For years, fraud prevention has largely been reactive: businesses let users sign up, complete onboarding, even pass through verification checks—and only then investigated suspicious patterns. But fraud no longer works at that pace. Today’s fraudsters use automation, stolen credentials, synthetic identities, and even AI-generated profiles. By the time they’re caught, the cost of verification has already been wasted, and the damage may be done.

This is where pre-KYC screening comes in. In simple terms, pre-KYC screening means screening users at the very first step—before they reach expensive and resource-heavy processes like KYC or credit scoring. Instead of waiting until onboarding to find problems, companies “shift left”: they move fraud prevention earlier in the customer journey, filtering out bad actors before they enter the system.

The rising cost of fraud

- Global online fraud losses are expected to exceed $362 billion by 2028.

- The average KYC check costs between $3 and $15 per user—a price that adds up quickly when fraudsters slip through.

- Digital onboarding is now the default in banking, fintech, and e-commerce, creating more entry points for fraudsters than ever before.

Take, for example, a European lending platform that recently discovered over 15% of its KYC rejections could have been prevented earlier with simple pre-checks on email and IP data. By introducing an upfront filter, the company cut verification costs by nearly a third and freed up analysts to focus on genuine applicants.

In this article, we’ll break down what pre-KYC screening really means, explore the most common approaches and technologies behind it, and look ahead at how fraud prevention is evolving to meet tomorrow’s threats.

What is pre-KYC Screening?

Fraud pre-check is best understood as an early-stage screening process that quietly evaluates new applicants before they enter costly onboarding workflows like KYC or credit decisioning. Instead of treating fraud detection as something that happens after verification or during the first transaction, pre-check moves the process to the very front of the customer journey.

This makes it different from traditional fraud detection. Conventional systems often wait until a user is already inside the system—monitoring login activity, payment attempts, or suspicious account behavior. By that point, however, businesses have already invested time, money, and compliance resources. Fraud pre-check aims to stop bad actors before that investment is made.

So where does this screening usually happen?

- Sign-up forms: checking email addresses, phone numbers, or IPs at the moment of registration.

- Loan or credit applications: filtering out applicants using synthetic identities or risky signals before submitting them to full credit scoring and KYC.

- E-commerce checkouts: identifying fraudulent buyers before payment authorization to prevent chargebacks and inventory loss.

The benefits are substantial:

- Cost savings: each KYC check can cost several dollars, and multiplying that by thousands of fraudulent attempts can mean millions in wasted spend.

- Reduced friction: by blocking only the riskiest users upfront, legitimate customers move through the onboarding process faster and with fewer interruptions.

- Better customer experience: genuine users enjoy smoother sign-ups, while fraud teams deal with fewer false positives later on.

In short, pre-KYC screening is about shifting left—catching fraudsters earlier, protecting downstream processes, and allowing businesses to focus resources on real customers instead of imposters.

Why pre-KYC Screening is Critical

For many organizations, fraud prevention still means reacting after the fact. A new account is created, KYC is completed, maybe even the first transactions go through—and only then do red flags start to appear. By that point, it’s already expensive. The business has paid for verification, allocated analyst hours, and in some cases absorbed direct financial losses.

Synthetic identity fraud is both pervasive and costly:

- By mid-2024, TransUnion noted that attempted account openings using synthetic identities stood at 0.32%, with bankcard credit inquiries topping 1%—a first since reporting began.

- The overall financial sector saw synthetic identity fraud cause $3.2 billion in potential lender losses by mid-2024—a 7% increase from late 2023.

- Historically, in 2016, synthetic identity fraud accounted for up to 20% of all credit losses, with average loss per instance exceeding $15,000.

- Banks in the U.S. face an estimated $6 billion in losses attributed to synthetic identity fraud.

The cost of onboarding fraudsters goes beyond wasted KYC checks:

- Compliance risks: regulators expect firms to demonstrate strong controls. Allowing bad actors through the door increases exposure to fines and audits.

