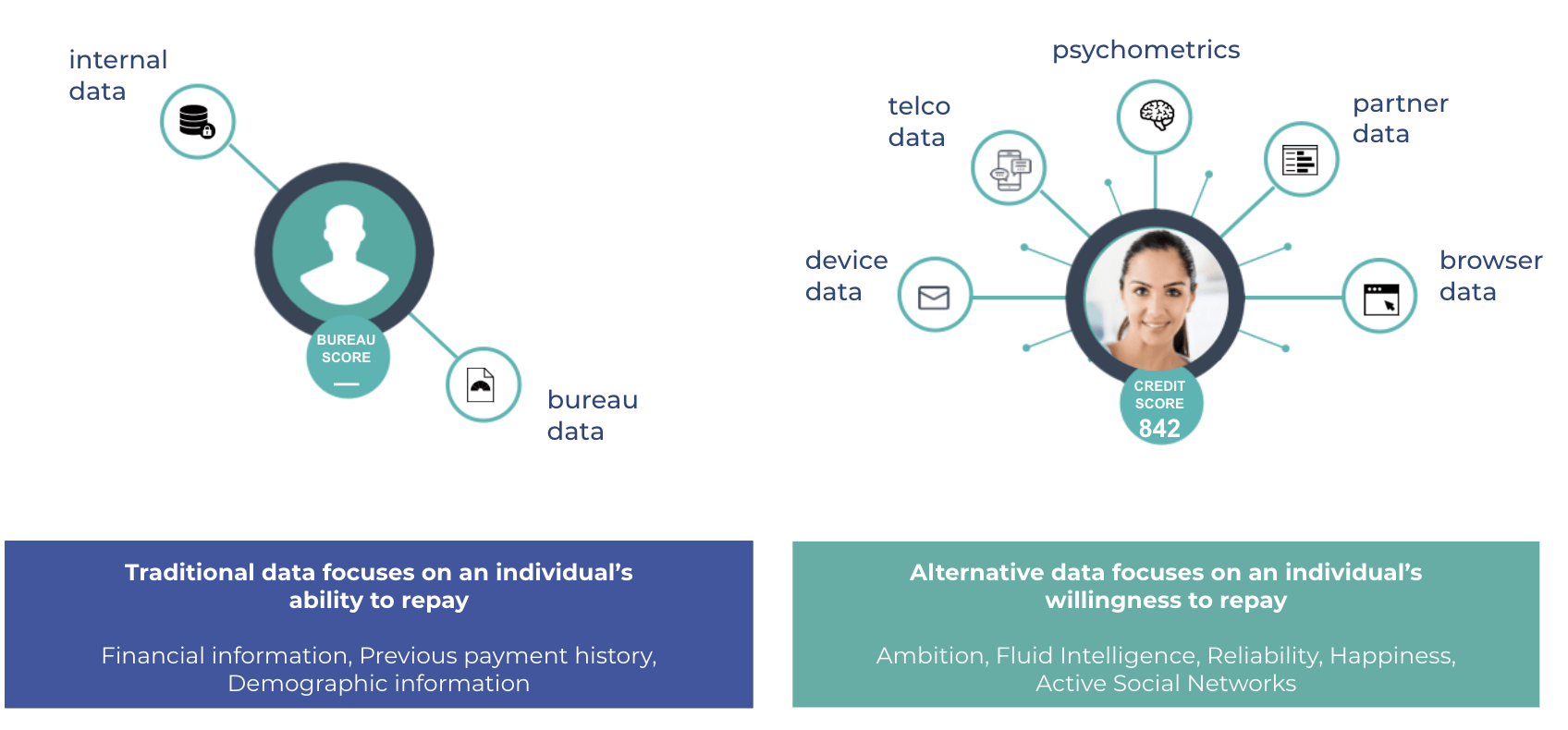

For decades, creditworthiness was defined by a narrow set of financial indicators. In the United States, credit bureaus like Experian, Equifax, and TransUnion—together with FICO scores—established the benchmarks lenders used to decide whether to extend credit. These models relied on a consumer’s history of loans, mortgages, and credit card repayments. While effective in mature financial markets, this approach leaves massive blind spots in today’s economy.

First, traditional bureau data excludes billions of people who live active digital and financial lives but lack credit cards or bank loans. Migrants, gig economy workers, young professionals, and residents of emerging economies are often classified as “thin-file” or “credit invisible,” even if they make regular mobile payments, utility transfers, or e-commerce transactions. Second, bureau scores are slow to adapt to fraud, relying on historical data when many modern threats—such as synthetic identities or stolen credentials—require real-time detection. Third, bureau systems remain regional and fragmented, limiting their usefulness in a globalized, cross-border financial environment.

This gap has given rise to alternative credit scoring, a data-driven approach that looks beyond traditional financial footprints to capture a richer, more accurate picture of both risk and opportunity.

TL;DR – Key Takeaways

- Why this matters: Traditional bureau data leaves big blind spots (thin-file, underbanked, cross-border, fast-moving fraud). Alternative signals close the gap and speed safer approvals.

- What counts as “alternative” data: Email/phone reputation, open banking cash-flow, behavioral/psychometric, transactional & utilities, telecom intelligence, social/digital footprint, and dark-web exposure.

- Who needs it most: Digital lenders, BNPL, neobanks, marketplaces, and any team fighting ATO, synthetic IDs, and onboarding fraud—especially in emerging markets.

- The landscape at a glance (35 providers): Email (e.g., Emailage, IPQS), Open Banking (Plaid, Yodlee), Phone (Truecaller), Behavioral (LenddoEFL, Credolab), Telecom (Telesign, NetNumber), Scoring Platforms (Ginimachine, Zest AI), Social/Online (Pipl), Dark Web (ZeroFox, CybelAngel).

- How teams deploy it: Use pre-KYC filters first (email/phone/dark-web), layer cash-flow & behavioral signals for affordability and fraud, then monitor continuously for changes.

- Outcomes to track: Approval-rate lift on thin-file segments, default and fraud-loss reduction, fewer manual reviews, faster time-to-yes.

- Gotchas: Data permissions & privacy, uneven regional coverage, and model drift—treat this as a living stack, not a one-off integration.

Featured approach: Scoreplex aggregates 300+ sources and outputs an explainable 0–1000 risk score for pre-KYC, onboarding, and fraud prevention, with strong coverage in LATAM/APAC.

The Current Landscape

Drivers of Change

Several structural and technological shifts explain why alternative credit scoring has become one of the fastest-growing segments in fintech and risk management:

- Financial Inclusion: According to the World Bank, around 1.4 billion adults remain unbanked worldwide. Alternative data offers a way to evaluate these individuals based on non-traditional but reliable signals, opening access to credit and financial services.

- Fraud and Identity Risk: Cybercrime, account takeovers, and synthetic identities are rising at unprecedented levels. Traditional scores can’t spot these threats early, but alternative datasets—like email reputation, phone history, or dark web exposure—can flag risks in real time.

- Digital Lending and Neobanks: The explosive growth of online lending platforms, BNPL providers, and challenger banks requires instant, low-friction onboarding. They cannot afford to lose customers due to missing bureau data, nor can they absorb high default rates.

- Emerging Markets: In regions like Latin America, Africa, and Southeast Asia, credit bureaus are often incomplete or outdated. Yet these same markets have high penetration of mobile phones, e-wallets, and digital platforms, creating new datasets that can be more predictive than legacy scores.

Together, these drivers have shifted the industry’s mindset: scoring is no longer just about access to credit—it’s also about security, compliance, and global financial inclusion.

What Is Alternative Credit Scoring?

Alternative credit scoring refers to the use of non-traditional data sources to evaluate an individual’s identity, risk profile, and repayment capacity. Instead of relying only on loans and credit cards, alternative scoring looks at:

- Email and phone data – verifying ownership, detecting fraud, and assessing digital reputation.

- Open banking feeds – analyzing income streams, spending habits, and cash flow stability.

- Behavioral signals – psychometrics, smartphone usage, and digital activity patterns.

- Transactional and utility data – regular payments for bills, subscriptions, and services.

- Telecom datasets – SIM history, call detail records, and mobile usage.

- Social and online footprints – validating professional networks, social media presence, and credibility.

- Dark web exposure – monitoring if identifiers (emails, phones, SSNs) appear in breaches.

By combining these signals into scoring models, lenders and fintechs can make faster, fairer, and more resilient decisions.

Applications of Alternative Credit Scoring

The practical applications extend far beyond credit approvals:

- Pre-KYC Screening: Quickly validating whether an applicant is legitimate before committing resources to compliance.

- Fraud Prevention: Detecting disposable or compromised identifiers before they cause losses.

- Digital Onboarding: Allowing fintechs and banks to onboard customers with minimal friction while still managing risk.

- Thin-File and Unbanked Lending: Providing credit access to people excluded from bureau systems.

- Cross-Border Credit: Helping migrants, students, and expats transfer their credit reputation across borders.

Why Alternative Data Matters

The Thin-File and Unbanked Problem

One of the most persistent challenges in global finance is the “thin-file” borrower—someone with little to no credit history in traditional bureau systems. This problem affects not just rural communities or developing economies but also young professionals, gig economy workers, and even people who prefer digital wallets over credit cards. According to the World Bank’s ID4D dataset, roughly 850 million people worldwide lack official identification, a foundational barrier that keeps many otherwise creditworthy adults outside formal finance. For these individuals, the absence of a traditional credit trail does not mean they are risky; it simply means their financial lives exist outside the legacy system.

This gap locks millions of creditworthy people out of essential financial services, from microloans and mortgages to cross-border remittances. Alternative data is stepping in to bridge that divide, allowing lenders to evaluate individuals based on a wider set of digital and behavioral indicators.

Regional Adoption Trends

Adoption of alternative scoring is not uniform—it mirrors the maturity of local financial ecosystems.

- United States and Europe: Open banking frameworks (like PSD2 in the EU) are driving the use of transactional data. Email and phone intelligence are also widely applied in fraud prevention.

- Latin America: With weaker traditional bureau coverage, fintechs lean heavily on telecom data, mobile wallets, and behavioral scoring to assess new borrowers.

- Africa: Mobile money ecosystems dominate. Telecom operators, rather than banks, often provide the richest signals for credit decisions.

- Asia-Pacific: Countries like India and the Philippines see a blend of open banking, telecom, and social data, fueled by rapid digital adoption and young populations.

Across regions, the trend is clear: alternative data is not a “nice-to-have” anymore—it’s becoming essential infrastructure.

Key Categories of Alternative Risk Data Providers

The ecosystem of alternative risk data is vast and constantly evolving. No single provider can capture the full spectrum of signals required to understand both the creditworthiness and fraud risk of a modern borrower. Instead, the industry has developed into a patchwork of specialized tools, each focusing on a particular data stream that reveals a different dimension of identity or behavior.

In the following sections, we break down these categories one by one and highlight the most prominent firms shaping this landscape.

