At its core, credit scoring allows financial institutions to evaluate the creditworthiness of individuals and businesses. Traditionally, this assessment occurs during loan applications and relies heavily on data sourced from credit bureaus and application forms.

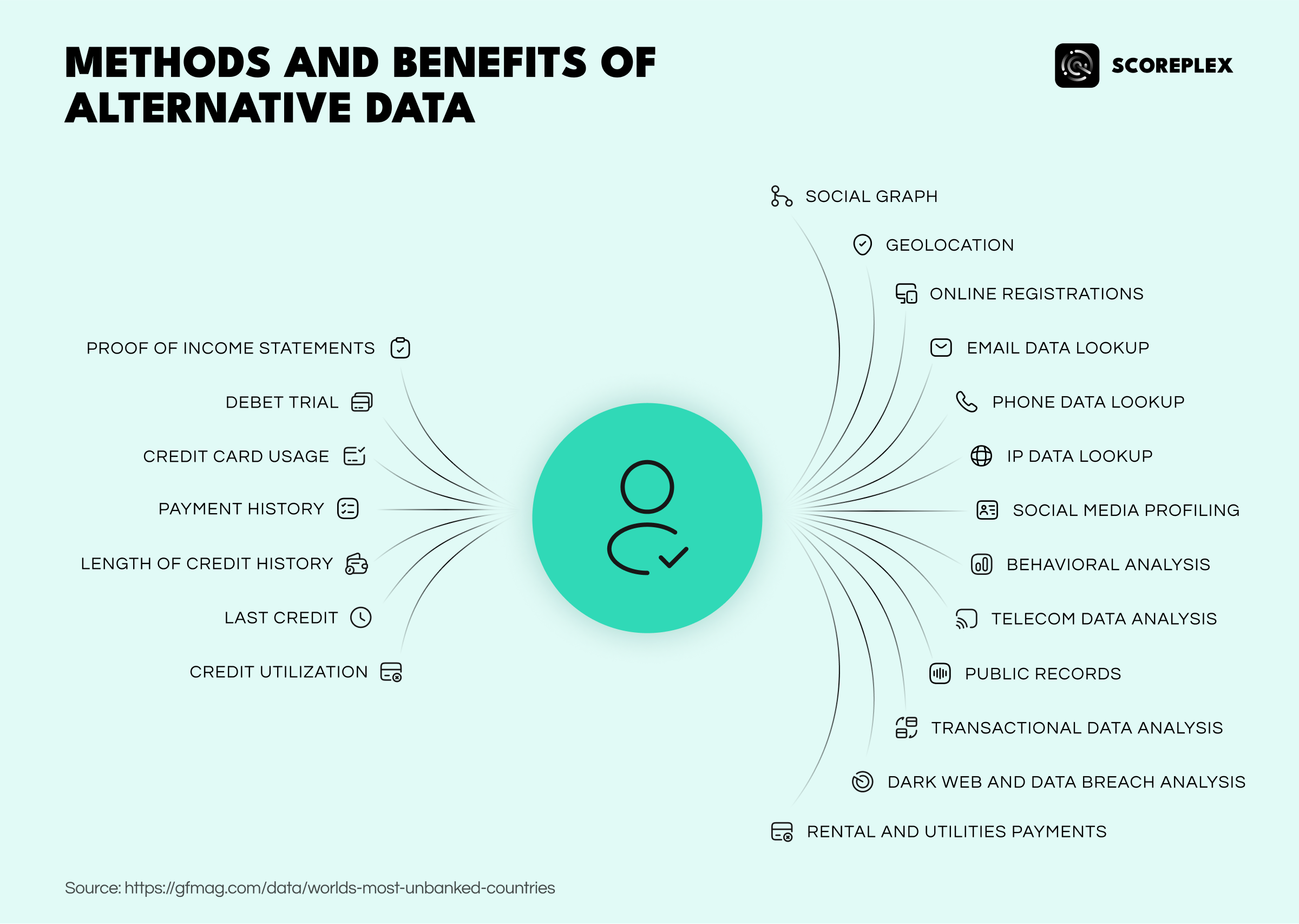

Traditional credit scoring typically examines several key financial indicators:

- Proof of Income: Verification through income statements.