- Chargebacks and financial losses: fraudsters who transact—even briefly—can leave behind unpaid balances or stolen funds.

- Operational strain: risk teams spend valuable time untangling synthetic identities or refunding victims.

- Reputation damage: users quickly lose trust in platforms that appear to harbor fake accounts or fraudulent sellers.

Fraud pre-check acts as an early filter. By identifying risky applications at the point of entry, businesses can reserve downstream processes—KYC, manual reviews, credit scoring—for users who are more likely to be genuine.

Consider a Latin American neobank that discovered nearly 20% of its monthly KYC costs were wasted on accounts later confirmed as fraudulent. By introducing a lightweight pre-check layer—flagging disposable emails and high-risk IPs before KYC—the bank reduced verification spend by a third and saw a measurable boost in approval rates for real applicants.

The business case is clear: pre-checking reduces false positives and improves conversion for genuine customers, while saving significant resources downstream.

Common Approaches in pre-KYC Screening

Email Risks

Emails are usually the first identifier provided by a user, and fraudsters exploit them heavily. Pre-KYC screening focuses on:

- Disposable domains: Temporary providers (e.g., Mailinator, 10MinuteMail) often appear in mass fake signups.

- Ultra-short-lived addresses: So-called “hyper-disposable” domains are spreading quickly in fraud ecosystems, making them a reliable early red flag.

- Breach exposure: Emails found in past leaks carry higher risk of credential stuffing or recycled identity fraud.

By filtering these signals upfront, businesses can block large volumes of fraudulent signups before they enter costly verification workflows.

Phone Risks

Phones are stronger identity anchors than emails but remain vulnerable to manipulation. Pre-KYC checks can flag:

- Carrier type: Whether a number belongs to a legitimate mobile network or a VoIP/disposable provider often used in bulk fraud.

- Number age: Freshly issued or recycled numbers are more likely to appear in synthetic or fraudulent applications.

- Geographic match: Country codes should align with the applicant’s stated location; mismatches are a common fraud signal.

With SIM swap fraud alone causing tens of millions in annual losses worldwide, early phone intelligence is a critical filter before KYC.

IP Risks

IP addresses provide valuable insight into a user’s true location and network behavior. Pre-KYC checks can uncover:

- Anonymization tools: VPNs, proxies, and TOR connections often used to disguise fraud attempts.

- High-risk infrastructure: IPs linked to datacenters, botnets, or flagged ranges commonly tied to automated signups.

- Location mismatches: Discrepancies between claimed residency and actual IP geography are strong red flags.

Because most large-scale fraud operations rely on masked or scripted connections, IP screening acts as an essential early barrier.

Digital Presence

Most genuine users leave some trace of activity online. Pre-KYC screening evaluates:

- Identity links: Consistency of names, emails, and phone numbers across social media, professional platforms, or public records.

- Footprint gaps: A complete absence of online presence—especially for an adult of working age—can indicate a synthetic identity created solely for fraud.

Checking digital presence adds context that traditional data points often miss, making it harder for fabricated identities to slip through.

Data Leaks

Billions of stolen emails, phone numbers, and credentials circulate in underground markets each year. Pre-KYC screening evaluates how identifiers appear in breach datasets and shared fraud registries:

- Breach exposure: Emails and phones found in major leaks may have been used in account takeover or recycled identity abuse, signaling the need for closer review.

- Consortium intelligence: Cross-checking against industry fraud databases helps spot identifiers tied to blacklisted actors or synthetic identities.

- No breach history: Most genuine identities appear at least once in large leaks (LinkedIn, Adobe, Dropbox). A brand-new email with no history may indicate a synthetic or disposable identity.

- Excessive breaches: Identifiers that appear in dozens of leaks are often “burned,” traded among fraudsters, and carry elevated risk.

By weighing both the presence and absence of breach data, pre-KYC screening assigns more accurate risk scores and filters compromised or suspicious identities before KYC.