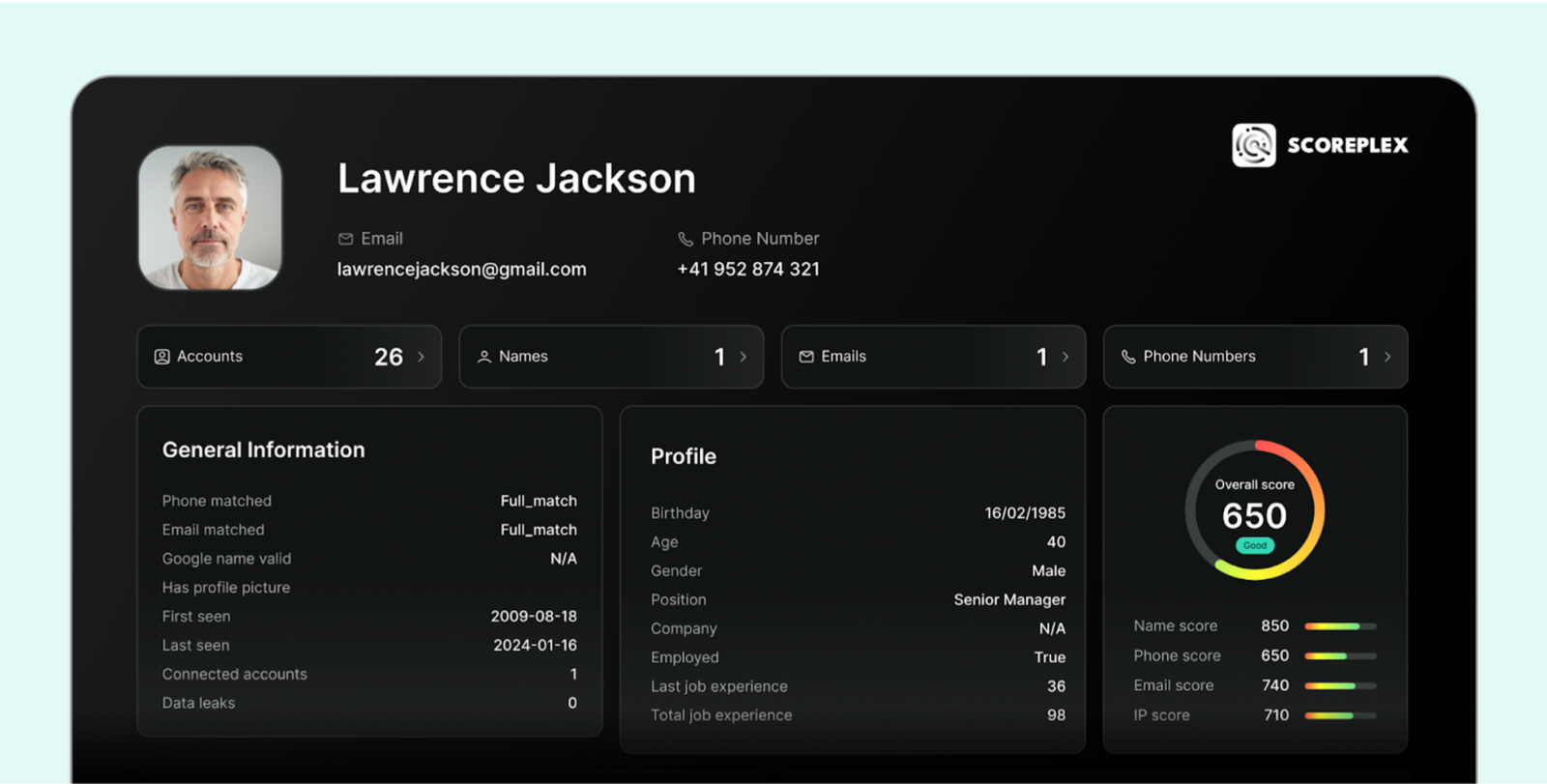

Featured Provider: Scoreplex

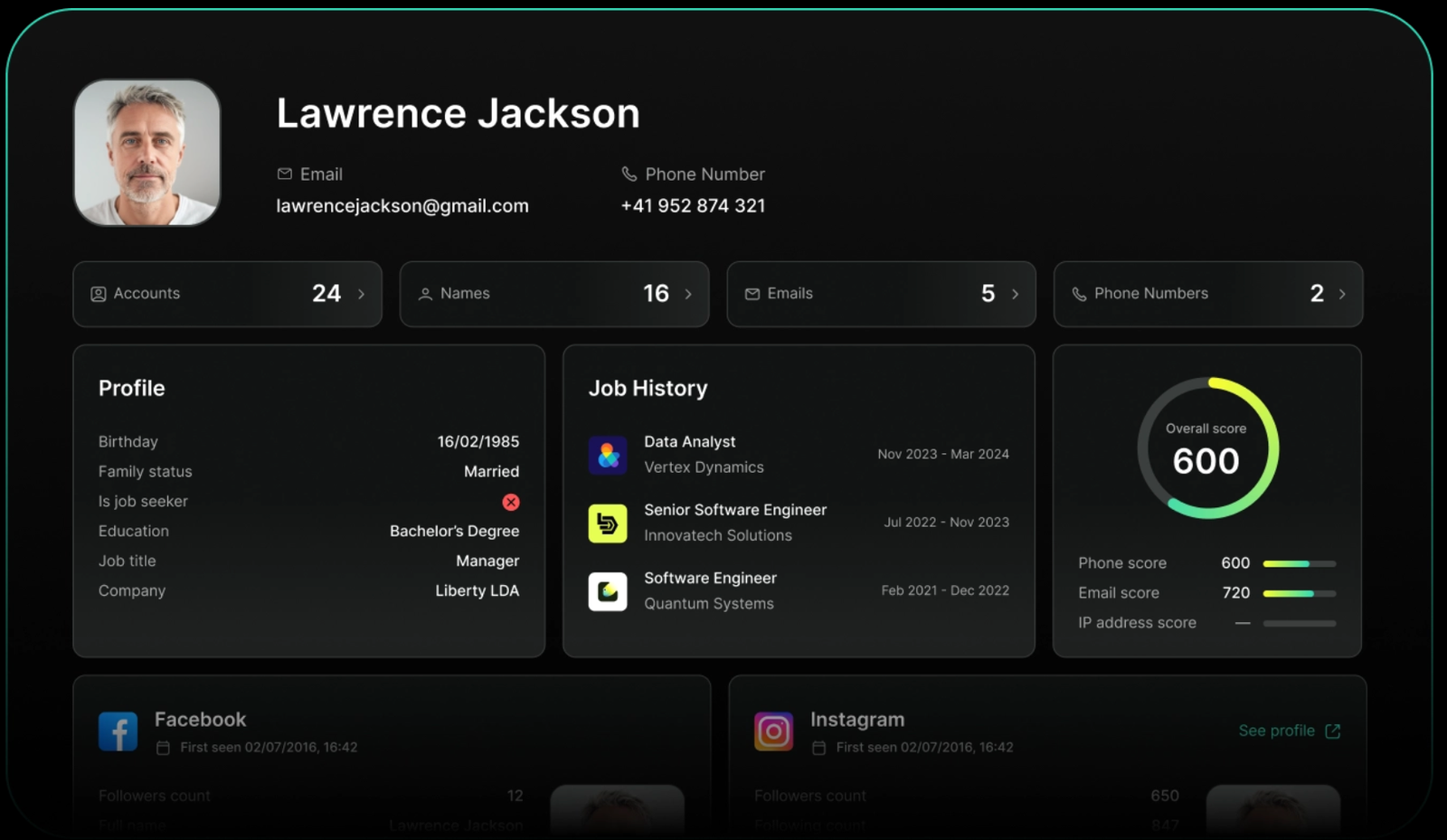

Before diving into the individual categories of alternative data providers, it is worth highlighting Scoreplex, a platform that sits at the intersection of many of these domains. Unlike specialized vendors that focus on one type of signal—such as email intelligence, open banking, or telecom data—Scoreplex aggregates over 300 sources across the digital footprint of an individual. Its mission is to fill the blind spots left by traditional credit bureaus and help lenders and platforms make better decisions in markets where bureau data is either incomplete or unreliable.

At the core of Scoreplex is its proprietary risk scoring model. This model evaluates personal identifiers such as emails, phone numbers, IP addresses, and digital footprints, layering them with enrichment data from online activity,, messaging apps, gambling platforms, and even dark web leak monitoring. By combining these dimensions, Scoreplex produces a dynamic, explainable score that can be integrated via API, SaaS dashboards, or bulk enrichment workflows.

Scoreplex is particularly valuable for:

- Pre-KYC Screening: Detecting synthetic identities and disposable accounts before costly compliance checks.

- Digital Onboarding: Offering low-friction verification that improves user experience while reducing fraud.

- Fraud Prevention: Catching mismatched identifiers, compromised emails, or risky signals.

- Financial Inclusion: Enabling thin-file or unbanked populations in LATAM, APAC, and Africa to be assessed fairly.

Market Focus: Scoreplex has a global outlook but places a strong emphasis on emerging markets, where traditional bureau data is weakest yet fraud activity is highest. Its client base includes lenders, BNPL providers, fintechs, and online marketplaces seeking both growth and robust risk controls.

Strengths: Wide coverage of personal identifiers, deep enrichment from 300+ alternative sources, and a risk score that is both intuitive and explainable.

Limitations: As a younger player, Scoreplex is still building brand recognition compared to established incumbents.

Website: Scoreplex

Email Data Providers

In the digital era, the email address is often the first and most enduring online identity a person owns. Unlike a phone number or social media profile, emails frequently persist for years, linking together registrations, financial transactions, and personal communication. This longevity makes email data an invaluable resource in alternative credit scoring and fraud detection. By analyzing the age, reputation, and behavioral patterns of an email address, providers can determine whether it belongs to a credible, long-term user or a high-risk disposable account.

Email intelligence is especially powerful for pre-KYC checks and digital onboarding, where speed and accuracy matter most. Before running expensive compliance verifications, lenders can use email-based risk scoring to filter out obvious fraudsters or synthetic identities. Signals such as domain age, linked social profiles, known breaches, and suspicious activity patterns can all serve as predictors of risk.

LexisNexis Risk Solutions (Emailage)

LexisNexis offers Emailage, one of the industry’s most recognized platforms for email risk assessment. The tool leverages a global consortium of transaction data, using advanced machine learning models to deliver reputation scores for email addresses. It can flag accounts linked to fraud rings, detect disposable or suspicious domains, and provide real-time fraud prevention.

- Use Cases: pre-KYC fraud checks, account opening, payment fraud prevention.

- Market Focus: strong adoption in North America, Europe, and Latin America.

- Strengths: global dataset, trusted compliance brand, proven scalability.

- Limitations: primarily enterprise-level; smaller fintechs may face high entry costs.

- Website: Emailage

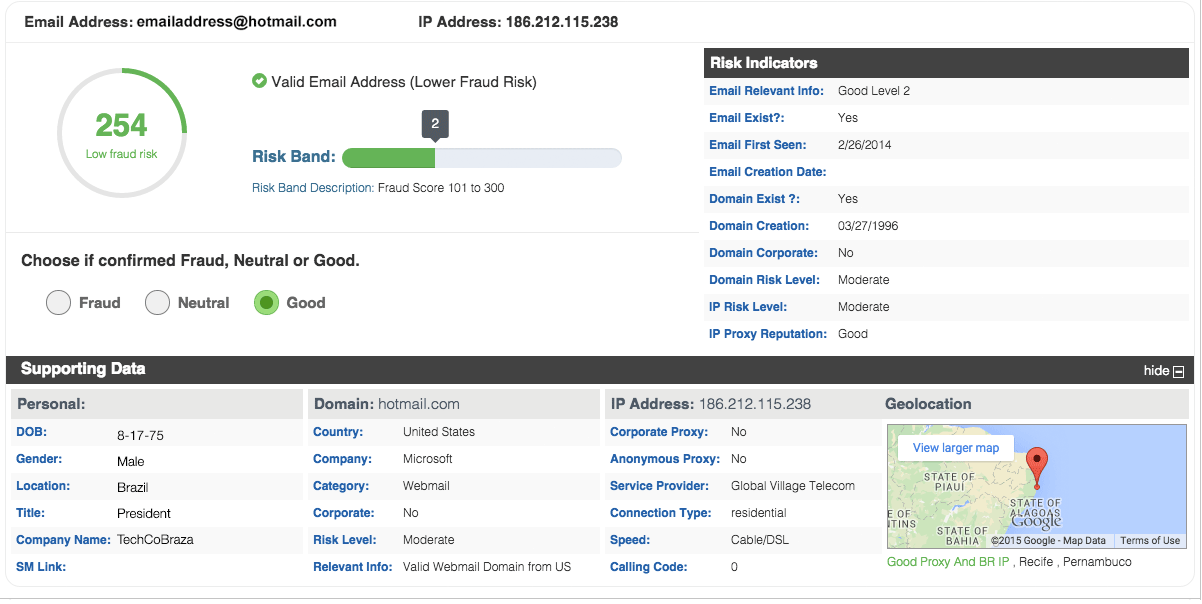

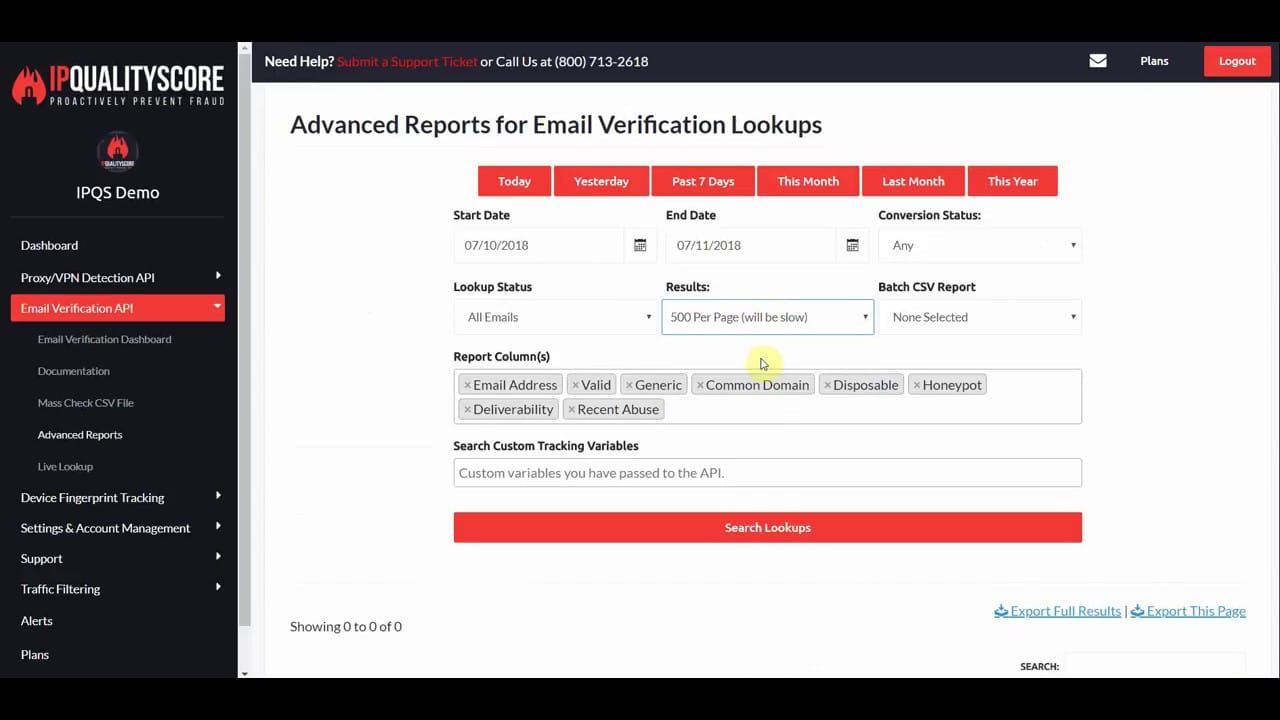

IPQualityScore

IPQualityScore (IPQS) provides fraud prevention tools that analyze emails, IP addresses, and phone numbers. Its email risk API evaluates whether an address is valid, disposable, or linked to high-risk activity. Features include domain intelligence, user behavior analysis, and fraud scoring based on activity patterns.

