger defense.

What it does best: Fraud.net provides a real-time AI platform that screens transactions, accounts, and entities using predictive analytics and anomaly detection. Its case management system is built for enterprise workflows—analysts can collaborate, escalate, and track investigations across teams and geographies. The secret sauce is its shared intelligence network, where fraud patterns detected by one participant enrich the defenses of others.

Who uses it: Fraud.net is particularly popular with banks, insurers, travel companies, and large marketplaces. These are industries where fraudsters exploit cross-platform gaps—using stolen identities or mule accounts in one sector and then pivoting to another.

Why it stands out: The consortium approach means network effects in fraud detection. For example, if a fraudster uses a compromised card with one airline, that risk signal can protect other merchants downstream. Combined with enterprise-ready dashboards and workflow automation, Fraud.net appeals to large organizations with formal fraud ops teams.

Trade-offs: Consortium data is only as strong as its membership. Niche industries or smaller players may see less benefit if peers aren’t contributing similar intelligence. The platform is also heavier than plug-and-play solutions, requiring dedicated teams to get full value.

For enterprises facing sophisticated, cross-industry attacks, Fraud.net turns collective knowledge into a force multiplier—transforming fraud defense from a solo battle into a shared, coordinated effort.

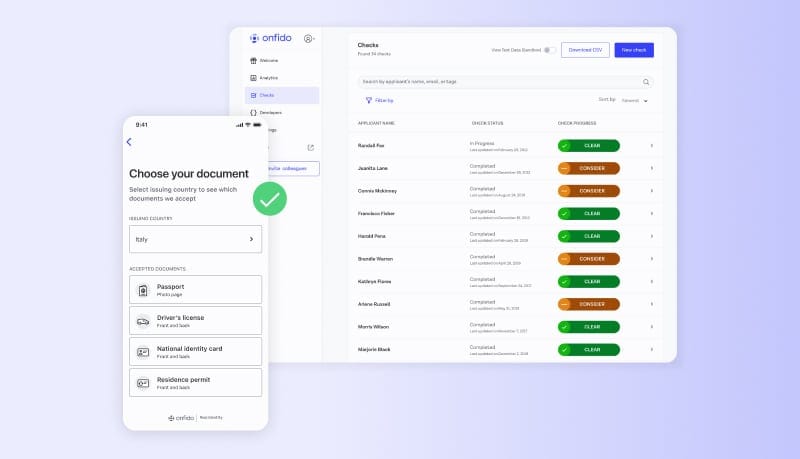

10. Onfido/Entrust — ID Verification Built for the Mobile-First World

In a digital economy, the question “Who’s really behind this account?” has never been harder to answer. Fraudsters armed with high-quality forgeries, stolen IDs, or even AI-generated deepfakes are pushing traditional verification to its limits. Onfido/Entrust tackles this head-on with document and biometric verification designed for a mobile-first world.

What it does best: Onfido’s platform enables users to capture an ID document and a selfie with liveness detection, verifying in seconds whether the person and the document match. Behind the scenes, it uses AI to analyze thousands of document types across 190+ countries. Combined with biometric checks, it flags counterfeit IDs, manipulated images, and attempts at impersonation. Businesses can configure the flow using Onfido Studio, a drag-and-drop orchestration tool that adapts checks to risk profiles and geographies.

Who uses it: Onfido is a trusted choice for fintechs, digital banks, gig economy platforms, and marketplaces that need to scale onboarding without sacrificing compliance. Startups love the fast SDK integration, while enterprises appreciate the ability to support global KYC requirements at scale.

Why it stands out: Onfido has been an early innovator in biometric liveness detection, helping clients stay ahead of emerging threats like deepfake fraud. Its smooth mobile UX has become a benchmark in ID verification, reducing friction and drop-offs during onboarding. Acquired by Entrust, Onfido now brings enterprise-grade security and compliance backing.

Trade-offs: Document capture always introduces friction. If not optimized, re-capture flows can cause customer churn. Onfido also excels in IDV but doesn’t address payment fraud or bot abuse—so it fits best as one layer in a broader fraud stack.