Name Analysis

Names themselves can provide early fraud signals. Pre-KYC checks can detect:

- Placeholders: Entries like “Test User” or obvious filler text.

- Cultural mismatches: Names inconsistent with the applicant’s stated geography or demographics.

- Suspicious patterns: Gibberish, leetspeak, or repetitive naming structures often generated by automated signups.

Screening names helps flag synthetic or low-effort fraud attempts before they enter verification workflows.

Cross-Matching

The strongest insights come from combining multiple signals. Pre-KYC screening looks for:

- Data consistency: Alignment between email, phone, name, IP, and digital presence.

- Geographic coherence: Country codes, IP locations, and declared addresses should logically match.

- Compound risk: When several smaller red flags (e.g., disposable email + VoIP number + proxy IP) appear together, they form a high-confidence fraud indicator.

Cross-matching transforms fragmented data points into a clear risk profile, enabling smarter filtering at the earliest stage.

Key Use Cases by Industry

Fraud pre-check is not a one-size-fits-all solution. Different industries face unique fraud challenges, and pre-screening helps adapt defenses to their specific risks.

Fintech, Online Lending & BNPL

Digital lenders and BNPL (Buy Now, Pay Later) platforms are at heightened risk of synthetic identity and application fraud. Pre-KYC screening enables them to:

- Loan and credit applicationsScreen applicants for high-risk signals, synthetic identities, and previously blacklisted information before submitting them to full credit scoring and KYC.

- Risk scoringGenerate real-time risk scores to prioritize manual reviews only for borderline cases, reducing operational costs while maintaining security.

- Credit Abuse MitigationIn BNPL especially, fraudsters exploit instant approvals by applying with shallow or compromised identities. Screening identifiers against breach databases and analyzing weak digital footprints reduces the risk of repayment fraud.

Given the digital acceleration in lending and BNPL, these platforms need robust frictionless screening to balance user experience with risk control.

E-Commerce & Marketplaces

E-commerce platforms and marketplaces face fast-growing fraud risks, with global losses expected to climb from $44.3 billion in 2024 to $107 billion by 2029. Pre-KYC screening provides practical solutions by filtering out fraudulent users before they interact with genuine customers.

- Fake Account DetectionFraudsters create fake buyer or seller accounts using disposable emails, VoIP numbers, or proxy IPs. Pre-KYC screening flags these anomalies at signup, stopping bulk account creation that leads to refund abuse, fake storefronts, or stolen-card testing.

- Fake Review PreventionCoordinated fake reviewer accounts inflate ratings for dishonest sellers or sabotage competitors. Pre-KYC cross-matches emails, IPs, and devices to identify clusters of linked accounts, blocking review manipulation before it undermines marketplace credibility.

By applying these solutions early, platforms protect revenue, reduce fraud-related costs, and maintain trust across their ecosystems.

Dating & Social Apps

Fraud is a persistent problem on dating platforms, with the FBI reporting nearly $4 billion in losses from romance scams in 2023. Fake profiles, bots, and social engineering attacks not only harm users financially but also erode trust in the platform.

Pre-KYC screening strengthens defenses before fraudsters engage with real users:

- Fake Profile DetectionAdvanced pre-check tools can cross-reference user data with known fake account patterns to prevent bots and imposters from entering the platform.

- Catfishing PreventionDetect inconsistencies in submitted information, such as mismatched photos, duplicate emails, or suspicious IP locations, which may indicate users attempting to impersonate someone else.

- User trust scoringAssign risk scores to new accounts for additional verification or moderation, reducing false positives while protecting genuine users.

By applying pre-KYC at signup, dating apps can silently reduce the prevalence of fake profiles while keeping onboarding friction low for real members.

Crypto & Web3

Crypto exchanges and wallet providers face constant threats of fraud and money laundering. In 2024, crypto-related scams in the U.S. alone caused losses of $9.3 billion, accounting for more than half of all national scam losses.