- Use Cases: e-commerce fraud detection, fintech onboarding, lead qualification.

- Market Focus: popular among digital businesses and global SMBs.

- Strengths: easy API integration, affordable pricing tiers, real-time scoring.

- Limitations: dataset not as broad as larger consortia; best for SMB to mid-market.

- Website: IPQualityScore

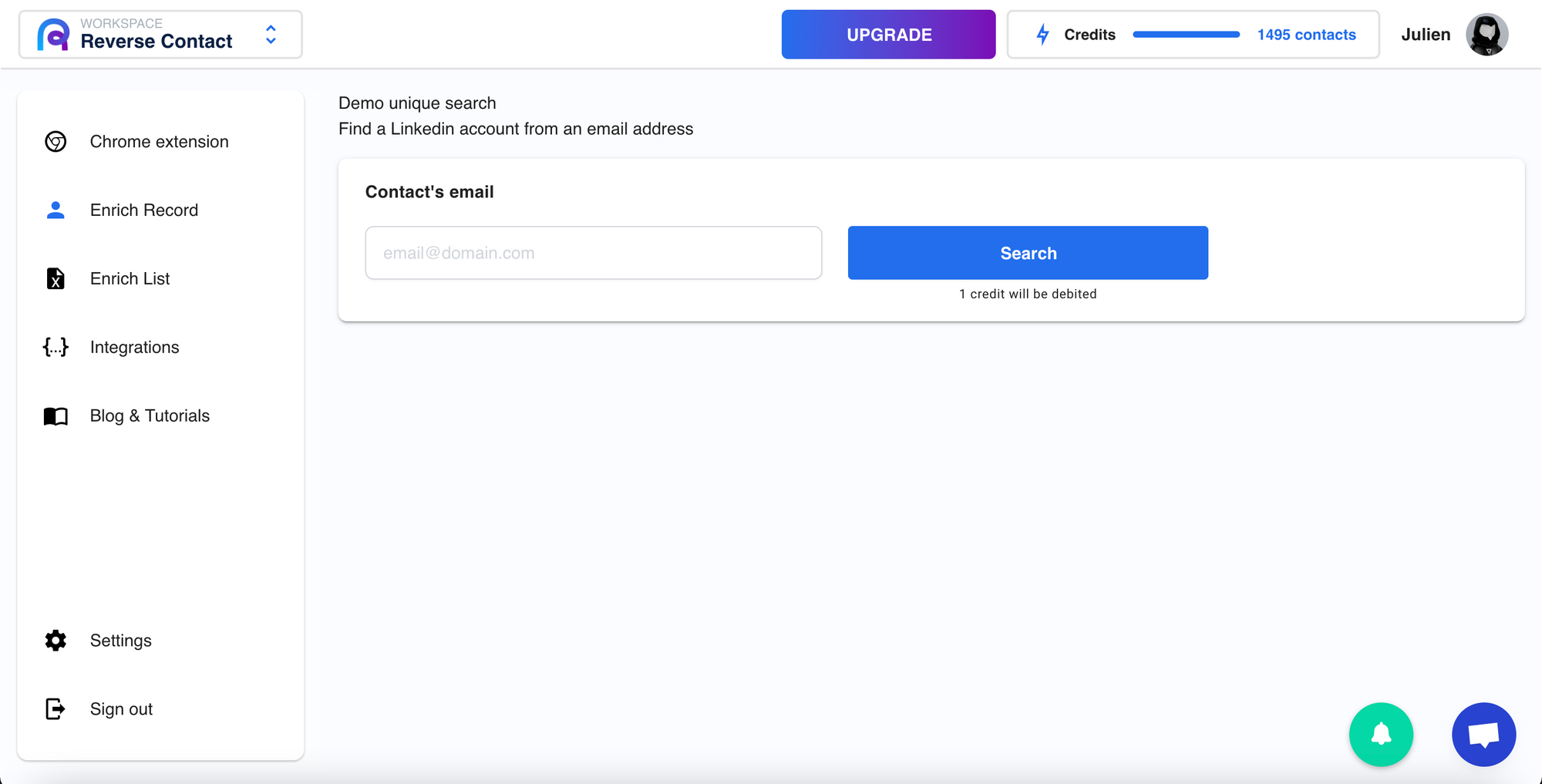

Reverse Contact

Reverse Contact specializes in enriching email addresses with associated social and professional profiles. By mapping emails to LinkedIn, GitHub, and other platforms, it provides insights into whether an applicant has a legitimate digital footprint. This makes it especially useful in fraud prevention and lead verification.

- Use Cases: B2B lead enrichment, onboarding credibility checks, KYC support.

- Market Focus: favored by sales intelligence platforms and fintechs targeting professionals.

- Strengths: strong coverage of professional networks, lightweight API for enrichment.

- Limitations: narrower scope (focused on enrichment rather than deep fraud analytics).

- Website: Reverse Contact

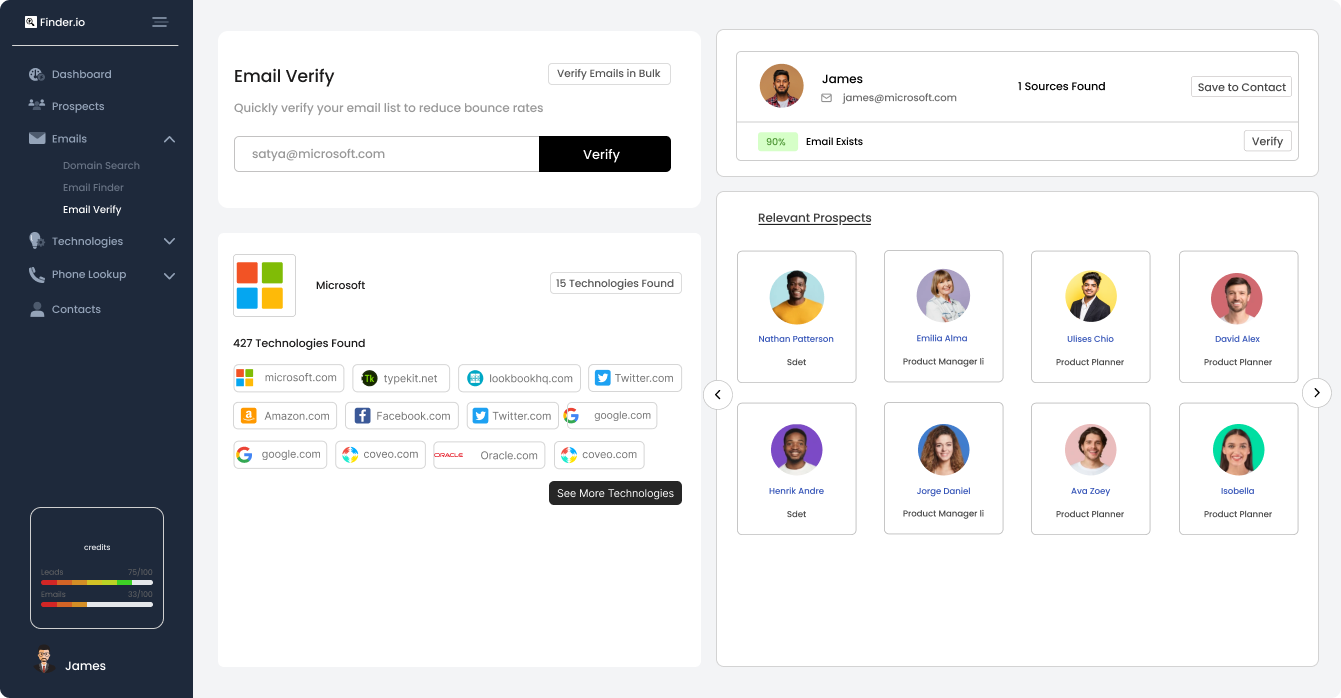

Finder.io

Finder.io positions itself as a lead generation and email verification tool that doubles as a lightweight risk filter. It helps businesses verify whether an email address is deliverable, active, and tied to legitimate online activity. While originally designed for sales teams, its data signals can also serve pre-KYC and fraud detection purposes by flagging invalid or disposable addresses.

- Use Cases: sales prospecting, digital onboarding, low-cost fraud prevention.

- Market Focus: small to mid-sized businesses seeking affordable enrichment.

- Strengths: user-friendly platform, quick verification, dual utility in sales and risk.

- Limitations: not purpose-built for deep fraud analytics; coverage narrower than enterprise-grade providers.

- Website: Finder.io

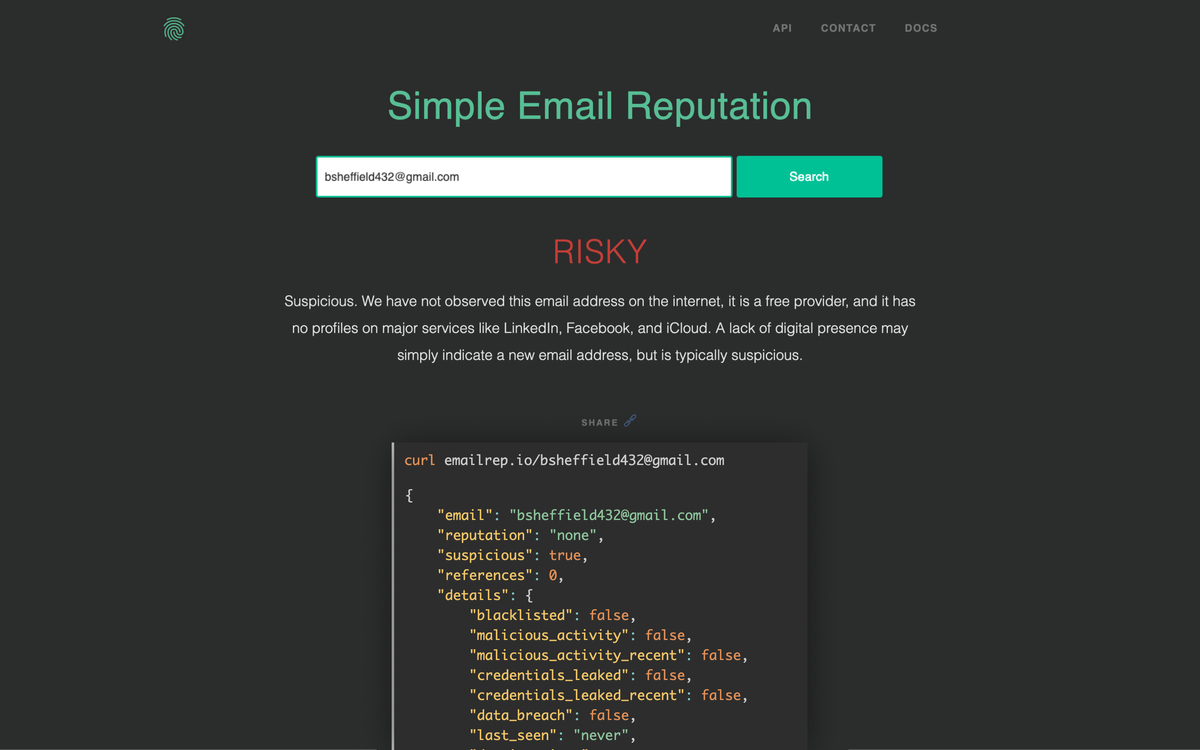

EmailRep

EmailRep, developed by Sublime Security, offers a specialized email reputation API built on threat intelligence, open-source data, and machine learning. It produces a reputation score along with detailed metadata—such as whether an address has appeared in breaches, is linked to suspicious behavior, or is tied to disposable providers.

- Use Cases: fraud prevention, account takeover risk checks, compliance support.

- Market Focus: security-conscious fintechs, SaaS platforms, and marketplaces.

- Strengths: strong reputation scoring model, robust threat intelligence integrations, simple API deployment.

- Limitations: primarily focused on fraud risk; limited enrichment beyond security context.