- Debt History: Current debts and repayment trends.

- Credit Card Usage: Spending behaviors and transaction history.

- Payment History: Record of timely payments on previous financial obligations.

- Length of Credit History: Duration since the first credit account was opened.

- Types of Credit Used: Variety in the borrower's credit accounts (credit cards, mortgages, leases, etc.).

- Recent Credit Activity: Recent credit inquiries and approvals.

- Credit Utilization: Ratio of outstanding debt compared to available credit limits.

The widely utilized FICO scoring model attributes varying levels of importance to these factors:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit (10%)

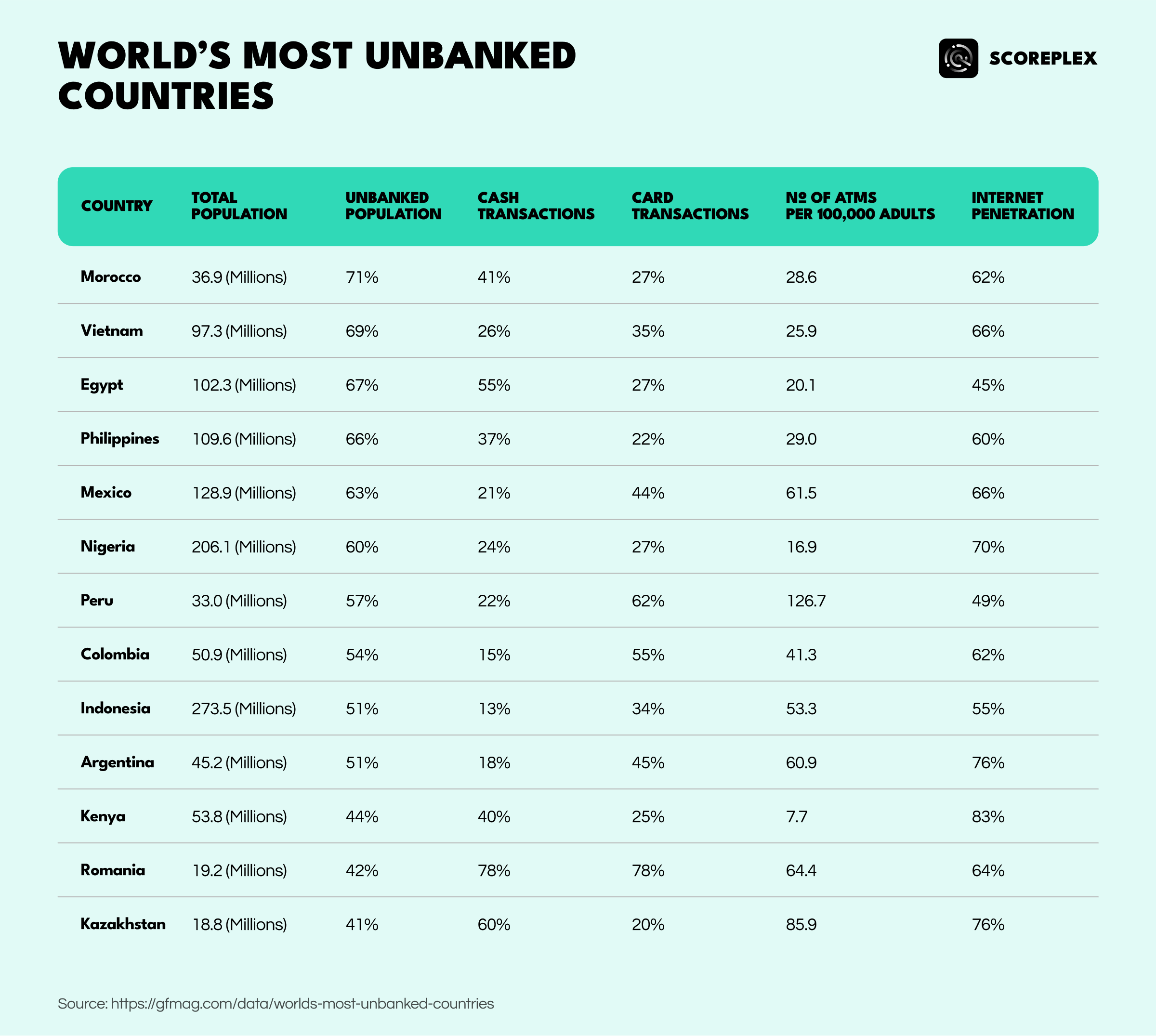

However, traditional credit scoring methods exclude roughly 3 billion people worldwide who lack sufficient credit history—known as "credit invisibles." These individuals face significant barriers in accessing loans and essential financial services, underscoring the need for alternative methods.

The Need for Alternative Data

In developing countries, a substantial proportion of the population remains underbanked or entirely unbanked. Without formal credit histories, these individuals cannot be accurately assessed using traditional models like the FICO score, restricting their access to financial services.