Pre-KYC screening strengthens defenses before costly KYC or trading begins:

- User OnboardingDuring account creation, crypto platforms face risks from bots, fake accounts, and synthetic identities. Pre-KYC screening enhances onboarding by analyzing a user’s digital footprint and cross-verifying submitted information.

- Early Fraud PreventionDetect early signs of phishing, account takeovers, or credential stuffing attempts before they compromise the platform or other users.

- High-Risk Activity DetectionIdentify unusual patterns during the first transactions, such as rapid movement of funds across multiple wallets or inconsistent geolocations, which may indicate fraud or laundering attempts.

By silently applying these checks upfront, crypto platforms reduce compliance risk while keeping onboarding smooth for legitimate traders.

Insurance

Fraud is a major burden in the insurance sector, with U.S. insurers facing an estimated $308.6 billion in fraudulent claims annually. Much of this stems from identity theft and synthetic applicants exploiting weak onboarding controls.

Pre-KYC screening helps insurers reduce losses before claims are ever filed:

- Identity Validation at OnboardingEnsuring that the applicant’s identifiers align with a consistent digital footprint, provides insurers with stronger confidence that a real individual, not a synthetic identity, is applying for coverage.

- Additional Identity Checks Before PayoffsBefore claims are paid, secondary screening of identifiers helps verify that the claimer is indeed the original insured party.

- Policy onboarding Prevent fake accounts or duplicate policies by screening contact information and IP addresses.

By filtering high-risk applicants upfront, insurers cut exposure to fraudulent policies and protect resources for genuine claimants.

Challenges and Limitations

While pre-KYC screening offers clear advantages, it’s not without challenges. Risk specialists and KYC teams need to weigh its benefits against the potential downsides and practical constraints.

Balancing Prevention and User Experience

The biggest trade-off is friction. Adding too many upfront checks can frustrate genuine customers, leading to drop-offs during sign-up or application. The goal is to block high-risk users silently while letting trusted ones pass with minimal interruption.

False Positives

Even sophisticated systems can misclassify legitimate users as fraud risks. For instance, a customer traveling abroad might appear suspicious due to an unusual IP address. Overzealous filters risk excluding genuine applicants, hurting revenue and trust.

Sophistication of Fraudsters

Fraud tactics evolve rapidly. Synthetic identities, deepfake documents, and AI-generated digital footprints can bypass weaker checks. This creates a constant arms race where fraud teams must continually update their methods.

Cost and Resources

Finally, implementing and maintaining pre-KYC screening requires investment in tools, APIs, and analyst oversight. For smaller firms, this can stretch budgets. The challenge is finding the right balance—investing enough to reduce fraud while keeping operations efficient.

In short, pre-KYC screening is powerful, but its effectiveness depends on thoughtful implementation, continuous tuning, and a careful balance between security and user experience.

Best Practices for Implementing pre-KYC Screening

Fraud pre-check is most effective when treated as an evolving strategy, not just a one-time tool. To get the most value, risk teams should keep the following practices in mind:

- Take a Layered Approach

No single signal is enough to stop fraud. Combining checks—email, phone, IP, device, and behavioral patterns—provides stronger coverage. For example, a disposable email might not be risky alone, but paired with a proxy IP and newly registered phone, the risk score becomes clear. - Use Continuous Monitoring and Feedback Loops

Fraud tactics change quickly. Systems should be updated regularly based on outcomes from real cases. Feedback loops—feeding analyst decisions back into rules or machine learning models—help keep detection relevant and accurate. - Adapt to Local Context

Fraud looks different in different markets. In LATAM, SIM swap fraud may be more common; in APAC, synthetic IDs can dominate. Rules and thresholds should reflect regional realities rather than applying a one-size-fits-all approach. - Leverage Alternative Data Sources

Beyond credit history, alternative signals like telco data, device metadata, or social graph consistency add context that traditional checks miss. This is especially valuable in markets with thin-file or unbanked populations. - Ensure Human Oversight and Explainability

AI-driven scoring can be powerful, but analysts need to understand why a user was flagged. Transparent scoring models and the ability to override automated decisions build trust with regulators and improve accuracy in edge cases.