Website: EmailRep

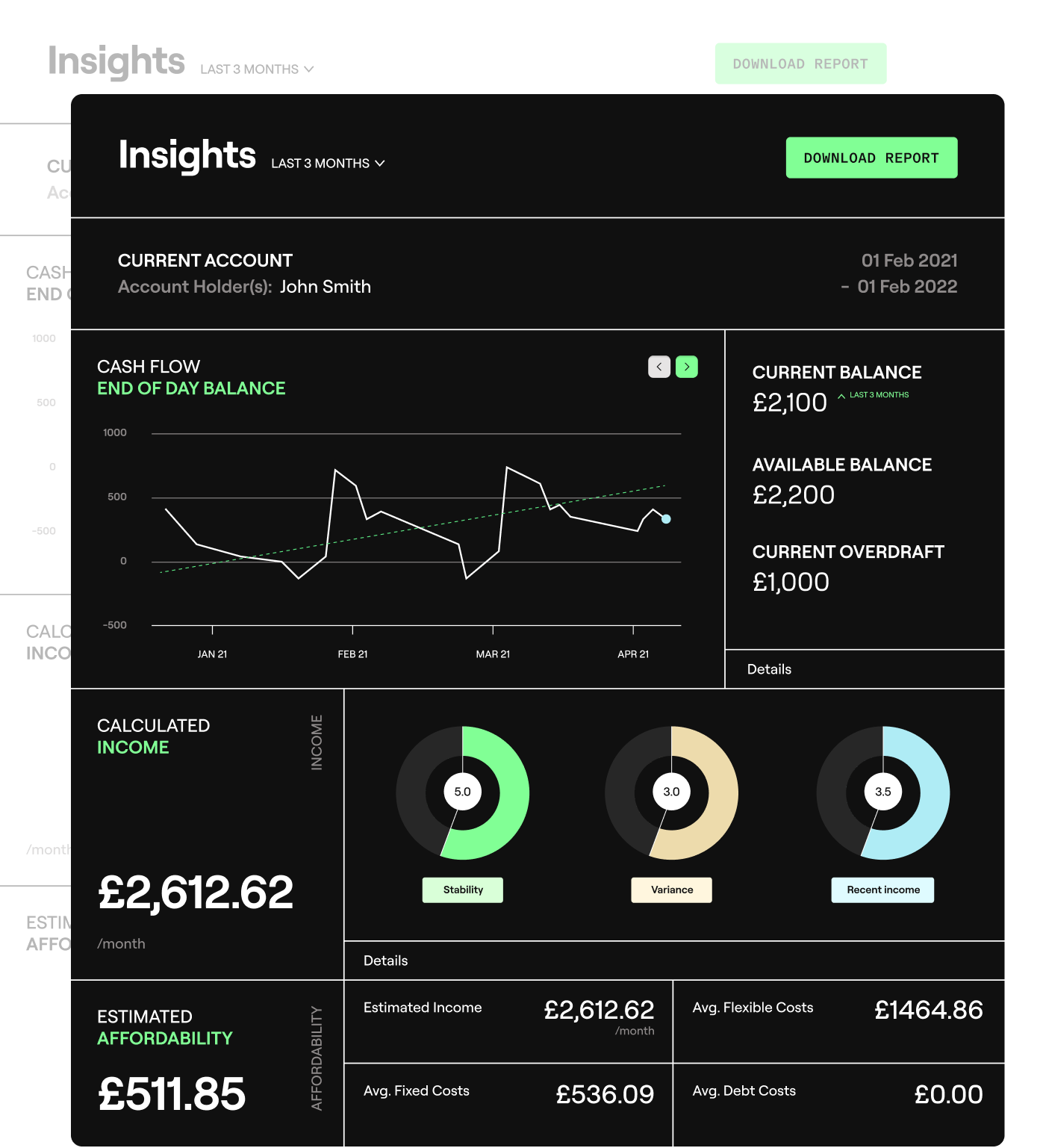

Open Banking Data Providers

Open banking has revolutionized credit assessment by giving lenders access to real-time financial data directly from bank accounts. With user consent, these providers connect through APIs to analyze income streams, spending habits, cash flow stability, and transaction categories. Unlike static bureau reports, open banking feeds allow financial institutions to evaluate not only whether someone has repaid debt in the past but also whether they can realistically afford new credit today.

For thin-file customers, open banking can serve as a primary source of risk evaluation, offering proof of income and financial behavior even without a credit card or loan history. For established borrowers, it acts as a fraud and affordability check, confirming that declared income and activity align with reality. Adoption is particularly advanced in Europe, where PSD2 and similar regulations mandate banks to share data securely with third parties. In other regions, fintechs and aggregators fill the gap by building connections with local banks and financial platforms.

Aperi Data

Aperi Data focuses on aggregating financial account data to provide lenders with actionable insights into consumer affordability and repayment potential. Its APIs deliver categorized transaction data, income verification, and creditworthiness assessments.

- Use Cases: loan underwriting, digital onboarding, affordability checks.

- Market Focus: fintechs and banks in the US and Europe.

- Strengths: streamlined API, strong transaction categorization.

- Limitations: coverage is limited outside developed banking markets.

Website: Aperi Data

Atto

Atto is a European open banking platform that delivers real-time account information and payment initiation services. It enables lenders to verify identity, income, and spending patterns while also facilitating secure transactions.

- Use Cases: instant income verification, fraud detection, credit scoring.

- Market Focus: primarily Europe under PSD2 regulation.

- Strengths: dual capability—data aggregation and payment initiation.

- Limitations: regional focus; less useful outside Europe.

Website: Atto

Yodlee

One of the pioneers in financial data aggregation, Yodlee offers a global platform for accessing bank, investment, and credit account data. Its analytics tools provide income verification, spending analysis, and risk modeling capabilities.

- Use Cases: underwriting, wealth management, fraud checks.

- Market Focus: strong global presence, especially in the US.

- Strengths: scale, reliability, extensive financial coverage.

- Limitations: legacy infrastructure can feel complex for agile fintechs.

Website: Yodlee

VantageScore

VantageScore combines traditional bureau data with open banking signals to create a more inclusive scoring model. It emphasizes thin-file borrowers by using alternative data such as rent and utility payments.

- Use Cases: credit decisioning, inclusion scoring, affordability analysis.

- Market Focus: United States financial institutions.

- Strengths: strong brand recognition, inclusive scoring models.

- Limitations: less API-first compared to fintech-native players.

Website: VantageScore

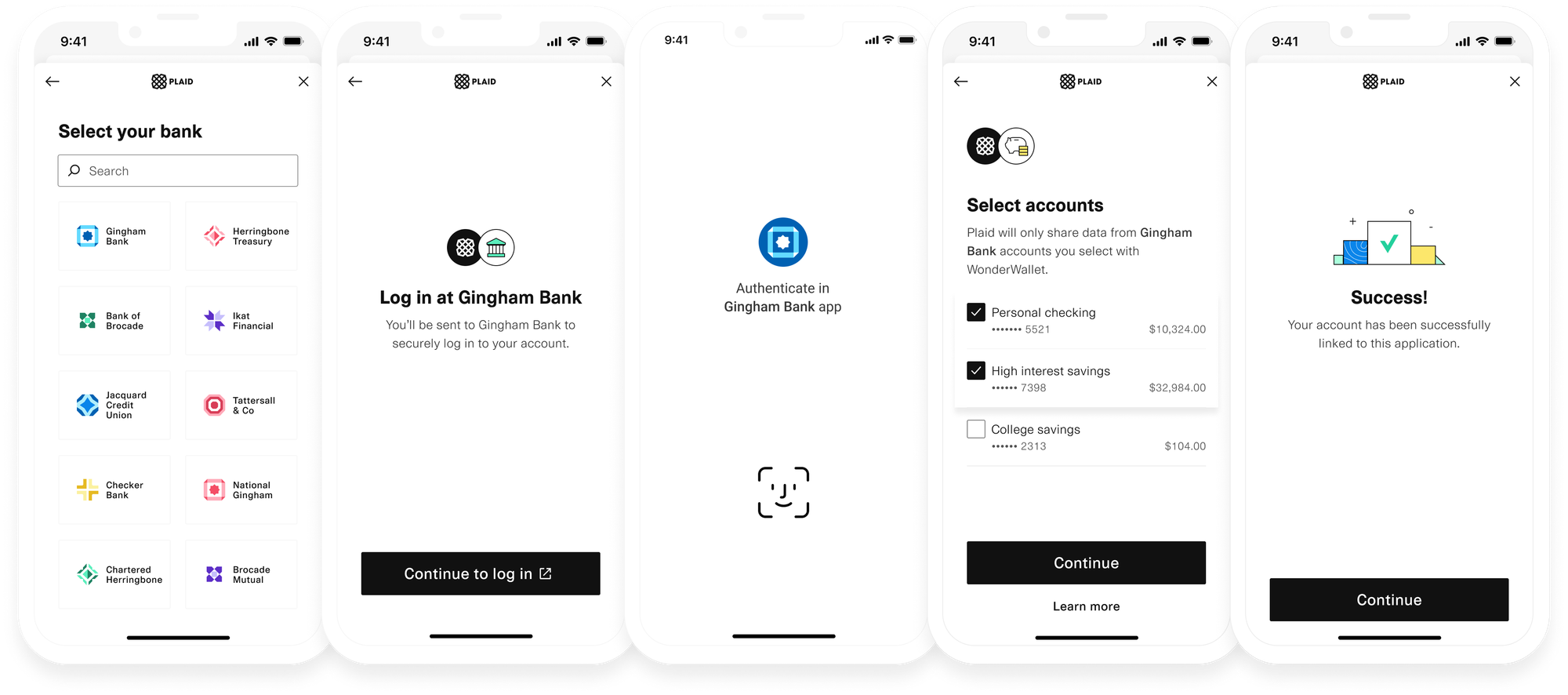

Plaid

Plaid has become one of the most recognized names in open banking, offering APIs that connect users’ bank accounts to apps and financial services. Its data products include income verification, transaction categorization, and risk insights.

- Use Cases: lending, BNPL, fraud prevention, personal finance apps.

- Market Focus: US, Europe, expanding globally.

- Strengths: wide adoption, developer-friendly APIs, strong fintech partnerships.

- Limitations: faces regulatory scrutiny in some regions.

- Website: Plaid

Phone Data Providers

Phone numbers have become one of the most widely used digital identifiers. Unlike email addresses, which can be created in seconds, a mobile number is often tied to a person’s long-term identity through SIM registration, telecom records, and two-factor authentication. This makes phone data a powerful tool for risk assessment, fraud detection, and identity verification.

Providers in this category analyze signals such as SIM swap history, carrier information, device type, and usage patterns to confirm legitimacy or flag suspicious activity. In emerging markets, phone data can also serve as a proxy for creditworthiness, as many unbanked individuals use their phones for mobile money, bill payments, and online transactions. For lenders and fintechs, phone intelligence bridges the gap between KYC compliance and fraud prevention, enabling both inclusion and security.

Truecaller

Truecaller is widely known as a caller ID and spam detection app with over 350 million active users worldwide. For businesses, it provides APIs that can verify phone numbers, identify spam risks, and validate caller information in real time. This dual focus on consumer utility and enterprise fraud prevention makes it a significant player in phone-based risk intelligence.

- Use Cases: spam/fraud detection, phone number validation, onboarding checks.

- Market Focus: strong adoption in India, Africa, and emerging markets.

- Strengths: massive user base, real-time spam/fraud detection.

- Limitations: consumer-focused origins mean enterprise integrations are secondary.

- Website: Truecaller

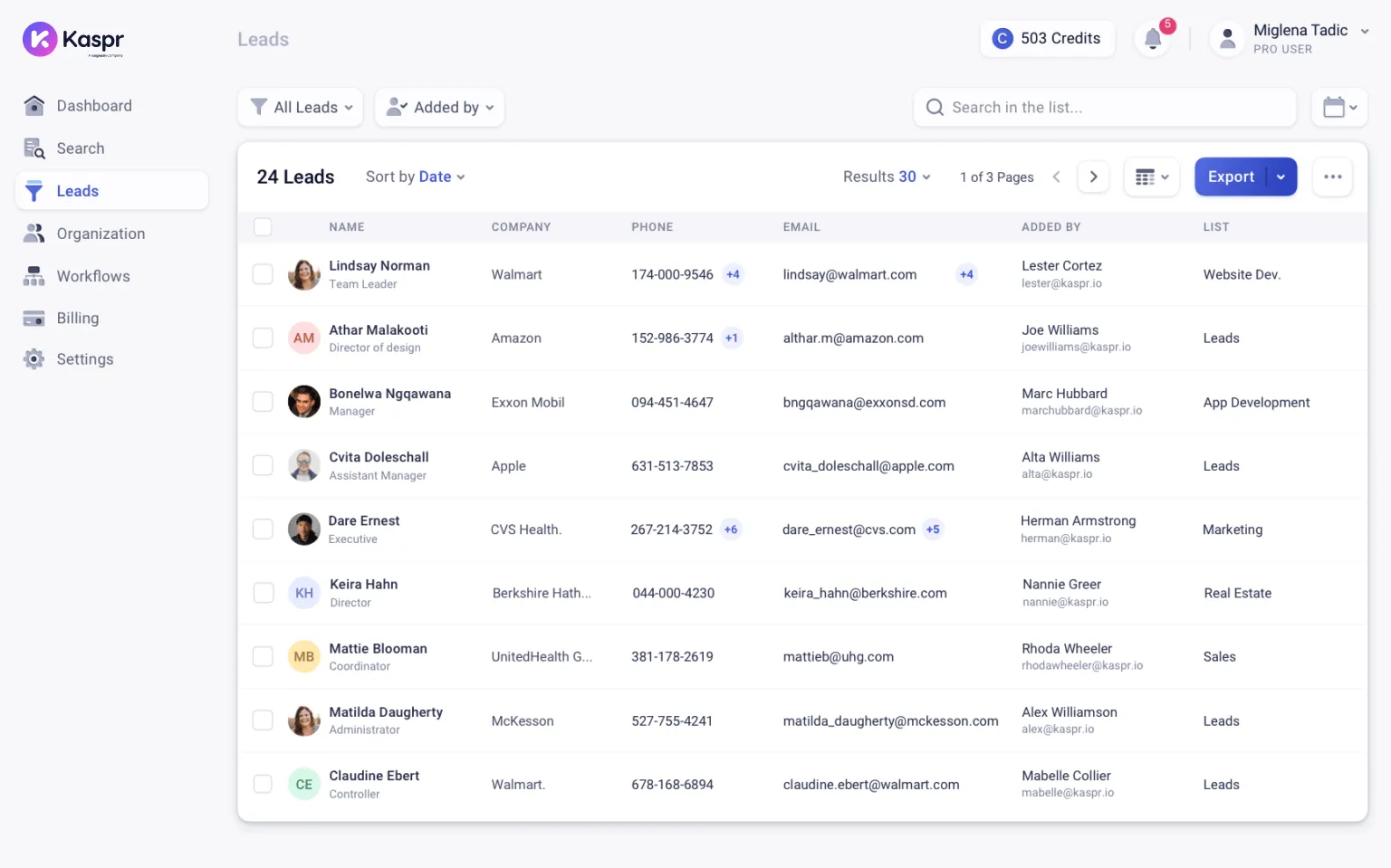

Kaspr

Kaspr offers B2B contact enrichment, connecting phone numbers with professional data such as LinkedIn profiles. While initially a sales intelligence tool, its APIs can support risk checks by validating whether a phone number is legitimate and linked to an established identity.