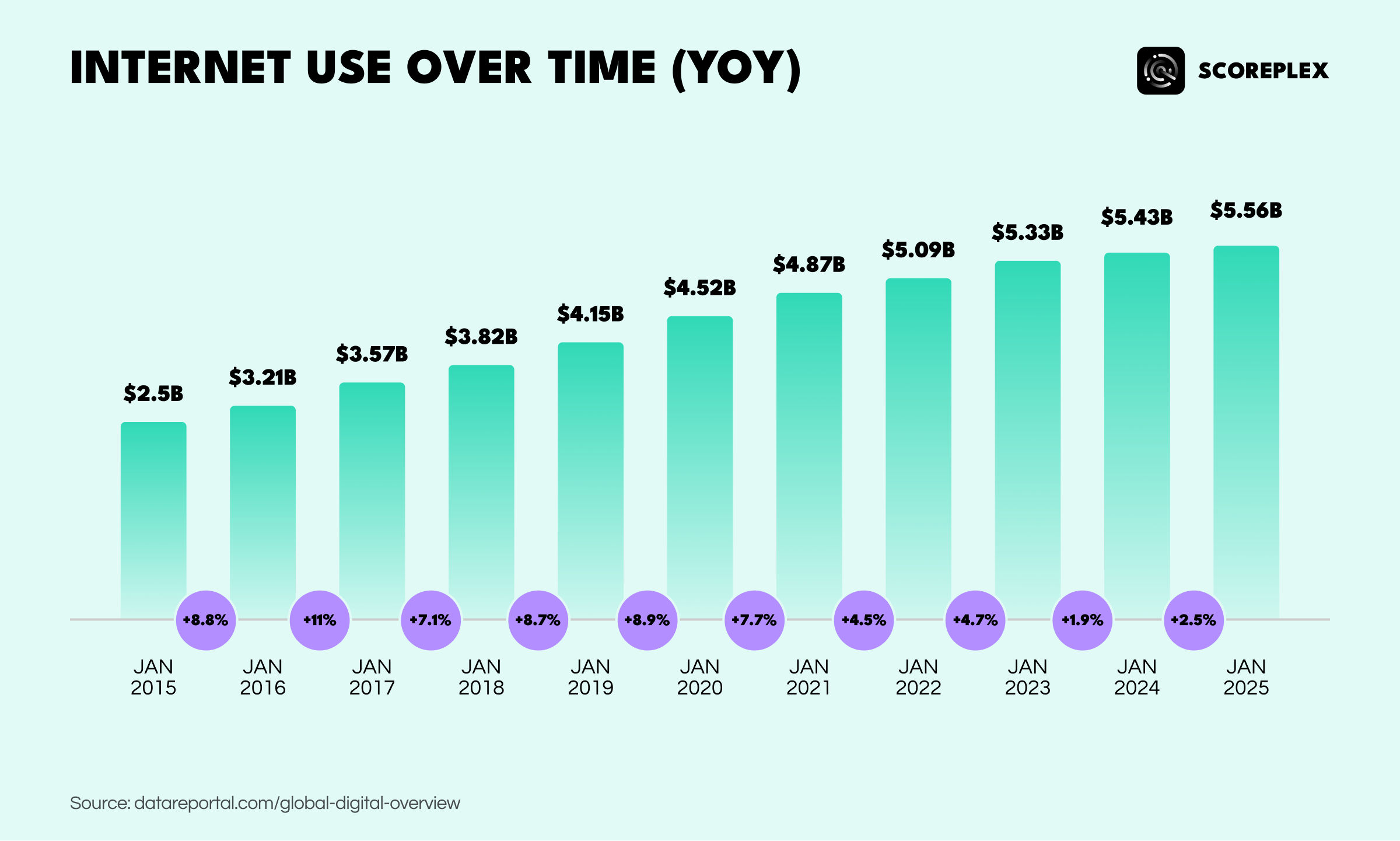

Moreover, global financial behaviors have evolved significantly, and traditional scoring models are struggling to keep pace. Millennials and Generation Z earn and spend differently, relying more heavily on digital banking, gig economy income, and online transactions, often avoiding traditional credit products entirely. This shift is influenced by factors such as the global financial crisis, the rise of digital financial services, gig platforms, and changing consumer behavior driven by online commerce. These trends highlight the urgent need to modernize traditional credit scoring systems to reflect today’s financial realities.

Leveraging Alternative Credit Scoring

Alternative credit scoring addresses these gaps by utilizing data sources beyond traditional credit bureau reports and loan applications. By incorporating alternative data, financial institutions gain a more comprehensive view of individuals’ financial behaviors, thus reducing fraud, improving risk assessment accuracy, and enhancing financial inclusion.

This approach is particularly advantageous for:

- Unbanked populations

- Individuals in cash-based economies

- Rural communities

- Young adults

- Immigrants

Alternative credit scoring includes diverse methods such as:

Digital Footprint Analysis: Examines an individual's online activities, digital interactions, and overall digital behavior to detect patterns indicative of financial responsibility.

Social Media Analysis: Evaluates data from platforms like LinkedIn (employment stability), Instagram, and Facebook (lifestyle and spending habits), and subscription services (Spotify, Netflix, Amazon Prime) to determine financial consistency and reliability.

Transactional Data Analysis: Reviews transaction records from digital wallets and payment apps, identifying consistent spending behaviors and regular payment practices.

Behavioral Analysis: Utilizes user interaction data, such as typing speed and mouse movement patterns, to detect potential fraudulent activities or establish psychological profiles.

Device Fingerprinting: Identifies fraudulent indicators by analyzing technical information of devices accessing financial services, detecting the use of emulators, VPNs, or jailbroken devices.

Email Analysis: Detects suspicious domains, inconsistent personal details, and blacklist appearances, which could signify potential fraud.

Phone Analysis: Monitors phone numbers for fraud signals, such as blacklist status or disposable numbers usage.

Geolocation Analysis: Tracks user movements and verifies residency or detects fraudulent activities through geographic data.

Telecom, Utility, and Rental Data: Reviews payment histories related to telecom bills, utilities, and rental agreements as alternative indicators of financial reliability.