By layering methods, localizing rules, and keeping humans in the loop, pre-KYC screening becomes a proactive, adaptable defense rather than a rigid filter.

Conclusion

Fraud pre-check has become a critical part of modern risk management. By shifting fraud detection to the very start of the customer journey, organizations can stop bad actors before they drain resources, waste KYC budgets, or damage trust. Instead of reacting once fraud is already inside the system, pre-check provides a proactive filter that protects compliance, revenue, and customer experience.

The difference between reactive and proactive prevention is more than timing—it’s strategy. Reactive measures mean constant firefighting, while proactive pre-check allows risk teams to focus their efforts where they matter most: genuine customers and edge cases that require real investigation. The result is a fraud program that is leaner, more cost-effective, and more resilient against evolving threats.

Ultimately, pre-KYC screening is not just another layer of defense—it’s a mindset shift. Digital businesses that embrace it stop treating fraud prevention as an afterthought and start seeing it as a foundation for growth. In an era where trust is currency, the ability to silently and effectively screen out fraudsters at the front door is what will separate leaders from laggards.

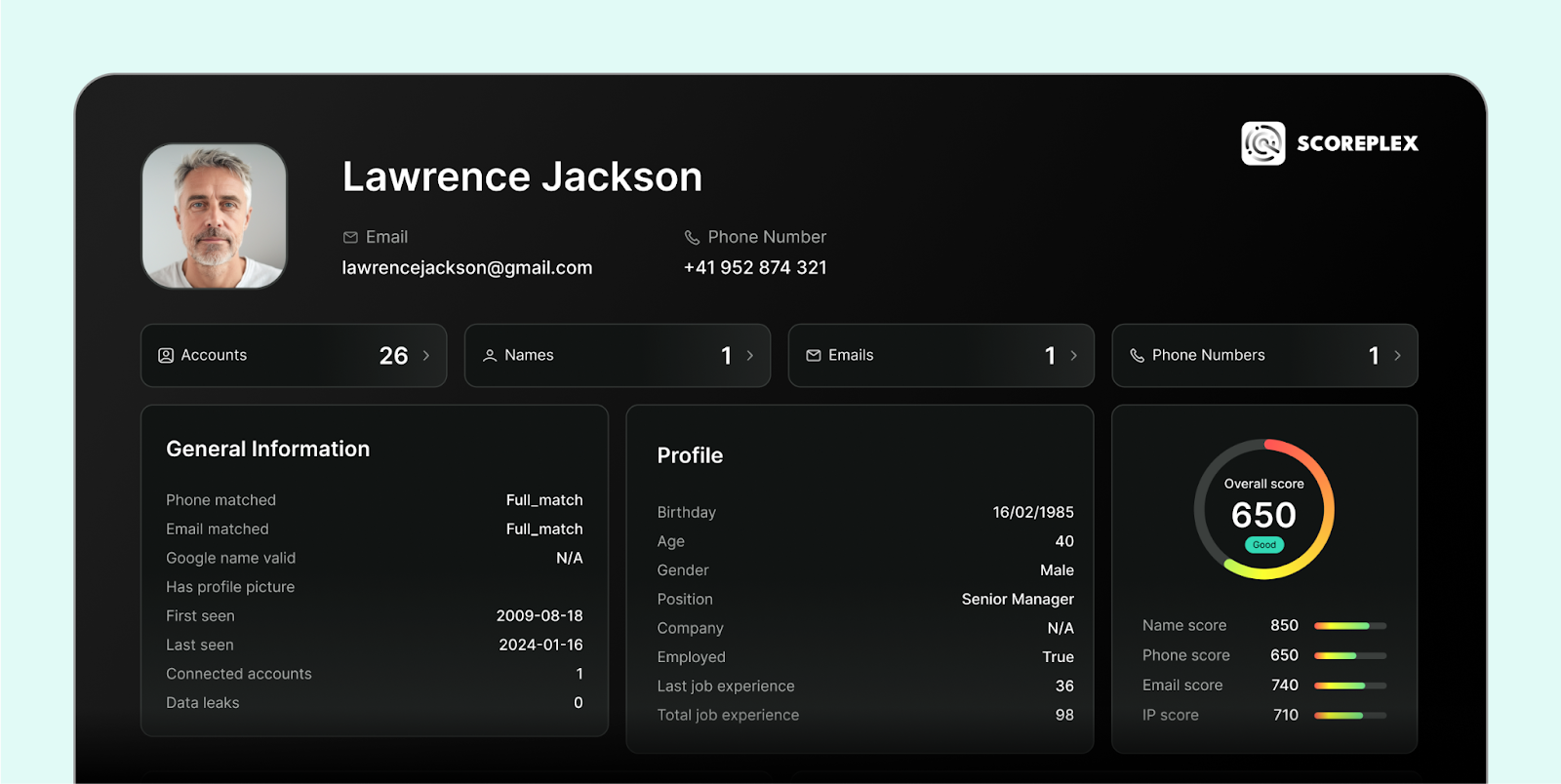

How Scoreplex Helps Conduct pre-KYC Screening

While the theory of pre-KYC screening is straightforward, putting it into practice requires technology that can analyze signals at scale, in real time, and without creating friction for legitimate users. This is where Scoreplex comes in. By combining digital footprint intelligence, machine learning, and transparent risk scoring, Scoreplex empowers businesses to silently block fraud while streamlining onboarding for genuine customers.

Stealth Screening Before KYC

A key advantage of Scoreplex is its ability to operate invisibly in the background. As soon as a user enters basic identifiers—such as an email address, phone number, or IP—Scoreplex runs silent checks across hundreds of open-source, commercial, and proprietary datasets.