- Use Cases: lead enrichment, onboarding credibility checks, digital verification.

- Market Focus: European B2B firms and SaaS providers.

- Strengths: strong LinkedIn integrations, simple enrichment API.

- Limitations: less focused on fraud prevention; primarily geared to sales teams.

Website: Kaspr

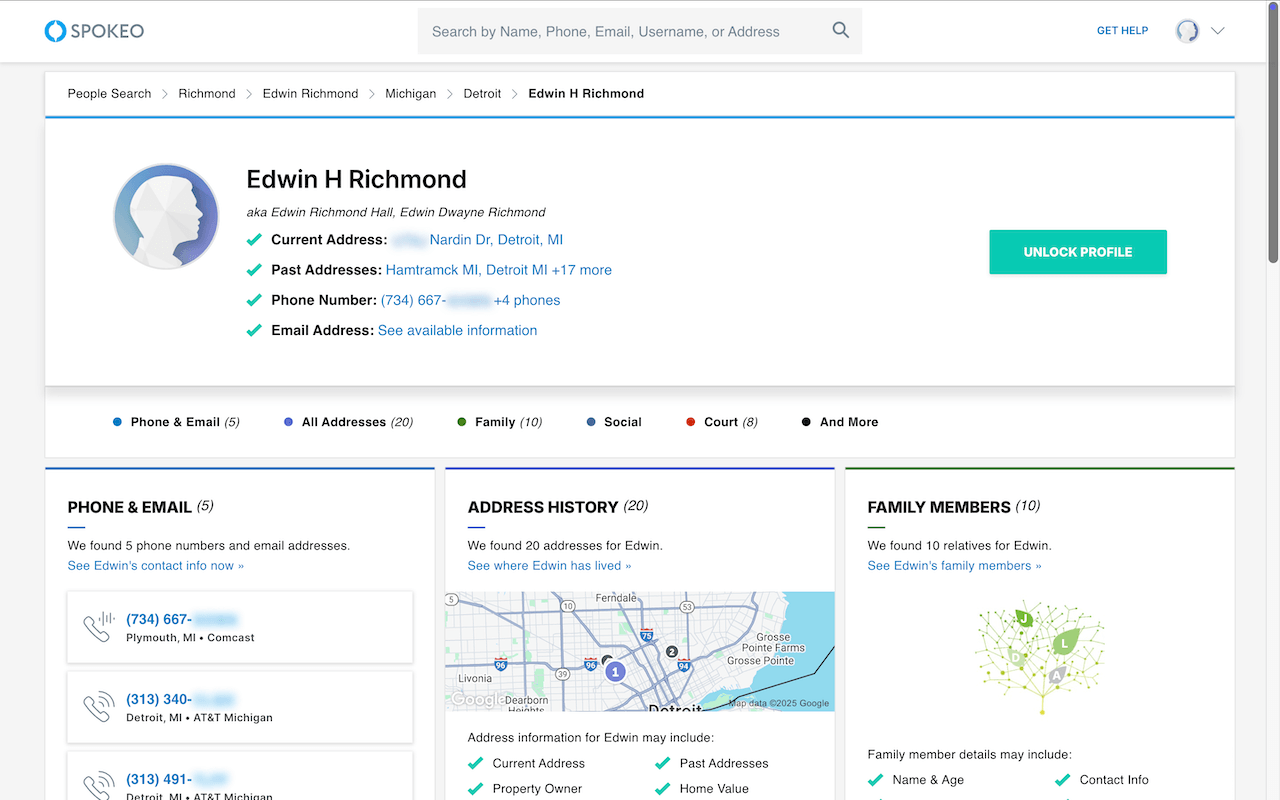

Spokeo

Spokeo is a people search and phone lookup service that aggregates data from public records, social networks, and telecom sources. It helps businesses validate whether a phone number is tied to a real person, uncover associated digital footprints, and flag potential risks.

- Use Cases: identity verification, fraud checks, background screening.

- Market Focus: US market, with broad consumer and SMB adoption.

- Strengths: large database of US public records, easy-to-use lookup tools.

- Limitations: coverage outside the US is limited.

Website: Spokeo

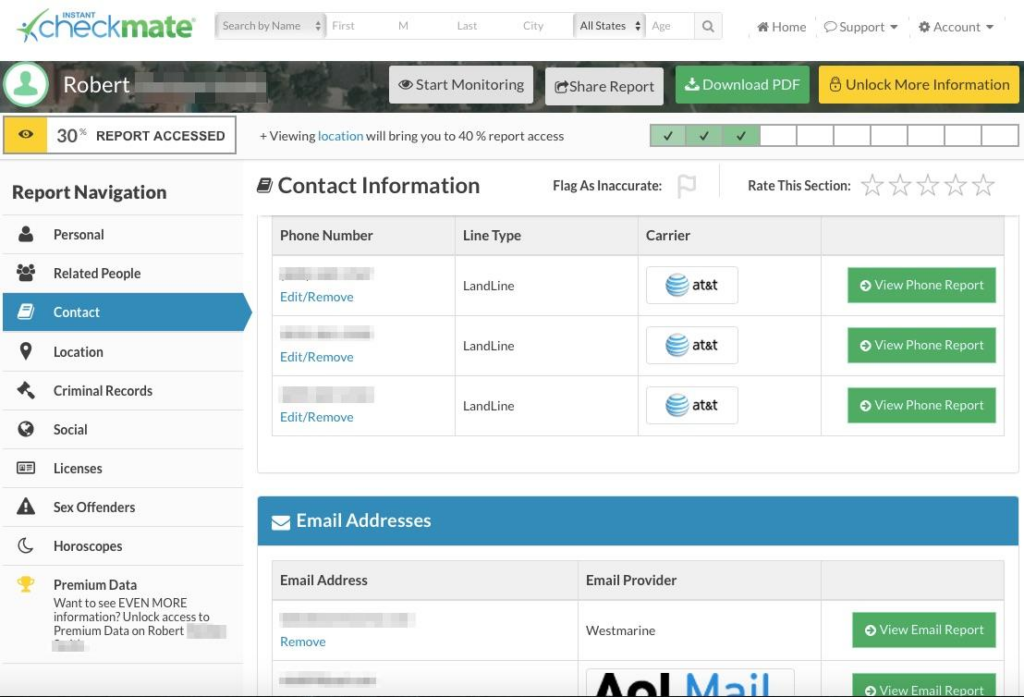

Instant Checkmate

Instant Checkmate is a background check and phone number lookup service that pulls data from public records, court filings, and telecom databases. For risk assessment, it helps confirm whether a phone number is tied to a legitimate identity and surfaces associated personal history. While consumer-focused, its database can be valuable for platforms needing fast checks on potential fraudsters.

- Use Cases: background checks, fraud detection, onboarding validation.

- Market Focus: United States, primarily consumer and SMB users.

- Strengths: extensive US records coverage, fast lookup capabilities.

- Limitations: consumer-first positioning, limited use in enterprise fraud prevention.

- Website: Instant Checkmate

Behavioral Data Providers

Behavioral data providers focus on how people interact with technology, complete tasks, and manage their daily routines. The idea is that small patterns in behavior—such as typing speed, smartphone usage, or responses to psychometric questions—can serve as predictors of reliability and financial discipline. While traditional credit bureaus measure past repayments, behavioral analytics look at current habits and cognitive traits that correlate with repayment potential.

This approach is especially relevant in emerging markets, where large populations may lack credit or banking history but still use smartphones, social media, and digital wallets. Behavioral data can also complement open banking or phone intelligence by providing an extra layer of insight into how individuals think and act.

LenddoEFL

LenddoEFL combines psychometric assessments with digital footprint analysis to generate alternative credit scores. It asks users to complete short behavioral surveys, which are scored against repayment patterns. The platform is designed to help lenders evaluate thin-file borrowers who lack bureau histories.

- Use Cases: microfinance, inclusion scoring, lending in emerging markets.

- Market Focus: strong in LATAM, Southeast Asia, and Africa.

- Strengths: proven inclusion-focused methodology, mobile-first approach.

- Limitations: survey-based scoring may face adoption hurdles in some markets.

- Website: LenddoEFL

Moyo

Moyo is an AI-powered platform that uses behavioral analytics and mobile usage data to predict creditworthiness. It analyzes how users interact with their devices, including app activity and data patterns, to identify repayment potential.

- Use Cases: digital lending, fraud detection, thin-file borrower scoring.

- Market Focus: global, with emphasis on emerging markets.

- Strengths: innovative behavioral signals, real-time scoring.

- Limitations: requires access to device-level data, which may raise privacy concerns.

- Website: Moyo

Credolab

Credolab transforms smartphone metadata—such as app usage, device settings, and geolocation patterns—into predictive credit scores. By analyzing hundreds of behavioral variables, it offers lenders a unique view into borrower reliability.

- Use Cases: credit scoring, fraud prevention, digital onboarding.

- Market Focus: Asia-Pacific, Europe, LATAM.

- Strengths: scalable smartphone-based scoring, quick integration via SDK.

- Limitations: dependent on smartphone access and user permissions.

- Website: Credolab

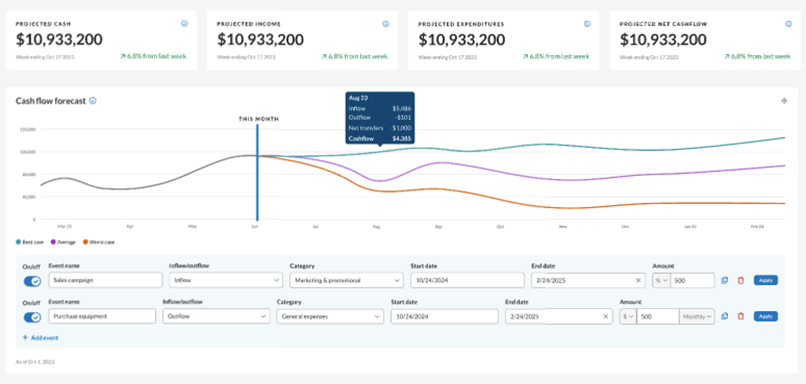

Transactional Data Providers

Transactional data providers focus on how money flows in and out of accounts. Unlike bureau scores, which reflect long-term repayment history, transactional analytics give lenders a real-time view of income stability, spending habits, and financial resilience. By analyzing categories of expenses, recurring payments, and cash flow patterns, these tools help lenders understand not just whether someone has repaid debts in the past, but whether they are likely to manage new obligations today.

For digital lenders and BNPL providers, transactional data is particularly valuable because it reveals affordability—whether a borrower can take on additional credit without risk of default. It also plays a growing role in fraud prevention, as unusual or inconsistent transaction flows may point to synthetic identities or account misuse.