Combining Traditional and Alternative Data

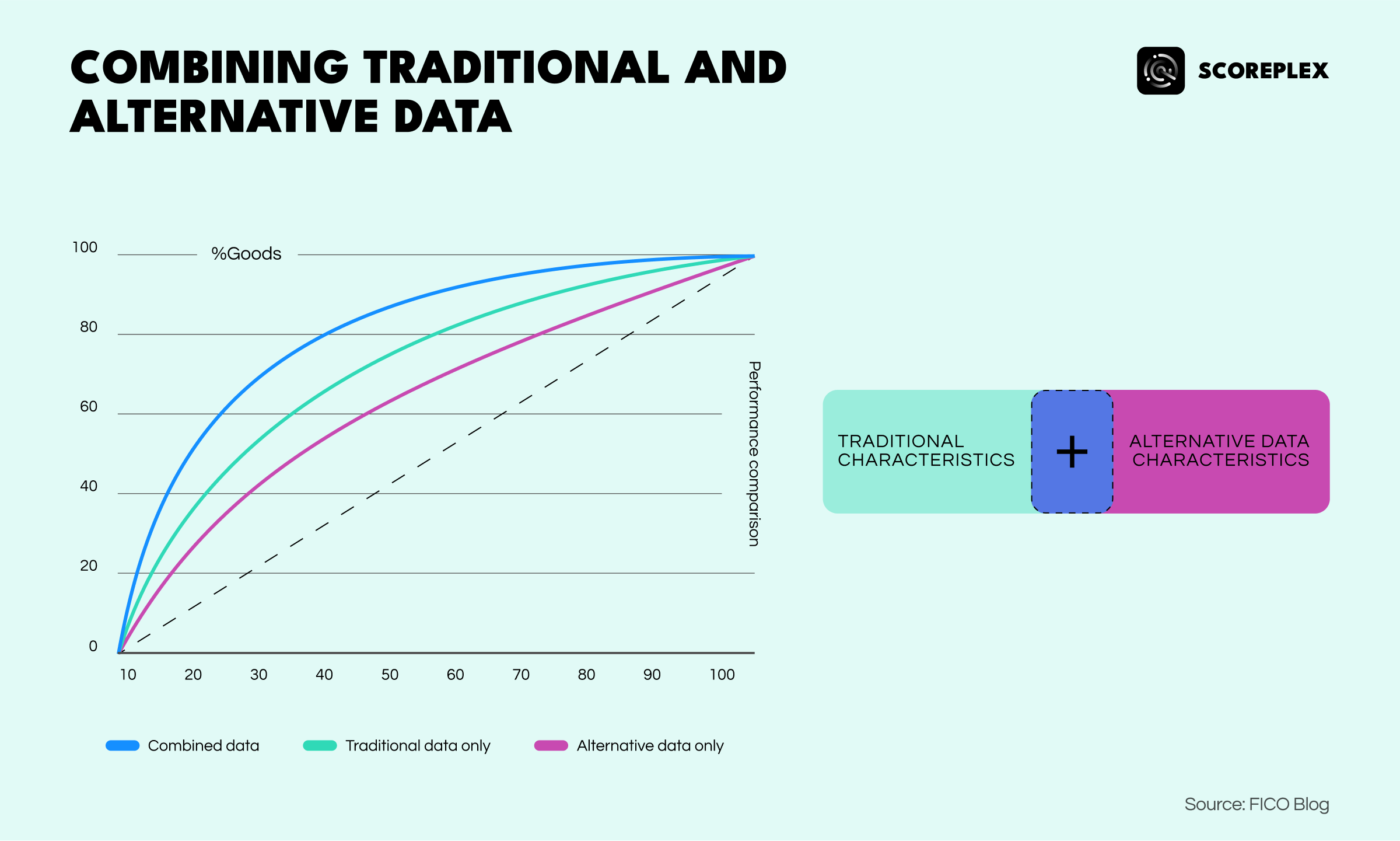

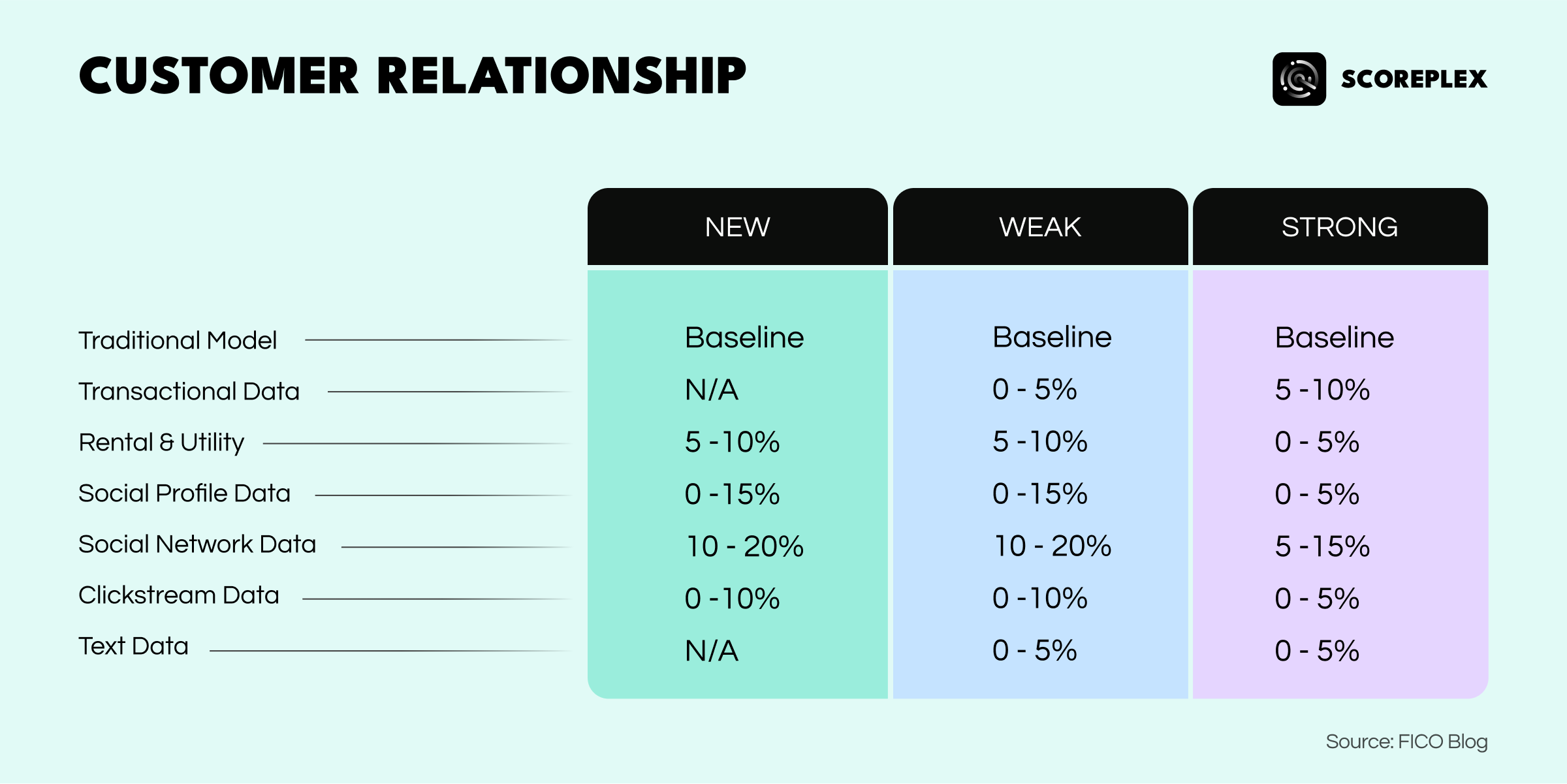

While alternative data provides crucial insights into a borrower's financial profile, traditional credit bureau data typically has stronger predictive capabilities when used independently. Alternative credit data alone reaches about 60% of the predictive power of comprehensive traditional data.

However, integrating traditional and alternative scoring methods substantially enhances the accuracy and reliability of credit assessments. This combined approach is particularly powerful for underbanked populations, effectively bridging gaps when traditional credit scoring information is unavailable or incomplete.

Ultimately, alternative credit scoring not only facilitates financial inclusion but also significantly contributes to reducing fraud and enhancing the robustness of credit evaluations.

About Scoreplex

Scoreplex provides alternative data for credit scoring and fraud prevention through digital footprint analysis using over 140 open sources.

By leveraging social media activity analysis, data leak monitoring, social profiling, and dynamic social graph generation, we enhance scoring models with insights that conventional data sources cannot capture.