- Fraudulent signals (e.g., disposable emails, VoIP numbers, proxy IPs) are flagged in the first place, before a user ever reaches costly KYC workflows.

- Legitimate applicants move forward seamlessly, without added friction or delays.

- Risk teams receive enriched context only when anomalies appear, reducing unnecessary manual reviews.

This “stealth mode” ensures that fraudsters are filtered out without tipping them off, while genuine customers experience faster onboarding and fewer verification hurdles.

Comprehensive Risk Scoring

At the heart of the platform is a transparent rule-based scoring engine, powered by 200+ pre-configured rules. Applicants are automatically assigned to a five-point scale, from Poor to High. This enables businesses to instantly:

- Approve trusted users.

- Route “moderate risk” users to manual review.

- Block high-risk applications before costly KYC.

- Pre-defined rules

Advanced Risk Checks

Scoreplex layers deeper checks to catch sophisticated fraud attempts:

- Real-Time Phone Verification: Instantly validates contact data, flagging disposables, VOIP, and breached accounts.

- Email Intelligence: Evaluates domain reputation, age, and breach history to uncover high-risk addresses. It can also detect temporary or algorithmically generated emails commonly used in bulk fraud campaigns.

- IP Intelligence: Detects VPNs, proxies, TOR usage, and blacklisted IPs.

- Online Presence Analysis: Examines activity across digital platforms to spot shallow or abnormal behavior patterns.

- Data Leak Monitoring: Monitors thousands of leak sources; if identifiers match compromised data, the account is flagged as risky.

- Name Analysis: Flags placeholder names, typosquatting, or cultural mismatches.

- Cross-Field Consistency: Verifies whether names, emails, and phones logically align across multiple data sources.

Seamless Integration

With a real-time API, Scoreplex integrates directly into existing onboarding and application workflows. Risk scores are delivered in milliseconds, ensuring fraud prevention happens silently, without slowing the customer journey.