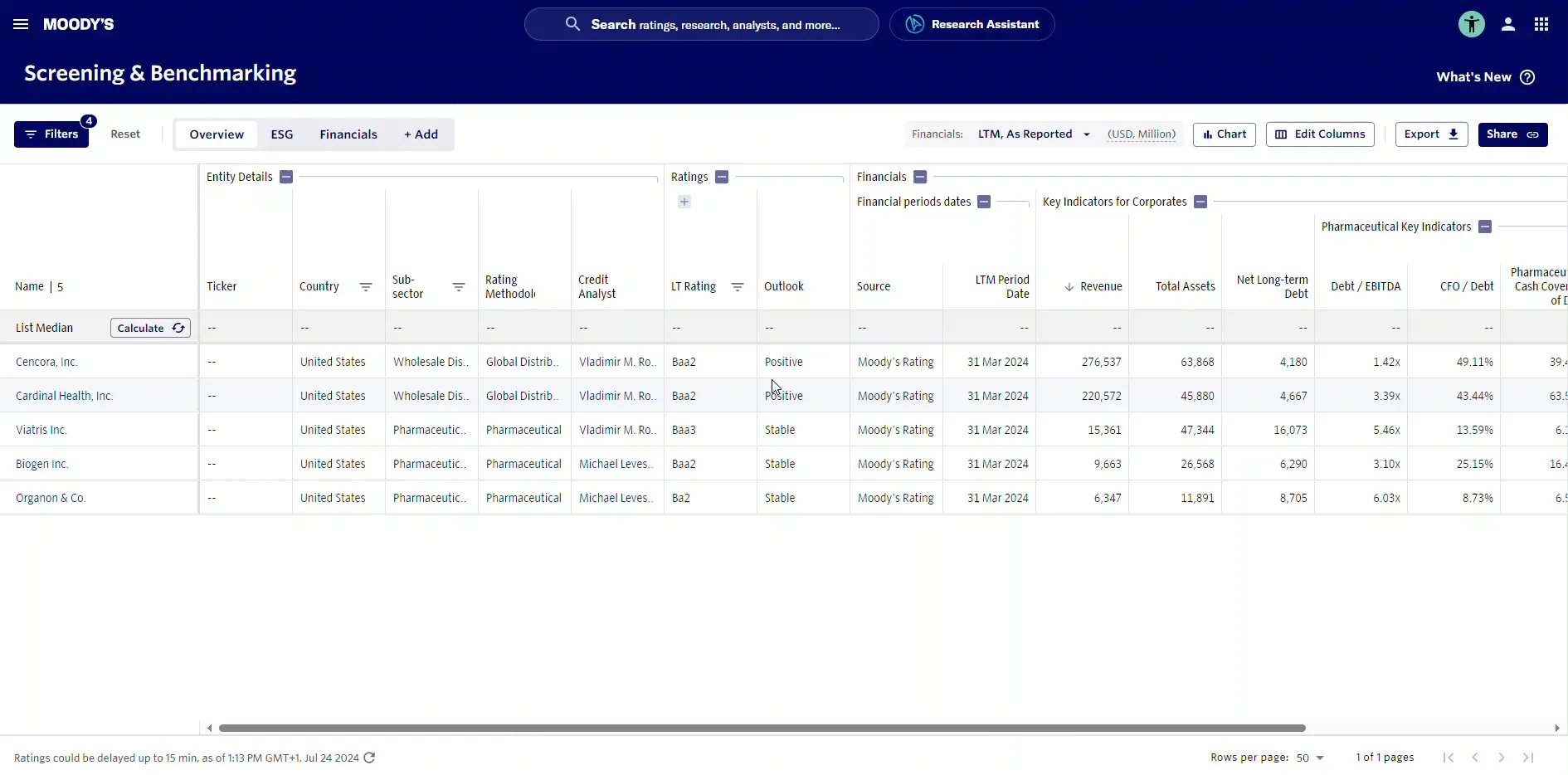

Moody’s

Moody’s, best known as a credit rating agency, has expanded into transactional data analytics through partnerships and acquisitions. It provides lenders with tools to assess bank account data, spending behavior, and repayment capacity.

- Use Cases: credit decisioning, portfolio risk management.

- Market Focus: global, with emphasis on institutional lenders.

- Strengths: trusted brand, deep analytics expertise.

- Limitations: heavier enterprise focus, less accessible to small fintechs.

Website: Moody’s

TrustDecision

TrustDecision offers risk management and transactional analytics for financial institutions. Its solutions include cash flow analysis, affordability checks, and fraud detection based on unusual transaction activity.

- Use Cases: underwriting, fraud prevention, digital lending.

- Market Focus: Asia-Pacific and emerging markets.

- Strengths: strong regional coverage, flexible solutions.

- Limitations: smaller presence in US/EU compared to peers.

- Website: TrustDecision

Dana

Dana is a Southeast Asian digital wallet and payments platform that leverages its transactional data for risk assessment. By analyzing user payments, top-ups, and spending patterns, it provides alternative credit insights in markets with limited bureau coverage.

- Use Cases: micro-lending, BNPL, financial inclusion.

- Market Focus: Indonesia and Southeast Asia.

- Strengths: deep regional penetration, strong e-wallet data.

- Limitations: regional focus; less applicable outside SEA.

- Website: Dana

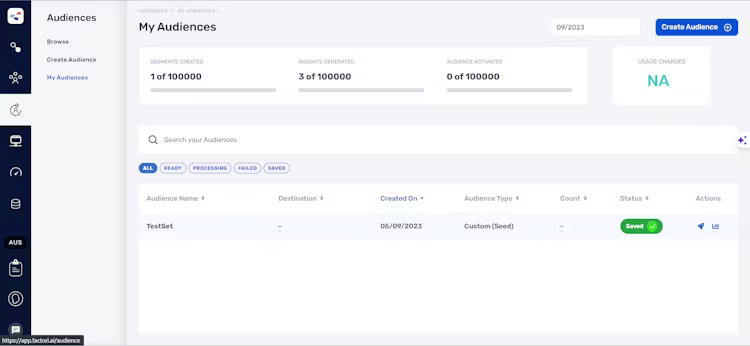

Factori

Factori applies AI to transactional and financial data, providing lenders with enriched insights into income streams, cash flow patterns, and repayment likelihood. It specializes in categorizing raw transaction data into actionable risk indicators.

- Use Cases: affordability scoring, fraud detection, lending optimization.

- Market Focus: fintechs and digital banks.

- Strengths: AI-driven categorization, fast insights.

- Limitations: newer player with smaller footprint.

- Website: Factori

Telecom Data Providers

Telecom data is becoming one of the most important signals in alternative credit scoring, particularly in emerging markets where credit bureau coverage is thin. Mobile phones are central to daily life—used for communication, payments, and even identity verification. This makes telecom data a valuable proxy for both identity validation and creditworthiness.

Key signals include SIM registration history, call detail records, mobile usage patterns, and network-level intelligence such as porting, roaming, or device-switching events. These factors can reveal the stability of a user’s digital identity, flag high-risk behaviors (like frequent SIM swaps), and even help lenders score unbanked individuals based on their telecom footprint.

TMTid

TMTid provides global mobile identity verification services, helping organizations verify whether a phone number is valid, active, and tied to a real subscriber. Its solutions are built around carrier data and designed to catch fraud attempts such as SIM swaps or identity takeovers.

- Use Cases: fraud prevention, KYC, onboarding verification.

- Market Focus: telecom operators and financial services globally.

- Strengths: deep telecom integrations, real-time identity signals.

- Limitations: primarily carrier-driven, requiring telecom partnerships.

- Website: TMTid

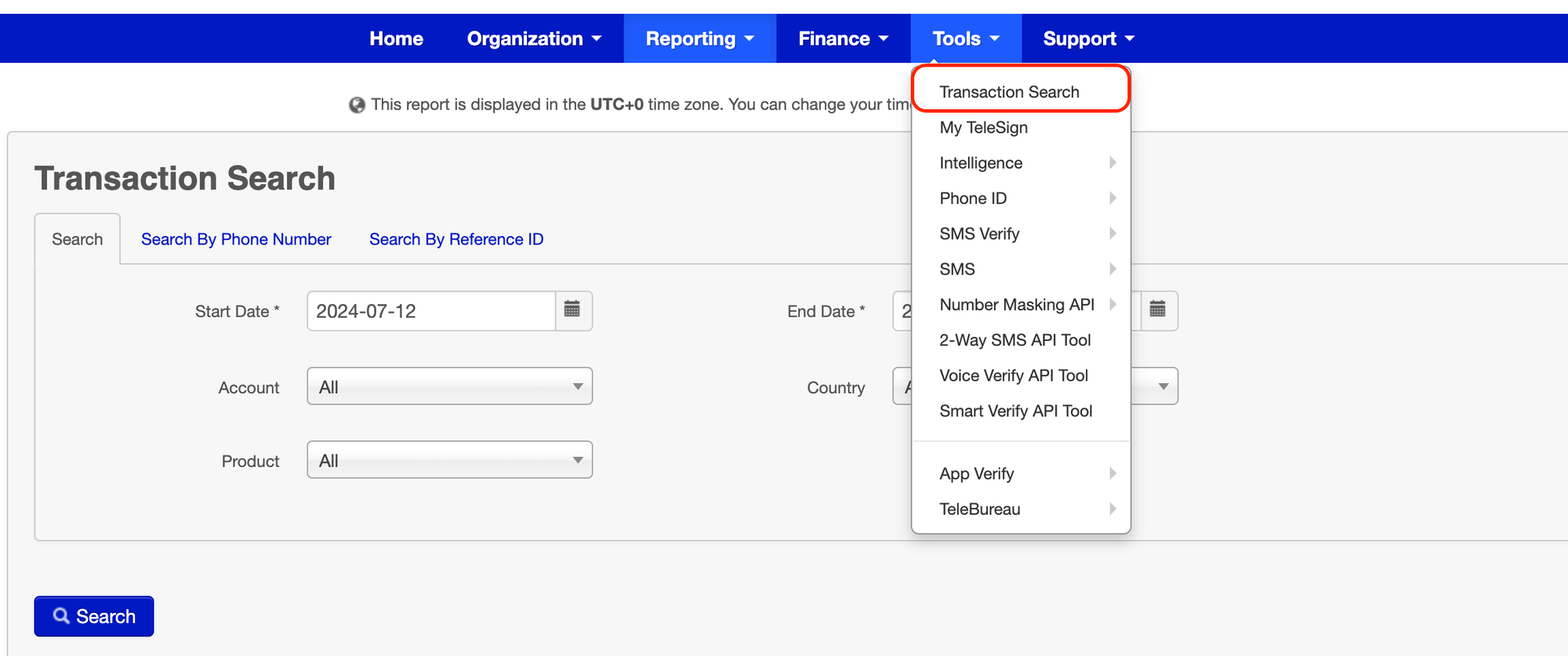

Telesign

Telesign delivers telecom-based digital identity and risk scoring solutions, leveraging carrier data to detect fraud and validate users. Its “Intelligence” product enriches phone numbers with risk signals such as line type, carrier, and potential fraudulent activity.

- Use Cases: account security, fraud detection, mobile onboarding.

- Market Focus: strong presence in the US and Europe.

- Strengths: reliable telecom intelligence, strong API-first approach.

- Limitations: risk scoring breadth narrower compared to multi-source platforms.

- Website: Telesign

NetNumber

NetNumber provides global telecom intelligence services, including number portability data, carrier lookup, and fraud detection. Its platform supports identity verification and call validation by ensuring that numbers are correctly assigned and not spoofed.

- Use Cases: fraud prevention, telecom compliance, financial onboarding.

- Market Focus: telecom operators, banks, and fintechs worldwide.

- Strengths: strong focus on number portability and global coverage.

- Limitations: specialized offering; best as part of a larger risk stack.

Website: NetNumber

Scoring Platforms

While specialized providers focus on individual signals like email, phone, or telecom data, scoring platforms aim to bring these disparate data points into unified risk models. Powered by AI and machine learning, they allow financial institutions and fintechs to build, deploy, and refine credit decisioning models at scale.

These platforms are valuable because they help organizations avoid the challenge of stitching together dozens of APIs and data sources manually. Instead, they provide a centralized layer of intelligence that can ingest alternative and traditional data alike, producing more accurate and explainable risk scores. Some offer no-code or low-code environments, enabling non-technical risk teams to design and update models without depending entirely on data scientists.

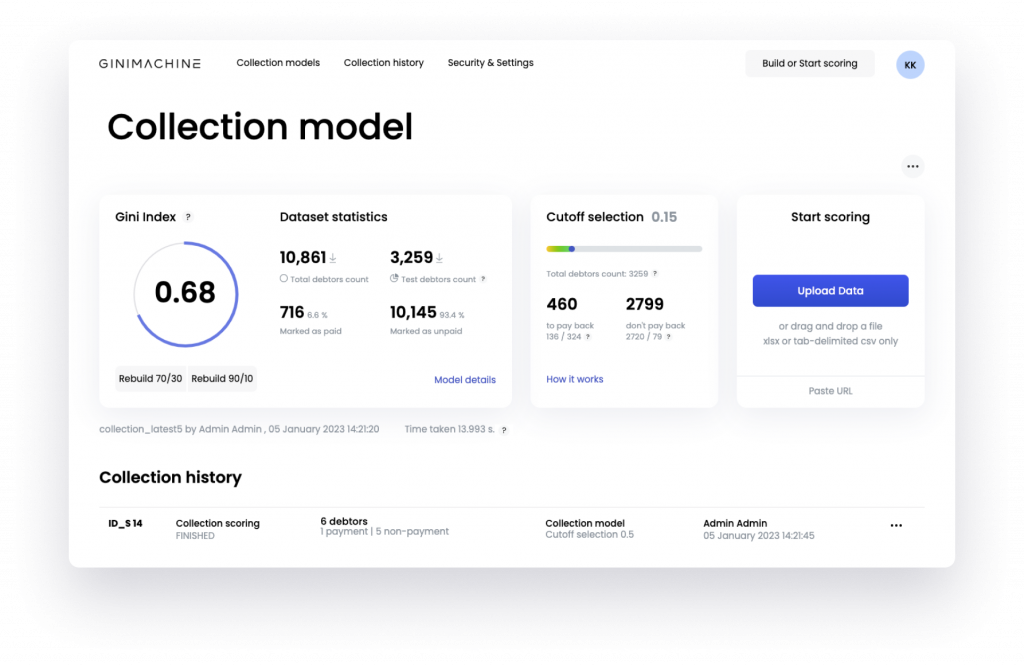

Ginimachine (by HES)

Ginimachine is a no-code AI-based credit scoring platform designed to help lenders build and deploy models quickly. It supports both traditional bureau data and alternative sources such as transactional, behavioral, and telecom datasets. Its drag-and-drop interface allows non-technical teams to create predictive models without coding.

- Use Cases: loan underwriting, pre-KYC screening, customer segmentation.

- Market Focus: Europe, North America, and emerging fintech markets.

- Strengths: no-code usability, fast model deployment, explainable AI outputs.

- Limitations: relies on the quality of integrated data sources; platform adoption requires training.