For businesses needing fast, compliant, and user-friendly ID verification, Onfido is a proven gatekeeper—making sure the person on the other side of the screen is exactly who they claim to be.

Emerging Trends & Innovations in Fraud Prevention

Fraud prevention is evolving as quickly as the threats themselves. In 2025, the industry is moving beyond static rule sets toward adaptive, intelligent systems that learn and react in real time. Five major trends are reshaping the way professionals approach digital trust:

1. Smarter AI & Machine Learning

The days of simple “if/then” fraud rules are fading. Modern platforms rely on continuous-learning models that adjust with every new data point. Techniques like anomaly detection and adaptive scoring allow systems to catch previously unseen fraud patterns—whether that’s synthetic identities or emerging attack vectors—without waiting for a human to flag them.

2. Alternative Data & Signals

With traditional credit and identity data often limited—especially in high-growth regions like LATAM and Southeast Asia—companies are turning to alternative signals. Open sources, device reputation, carrier data, and even social graph analysis are being integrated into fraud models. These enrichments help businesses score applicants that legacy systems might treat as “thin file” or invisible.

3. Real-Time & Pre-Event Prevention

The focus is shifting from reacting after fraud occurs to blocking bad actors before they enter the system. Pre-check tools and real-time monitoring reduce wasted KYC costs and stop fraud at the earliest point in the funnel, improving both security and efficiency.

4. Automation & Risk Scoring

Finally, automation is reducing the reliance on manual reviews. Risk-based scoring allows low-risk customers to glide through while high-risk ones face escalation. This not only reduces operational costs but also ensures smoother user experiences.

Together, these innovations signal a shift: fraud prevention is no longer about catching fraudsters; it’s about building frictionless trust at scale.

How to Choose the Right Tool for Your Business

With so many fraud prevention systems on the market, the challenge isn’t just finding a “good” tool—it’s finding the right one for your business model and risk profile. A few principles can help guide the choice:

1. Match Use Case to Capabilities

Start with your biggest pain points. Are chargebacks eating into margins? A payment fraud tool like Forter or Kount may fit best. Struggling with fake signups? Look at bot defenses such as Arkose Labs. Facing identity theft or synthetic fraud? Identity-first platforms like Socure or Onfido could be the answer. Burning budget on verifying fake or low-quality applicants? A pre-KYC solution like Scoreplex can filter out obvious fraud early, saving time, money, and operational resources before costly checks begin.

2. Consider Geography & Localization

Fraud looks different in every region. A solution strong in U.S. credit data may struggle in LATAM, where alternative signals (like those used by Scoreplex) are more valuable. Choose vendors with regional data depth, not just global marketing.

3. Weigh Technical Debt

Integration effort matters. Some platforms plug in with a few API calls, others require extensive rule-tuning and dedicated ops teams. Think about your maintenance capacity before committing.

4. Budget Beyond Licensing

Costs aren’t only upfront fees. Consider downstream savings: fewer manual reviews, reduced chargebacks, and improved approval rates can justify a higher sticker price.

5. Balance Security with Customer Experience

Every layer of defense risks adding friction. The best systems use risk-based scoring to keep good customers moving smoothly while escalating only the riskiest cases.

The bottom line: there’s no universal best tool—only the one that aligns with your growth stage, region, and fraud profile. Build your stack like a defense-in-depth strategy, where each layer plays its part without slowing down genuine users.

Conclusion

Fraud is no longer a side concern—it’s a core business risk. From synthetic identities costing lenders billions to automated bot attacks overwhelming marketplaces, the threat landscape is constantly shifting. The good news: businesses today have more tools than ever to fight back.

As we’ve seen, there is no single “best” fraud prevention solution. Each platform shines in a different area: some excel at payment fraud, others at identity verification, others at pre-event filtering or bot defense. The most resilient companies take a layered approach, building a fraud stack that balances prevention with user experience, compliance, and scalability.

For organizations operating in fast-growing markets or managing high volumes of new applications, the ability to filter out obvious fraud before KYC can be a game-changer. That’s where solutions like Scoreplex bring unique value—leveraging alternative data and OSINT signals to deliver real-time risk checks that cut costs and strengthen trust from the very first step.