- Website: Ginimachine

Scienaptic

Scienaptic provides an AI-powered credit decisioning platform that helps lenders deploy adaptive risk models. It focuses on combining structured and unstructured data, including alternative data streams, to improve inclusivity and reduce default risk.

- Use Cases: consumer lending, BNPL, small business lending.

- Market Focus: North America, India, and Europe.

- Strengths: proven deployments with banks and credit unions, strong AI explainability.

- Limitations: typically enterprise-oriented, making it less accessible for smaller fintechs.

- Website: Scienaptic

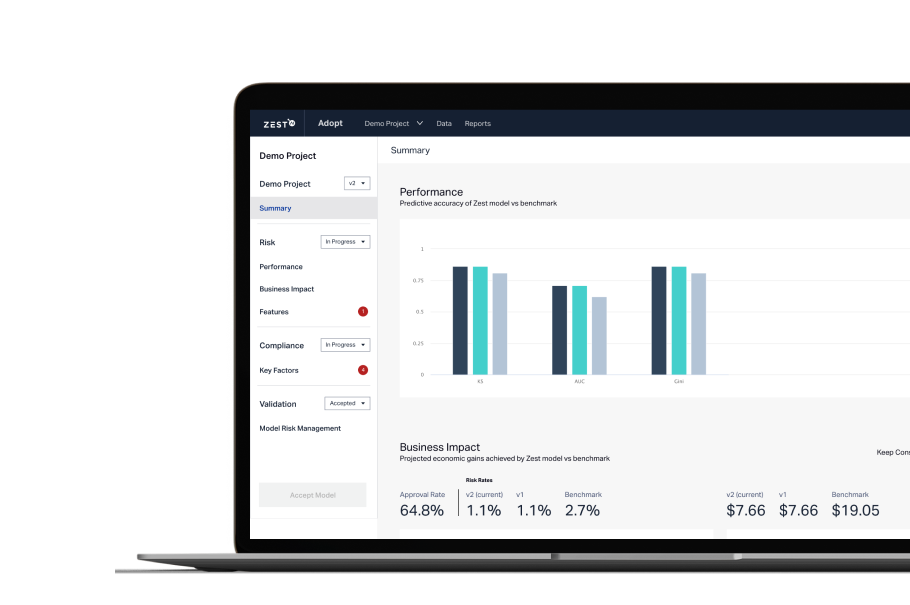

Zest AI

Zest AI is one of the most established players in the alternative credit scoring space. It offers a machine learning platform for underwriting that integrates both bureau and alternative data. Its technology enables lenders to expand credit access while maintaining risk controls, with a strong emphasis on explainability to meet regulatory standards.

- Use Cases: credit card lending, auto loans, personal loans.

- Market Focus: primarily US financial institutions, with growing global reach.

- Strengths: regulatory compliance, proven track record, ability to increase approval rates without raising default rates.

- Limitations: heavily focused on larger institutions; smaller fintechs may find it resource-intensive.

- Website: Zest AI

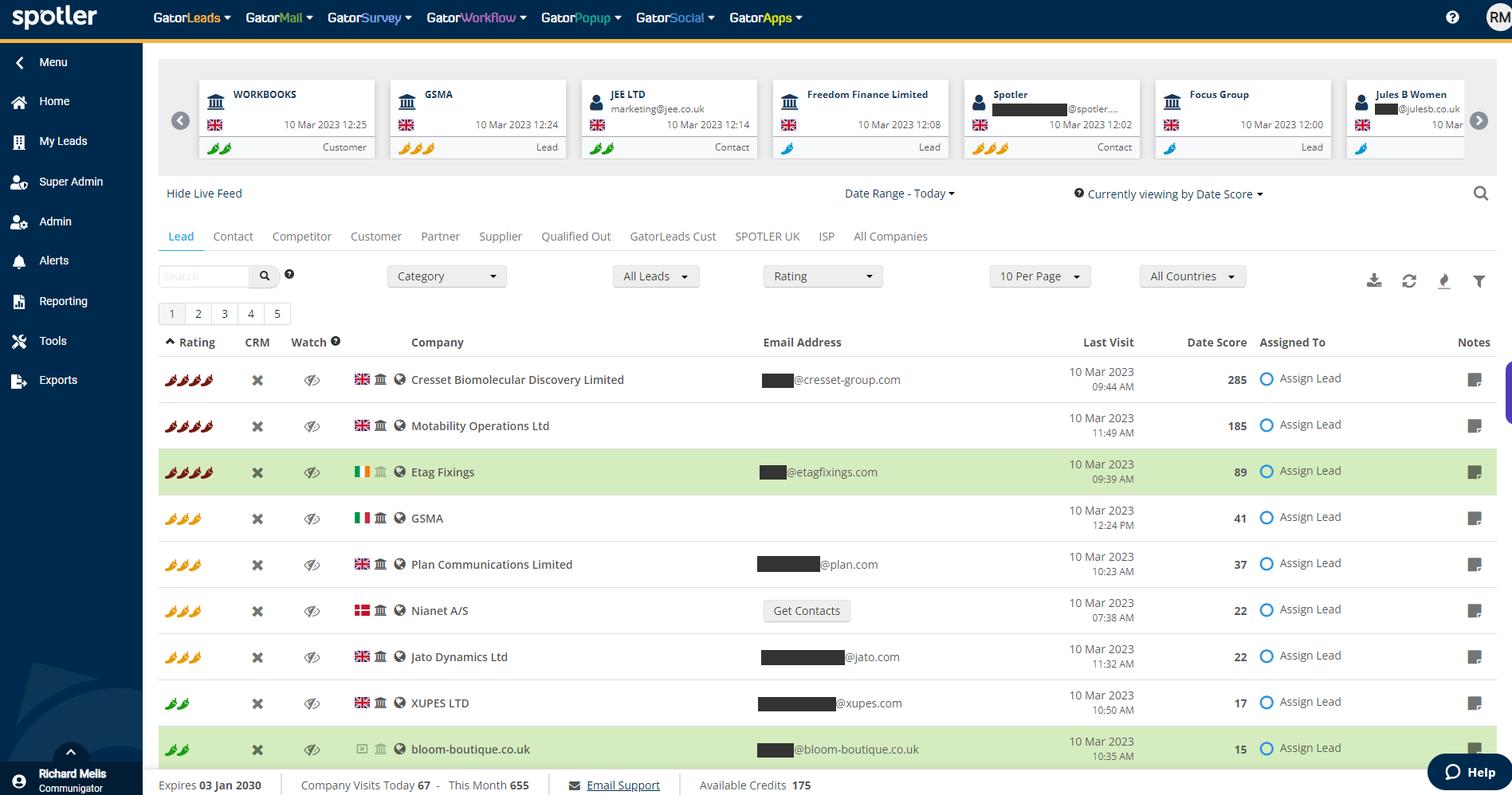

Spotler

Spotler provides no-code predictive modeling solutions that extend beyond marketing into risk assessment and credit scoring. Its ActivatePro platform enables organizations to build predictive models without coding expertise, allowing risk teams to experiment with alternative datasets and refine their scoring approaches.

- Use Cases: predictive modeling, credit decisioning, customer segmentation.

- Market Focus: Europe, with adoption among mid-sized businesses.

- Strengths: intuitive no-code interface, accessible for non-technical teams.

- Limitations: less specialized in financial services compared to platforms like Zest AI or Scienaptic.

- Website: Spotler

Social Media & Online Presence Monitoring

A person’s online presence often tells as much about their identity and credibility as their financial records. From LinkedIn profiles to social media activity, digital footprints can reveal whether an applicant is authentic, engaged, and consistent—or whether they are hiding behind disposable accounts and synthetic identities. For risk management, social media and online presence monitoring providers enrich identity checks with signals that traditional credit bureaus cannot capture.

These solutions are particularly valuable in fraud prevention and pre-KYC screening, where the presence—or absence—of a digital footprint can be a key indicator of risk. They also play a growing role in due diligence, employment screening, and marketplace onboarding, where credibility and trustworthiness are paramount.

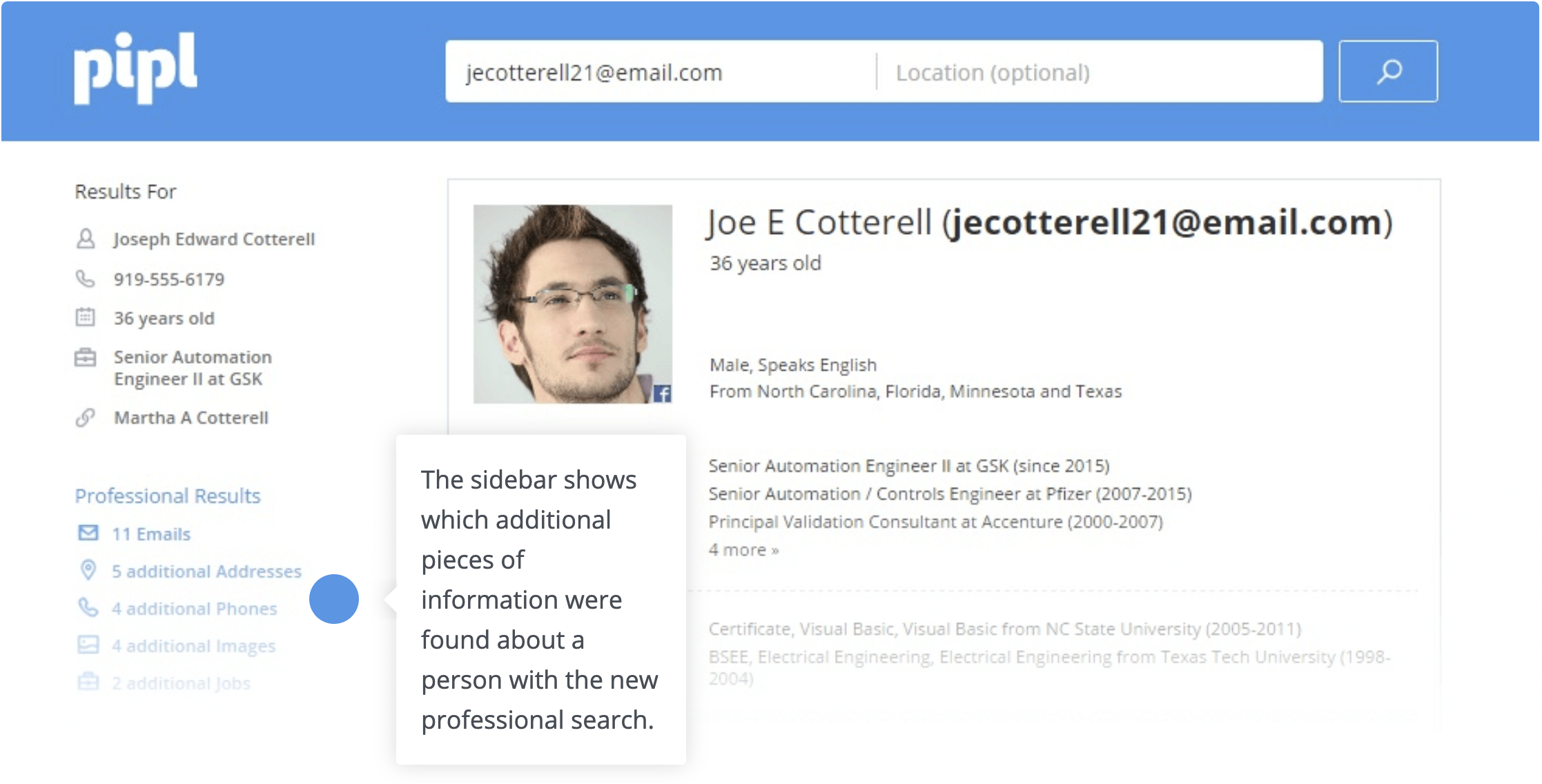

Pipl

Pipl is one of the best-known platforms for people search and online identity verification. It aggregates data from social media, public records, and online platforms to create detailed digital profiles. For risk scoring, Pipl helps organizations confirm whether an identity is real, consistent, and supported by a traceable online presence.

- Use Cases: KYC, fraud prevention, background checks, due diligence.

- Market Focus: global, with strong adoption in financial services and security.

- Strengths: large, structured dataset; strong API for integration.

- Limitations: consumer data privacy concerns may limit use in highly regulated regions.

- Website: Pipl

Social Searcher

Social Searcher provides tools to monitor and analyze public social media activity. Its API can track mentions, keywords, and sentiment across multiple platforms, offering organizations insights into an applicant’s digital presence and credibility. While originally built for marketing, its applications extend into risk analysis and onboarding verification.

- Use Cases: social footprint validation, brand/reputation monitoring, KYC support.

- Market Focus: SMBs and fintechs looking for affordable monitoring tools.

- Strengths: easy-to-use tools, affordability, broad social media coverage.

- Limitations: not purpose-built for fraud detection; requires adaptation for risk use cases.

- Website: Social Searcher

X1

X1 provides enterprise-grade online presence monitoring and search solutions. Its platform is designed for investigations, compliance, and fraud prevention, allowing organizations to search and analyze large volumes of social media and online data quickly.

- Use Cases: fraud investigations, compliance monitoring, corporate due diligence.

- Market Focus: enterprises, financial institutions, investigators.

- Strengths: scalable search capabilities, strong compliance orientation.

- Limitations: enterprise-level complexity and cost.

Website: X1

Dark Web & Data Breach Monitoring

One of the fastest-growing risks in digital finance is the exposure of personal identifiers on the dark web. Emails, phone numbers, passwords, and identity documents frequently end up in breach dumps, hacker forums, or illicit marketplaces. For lenders and fintechs, knowing whether an applicant’s identifiers have been compromised is essential: a breached account often signals elevated fraud risk, account takeover potential, or synthetic identity creation.

Dark web and breach monitoring providers crawl hidden networks, forums, and leak repositories to detect whether sensitive data has been exposed. When integrated into onboarding and fraud prevention workflows, these tools add an early warning system, helping organizations flag compromised users before they become fraud cases.

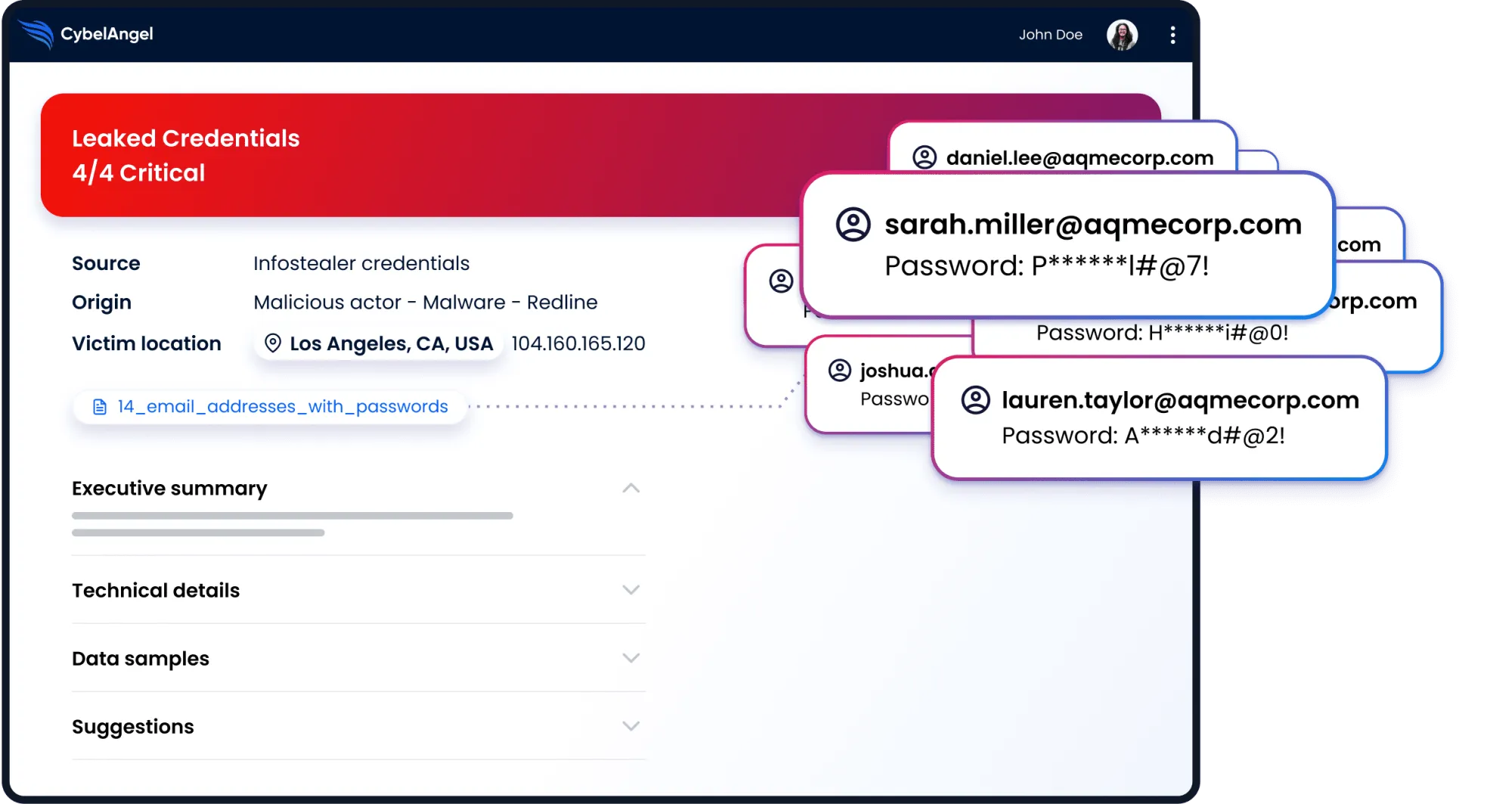

CybelAngel

CybelAngel offers digital risk protection services, with strong capabilities in dark web monitoring. Its platform detects exposed credentials, leaked databases, and sensitive information across hidden networks. By providing real-time alerts, it helps financial institutions mitigate risks before attackers exploit stolen data.

- Use Cases: dark web monitoring, credential leakage detection, fraud prevention.

- Market Focus: global enterprises, especially in finance and technology.

- Strengths: wide coverage of hidden sources, actionable alerts.

- Limitations: enterprise pricing and complexity; less suited for small fintechs.

- Website: CybelAngel

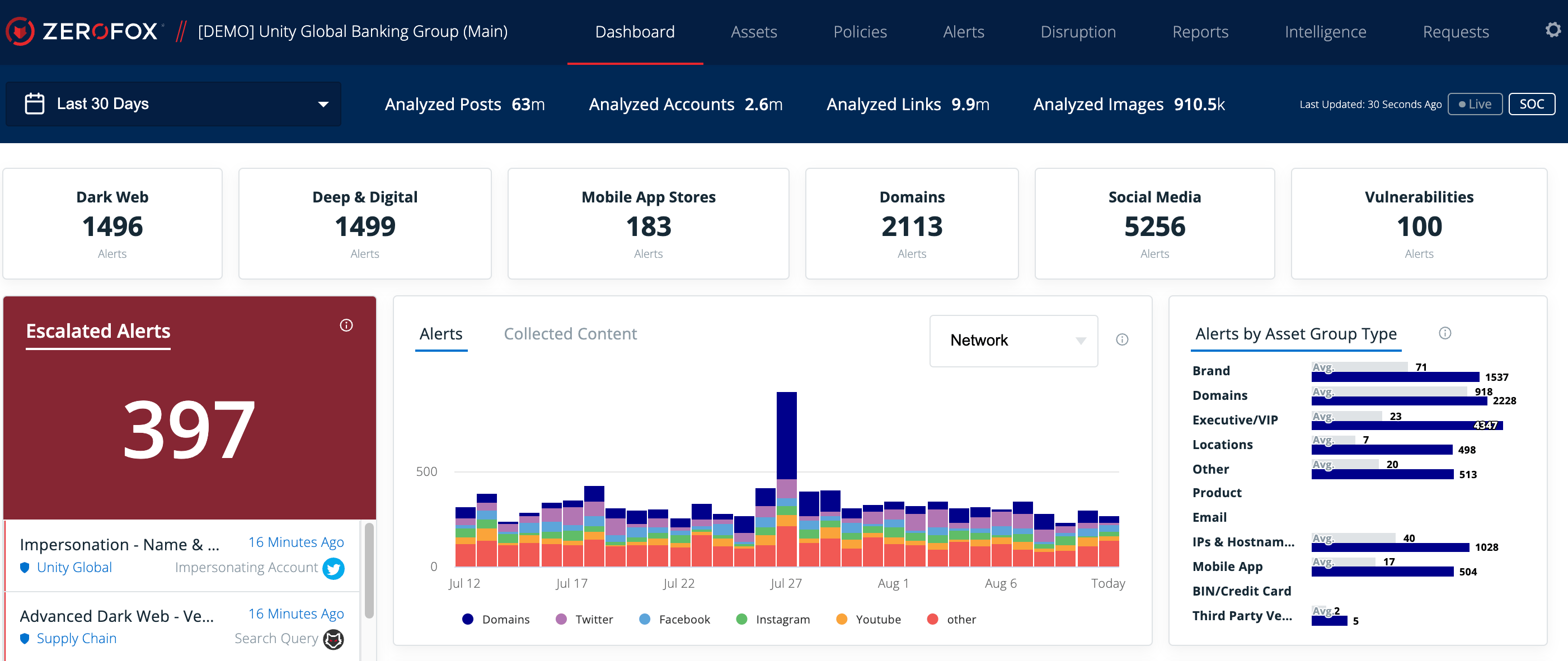

ZeroFox

ZeroFox is a leader in external threat intelligence and digital risk monitoring. Its dark web solution scans breach data, hacker forums, and marketplaces for compromised accounts and credentials. It combines monitoring with remediation services to help clients act on exposures.

- Use Cases: fraud prevention, account takeover risk mitigation, compliance support.

- Market Focus: North America, global enterprises.

- Strengths: comprehensive intelligence platform, integrated remediation.

- Limitations: broader focus on threat intelligence may dilute depth in credit-specific risk.

- Website: ZeroFox

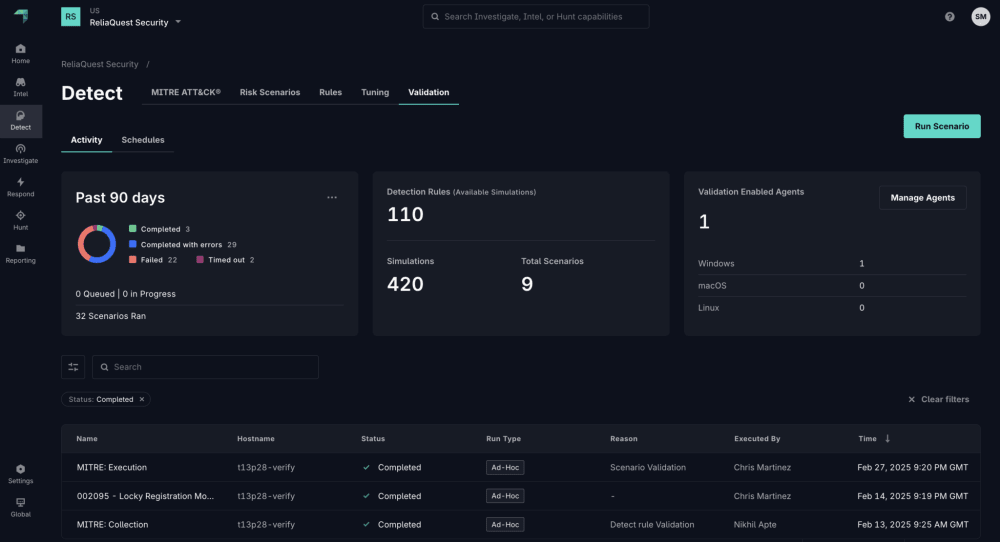

ReliaQuest

ReliaQuest provides cybersecurity and dark web monitoring solutions through its GreyMatter platform. It tracks compromised data across hidden sources and integrates findings into broader security operations. For financial services, this means identifying high-risk users whose identifiers have been exposed before fraud occurs.

- Use Cases: breach monitoring, security operations, fraud risk detection.

- Market Focus: enterprises, especially in finance and healthcare.

- Strengths: integration with wider security tools, strong enterprise focus.

- Limitations: complex deployment; tailored for large organizations.

- Website: ReliaQuest

Conclusion

The evolution of risk scoring is no longer about simply extending credit—it’s about trust, inclusion, and resilience in a digital-first economy. Traditional bureau models, while still important, cannot keep pace with the realities of modern finance, where billions of people remain unbanked, fraud tactics evolve daily, and cross-border transactions blur the boundaries of national credit systems.

The providers explored in this article demonstrate just how diverse the alternative data landscape has become. From email and phone intelligence to open banking feeds, behavioral analytics, telecom footprints, and dark web monitoring, each category contributes a crucial piece of the puzzle. For some organizations, open banking data may be the cornerstone of decisioning; for others, telecom and behavioral signals will carry more weight. The common thread is clear: a single data stream is rarely enough. The strongest models come from blending multiple signals into a holistic view of risk.

For lenders, fintechs, and marketplaces, adopting alternative scoring is not a matter of “if,” but of when and how. The competitive edge lies in integrating these tools efficiently, balancing financial inclusion with rigorous fraud prevention, and ensuring compliance with evolving regulations.

Ultimately, alternative credit scoring is not just about scoring—it is about unlocking opportunity responsibly. Those who harness its potential will not only reduce losses but also expand access to credit for the millions who have been overlooked by legacy systems.

Scoreplex as Your Alternative Data Provider

If you’re assembling an alternative-data stack, Scoreplex gives you signals-as-a-service—clean, explainable enrichment you can drop into onboarding, underwriting, and fraud ops without re-architecting your pipes.

What We Provide

- Unified enrichment over 300+ sources: email/phone/IP reputation, domain & website intel, social & web presence, breach/dark-web exposure, device/network context, web signals.

- White-box outputs: field-level flags and rule hits (200+ rules) so risk, compliance, and product teams can trace every signal.

- Global coverage with EM depth: strong signal density across LATAM and APAC, plus long-tail sources where bureau files are sparse.

Example Workflows

- Pre-KYC triage: email/phone/IP + breach checks to kill obvious bad before costs accrue

- Thin-file enrichment: digital footprint + contacts to separate newcomers from synthetics

What to Measure

- Hit-rate of actionable flags, manual review reduction, approval-rate lift on thin-file cohorts, and time-to-decision improvements.

Next Step

Plug Scoreplex in as your alternative data provider—keep your models, get better signals.